Roland Chai, head of marketplace technology at Nasdaq, said news has become a 24-hour cycle and boosted demand for the firm’s risk platform.

Chai told Markets Media that news has become a 24-hour cycle and increased event risk, such as the run on banks which was out of hours. He explained that clients want real-time market data and analytics, which has led to an increase in demand for Nasdaq’s risk platform.

“Clients understand the importance of real-time data, and being able to customise our dashboards, so risk managers can take action,” he added. “It is deployed through software-as-a-service (SaaS), has elastic pricing so clients pay for what they use, and benefit from our cloud partnership with AWS.”

In November 2021 Nasdaq and Amazon Web Services announced a multi-year partnership to build cloud-enabled infrastructure for capital markets.

During its first-quarter results call Nasdaq said it is continuing its cloud migration strategy following the successful migration of Nasdaq’s MRX options market core trading system onto AWS edge cloud. A second options exchange is slated to migrate by the end of this year and Nasdaq is currently moving its surveillance and BoardVantage SaaS solutions to the cloud.

“Low latency is in our DNA and real-time market data allows clients to calculate real-time exposures, value at risk (VaR), mark-to-market and P&L,” said Chai.

Nasdaq’s risk platform provides a single view across equities and options, fixed income, exchange traded derivatives and FX. Nasdaq will add more asset classes and analytics according to Chai.

Growth strategy

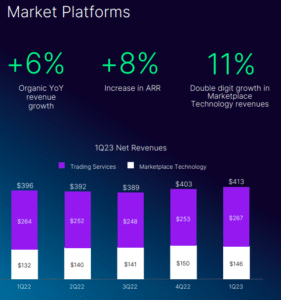

Nasdaq’s annualized SaaS revenues in the first quarter of this year increased 11% year over year to $729m, which primarily reflects strong growth in the fraud detection and anti-money laundering solutions. SaaS revenues in the period represented one third, 36%, of total company annualized recurring revenue( ARR), up from 34% in the first quarter of 2022.

One area of focus is the standard settlement cycle for most US broker-dealer transactions in securities reduced from two business days after a trade, T+2, by one day to T+1.

In February this year the Securities and Exchange Commission adopted final requirements for a 28 May 2024 implementation date, which is earlier than anticipated. The regulator said the change will reduce latency, lower risk, promote efficiency and greater liquidity in the markets.

Chai said the move to T+1 will have a big impact in the US and will bring significant efficiencies and capital savings.

“Both the buy side and sell side will need to transform their technology stack to ensure that settlement becomes smarter,” he added.

Another focus is optimisation of margin collateral as interest rates and volatility have been rising and clients want to sweat their collateral inventory.

Nasdaq has also had requests from clearing house and central securities depository clients to prepare for digital assets and tokenization as they want to leverage infrastructure that is regulated and offers settlement finality according to Chai.

The growth in regulated infrastructure for digital assets was highlighted by LCH SA, part of the London Stock Exchange Group, announcing its plans to a segregated clearing service, LCH DigitalAssetClear, subject to regulatory approval. The service will launch with the clearing of Bitcoin index futures and options contracts traded on GFO-X,a UK digital asset derivatives trading venue approved as a multilateral trading facility by the UK’s Financial Conduct Authority.

Arnab Sen, chief executive and co-founder of GFO-X, said in a statement that recent market events in the trading of digital assets, such as the collapse of FTX, highlighted the need for a safe, regulated venue where large financial institutions can trade at scale, while keeping their clients’ assets protected.

Chai said:”We are building out our risk offering and future post-trade transformation related to the cloud, SaaS and tokenization in a regulated and safe manner. We are also expanding in Latin America, South East Asia and Europe as they scale up their market infrastructures.”