Global retail participation on CME Group increased 50% last year and growth is expected to continue.

Julie Winkler, CME

Julie Winkler, chief commercial officer at CME Group, said on the results call today that global retail participation on CME was a record last year after increasing 50% over 2019. The largest retail volume was in equity index contracts, but participation in metals rose 50% and volumes also grew in foreign exchange and energy.

“Our digital education outreach reached 2.5 million traders, 15 times as many active traders as doing physical events,” she continued.

Terry Duffy, chairman and chief executive of CME Group, said on the results call today that retail is not going away. “We want their participation in all our markets but education is very important,” he added.

Terrence Duffy,

CME Group

The company reported total revenue of $4.9bn and operating income of $2.6bn for full-year 2020.

“As the ongoing global pandemic created an environment of extreme uncertainty and market volatility, we remained highly focused on helping our clients manage risk that was impacting their businesses,” said Duffy. “Despite the challenges, we achieved record international volume during full-year 2020 and saw strong, double-digit, year-over-year growth in the fourth quarter across our equity index and agricultural businesses.”

Volumes

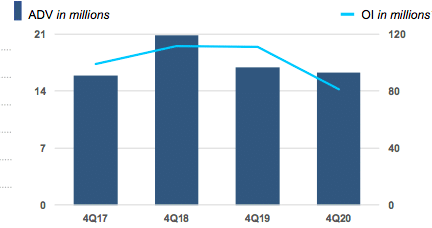

Total average daily volume last year was 19.1 million contracts, just below the record annual volume of 19.2 million contracts in 2018. There were records across equity index, metals, and natural gas futures and options.

Source: CME.

However average daily volume for interest rate contracts fell 27% in the fourth quarter of last year from the same period in 2019.

Sean Tully, global head of financial and OTC products at CME Group, said on the call that activity in rates was much higher this year, especially at the longer end of the curve.

In addition SOFR futures grew 63% to a record average daily volume of 69,325 contracts in the fourth quarter.

Bitcoin futures average daily volume grew 106% in the fourth quarter, and average daily open interest reached a record 11,108 contracts (55,540 equivalent bitcoin). This week CME launched Ether futures.

Tully said: “Ether futures traded 388 contracts yesterday across 55 accounts.”

What’s behind the surge in crypto markets? In part, increased institutional interest. @JimIuorio, @JackBouroudjian and @TimMcCourtCME discuss. https://t.co/2RrdW1cGRe pic.twitter.com/jPKUPQE1jR

— OpenMarkets (@Open_Markets) February 6, 2021

Duffy said the exchange is reviewing mini Bitcoin futures, which would be attractive to retail investors, but has no plans to announce a launch.

“Volume is still growing and we want to be cautious about how many people are trading a new asset class,” Duffy added. “We want to walk before we can run in crypto.”

He continued that a liquid options market is also required to launch mini contracts. CME launched Bitcoin options last year.

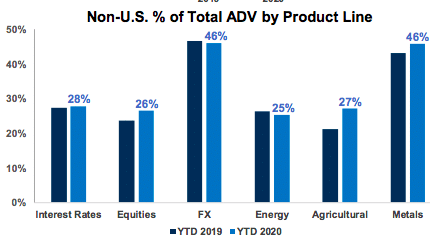

Outside the US, average daily volume grew 7% to a record 5.3 million contracts last year with Asia Pacific ADV increasing 28%.

Source: CME.

Acquisitions

This year CME completed the migration of BrokerTec business to CME’s Globex trading platform allowing clients to access listed derivatives, cash and repo markets on a common venue. John Pietrowicz, chief financial officer, said on the call that the integration makes it more efficient for client to execute relative value curve trades and reduce risk.

As part of the migration the existing BrokerTec global front end has been integrated into CME Globex, and real-time BrokerTec data can be streamed with futures and options data for users of the CME market data platform.

Pietrowicz said: “We will be launching seven initiatives to make the platform more attractive.”

EBS, the foreign exchange trading platform, is due to migrate to Globex in the fourth quarter of this year. Tully said FX volumes are expected to increase this year when the uncleared margin rules come into force and volume shifts to exchange-traded products.

“We are excited about the EBS migration as we can launch new products and analytics,” said Tully.

BrokerTec and EBS were both part of CME’s acquisition of NEX in 2018.

Last month CME announced the formation of a post-trade joint venture with IHS Markit which will combine the the exchange’s optimization businesses – Traiana, TriOptima, and Reset – with MarkitSERV.

PRESS RELEASE: @CMEGroup and @IHSMarkit to form leading post-trade services joint venture for OTC markets.

— CME Group (@CMEGroup) January 14, 2021

The combination will provide a more efficient front-to-back workflow with enhanced connectivity and improved trading certainty for global over-the-counter markets across interest rate, FX, equity and credit asset classes.

Pietrowicz continued that the large global banks are clients of both firms.

“However, our optimization services are complementary to MarkitSERV,” he added.