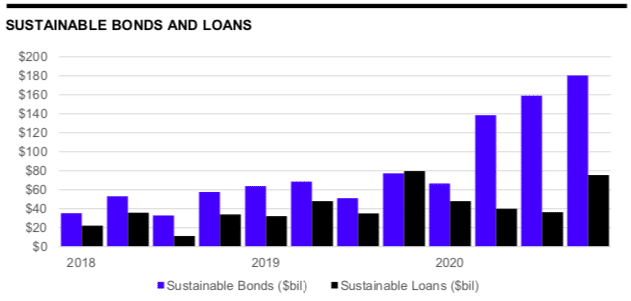

Sustainable finance bond volumes doubled last year from 2019 with the last three months reaching the highest ever quarterly issuance according to data provider Refinitiv.

Matt Toole, director of deals intelligence at Refinitiv, said in a report that sustainable bond issuance totalled $544.3bn (€500bn) last year, more than double volumes in 2019. In addition, $180.4bn of issuance during the fourth quarter was the highest quarterly total since Refinitiv’s records began in 2015.

Sustainable finance bonds include green bonds related to climate change, social bonds and sustainability bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both green and social projects.

Source: Refinitiv.

JP Morgan was the number one sustainable finance bond underwriter with 6.3% market share, followed by BNP Paribas and Credit Agricole according to Refinitiv.

The data provider said green bond issuance was an annual record of $222.6bn, 26% higher year-on-year, while sustainability and social bond categories each surpassed $100bn for the first time.

Brian Ellis, fixed income portfolio manager at Calvert, and Henry Paulson, ESG research associate, Calvert Research and Management, said in a blog that many analysts expect green bond issuance to increase this year with estimates ranging from $300bn to nearly $500bn.

Green bonds: On track to grow in 2021 https://t.co/3Gd9csVtr4 pic.twitter.com/t5oN42OPWK

— Calvert Updates (@CalvertUpdates) January 14, 2021

“The green bond market has grown to levels not many would have imagined at the beginning of this decade,” Calvert added. “In our view, this trend will likely continue as global demand grows for debt that supports environmental and other sustainability-focused projects.”

Social bond volumes grew to a record $164.2bn, nearly 10 times the total raised during 2019, due to Covid-19 related issuance. Sustainability bond volume was $127.6bn, more than triple the levels of the previous year according to Refinitiv.

Katherine Davidson, global and international equity portfolio manager at Schroders, said in a blog: “The dialogue has changed between investors and companies. ESG (environmental, social, governance) concerns used to be mainly discussed in terms of the “E” but it’s become very clear that the social aspect is just as important.”

Saida Eggerstedt, head of sustainable credit at Schroders, added that many companies have sought some kind of state support, whether via loans or access to furlough schemes. Eggerstedt said: “Governments want to see high standards from companies in terms of social and environmental behaviour if they are going to get state help and this will extend beyond the current crisis.”

Sovereign green bonds

Calvert said the sovereign green bond market is expected to grow further in the coming months, with the UK, Canada, Spain, and potentially up to 11 other governments, set to issue inaugural green bonds in this year. In addition, the European Union announced last year that it will sell €225bn ($267bn) of green bonds as part of its pandemic recovery fund.

Climate Bonds Initiative, the investor focused not-for-profit group promoting investment in the low-carbon economy, said in its first sovereign bond survey that more often than not, there is increased demand for sovereign bonds bearing a green, social, or sustainability label. Many bonds also exhibited a ‘greenium’, an issuance with a higher price and lower yield compared to existing vanilla debt.

“This suggests that, broadly speaking, there is a supply/demand imbalance pointing to a shortage of sovereign GSS bonds,” said the report. “This is consistent with the results of the Climate Bonds Green Bond European Investor Survey, in which investors said they would like to buy more green bonds from sovereign issuers.”

Pricing advantages among many benefits to Governments issuing Sovereign #GSS bonds.

Read more in @Climatebonds first of its kind global 'Sovereign Green, Social & Sustainability Bond Survey.' https://t.co/dirHqffvFQ #greenbonds #socialbonds #sustainabilitybonds pic.twitter.com/NesUsjH4Ox— Climate Bonds (@ClimateBonds) January 15, 2021

In addition the issuance of sovereign GSS bonds boost volume in local markets, increase liquidity and facilitate the growth of the essential market infrastructure and technical skills necessary for the development of a green bond market.

“In Belgium for example, the sovereign green bond encouraged the region of Flanders to issue a sustainability bond,” said the report.

In Germany, the Federal Republic of Germany – Finance Agency said this month that it will issue two green bonds this year, a 30-year green bund in May and 10-year in September.

Tammo Diemer, member of the Executive Board at the Federal Republic of Germany – Finance Agency, said in a statement: “In the future, we will issue green bunds every year to establish a green Euro interest rate benchmark.”

In addition, Deutsche Boerse’s Eurex has made green sovereign bonds deliverable into the existing German fixed income futures.

The German Finance Agency’s 2021 issuance outlook includes two key Green Federal #securities. We were involved in the conception of the green market segment for Germany by integrating now-deliverable #GreenBonds into existing German #FixedIncome #Futures. https://t.co/aU6TjzCbjh pic.twitter.com/u27o5Yhpi1

— Eurex (@EurexGroup) January 14, 2021

“For many of our investors, futures deliverability is one of the most important criteria. The turnover rate in Bund futures is usually even higher than the strong trading in the underlying itself,” added Diemer.

Jutta Frey-Hartenberger, fixed income derivatives R&D at Eurex, said in a statement these are the first futures to include green sovereign bonds into the deliverable basket.