Asset manager Franklin Templeton said it has the financial flexibility for another M&A opportunity following its acquisition of Putnam Investments, thanks to the partnership it has formed with Power Corporation of Canada.

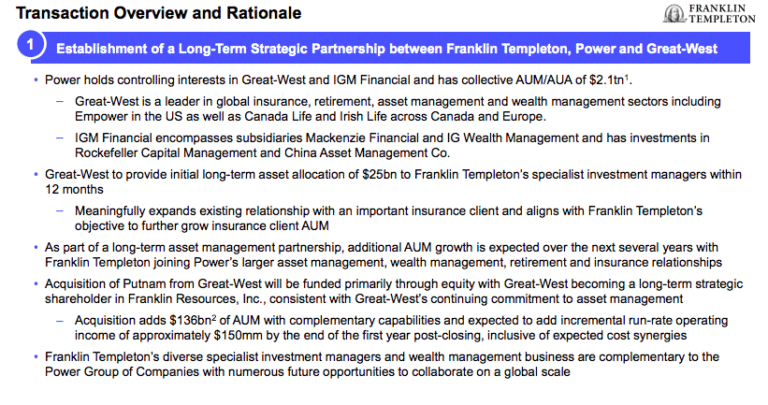

On 31 May 2023 Franklin Templeton announced a strategic partnership with Power Corporation of Canada. The Power group of companies include global insurance, retirement, asset management and wealth management firms with collective assets under management and/or administration of approximately $2.1 trillion. The group owns a controlling stake in Great-West Lifeco, which includes Empower in the US, Canada Life in Canada and Irish Life in Europe, and which will take a 6.2% stake in Franklin Resources.

As part of the transaction, Franklin Templeton has agreed to acquire Putnam Investments from Great-West for approximately $925m in equity.

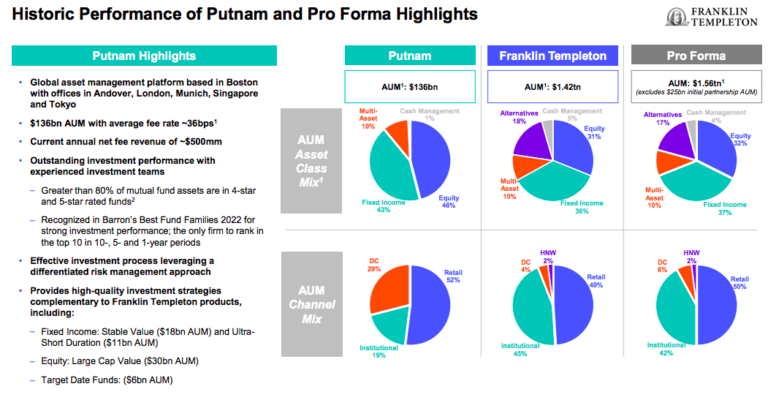

Jenny Johnson, president and chief executive of Franklin Templeton, said on the investor call that Putnam is a $136bn global asset manager which has outstanding long-term investment performance and complementary investment capabilities.

“I think that one of the challenges Power had with Putnam is that distributors are reducing the number of partners they work with,” she added. “We can bring Putnam to some of the bigger platforms where they may have been sub-scale.”

In addition, Putnam already has relationships with many of the Power Corporation investments, and Franklin Templeton will have conversations with them around its capabilities.

Putnam also accelerates Franklin Templeton’s growth into retirement and insurance markets with a strong target date fund offering and a highly regarded value investment capability according to Johnson.

The acquisition increases Franklin Templeton’s defined contribution assets under management to $90 bn in a segment known for its stable and growing assets. In addition, Johnson said US corporate defined contribution assets are expected to grow to over $12 trillion by 2027.

Putnam will also add scale and the potential for additional efficiencies within Franklin Templeton’s mutual fund platform and facilitate the potential to reposition sub-scale funds across the combined fund range. Franklin Templeton is the 14th largest US asset manager and Johnson believes this provides an opportunity to significantly move up the rankings.

She admitted that Putnam had outflows in 2021 and 2022, after positive flows in the previous two years. However, she argued that the outflows were concentrated in Putnam’s ultra-short duration products which were affected by interest rate increases and investors moving into money market funds.

Johnson said: “Once rates stabilise, it is quite likely that Putnam will be back into positive flows.”

She also highlighted that Putnam’s equity flows have been strong, particularly in US equities.

“The areas where they have struggled have been in multi-asset and fixed income, primarily concentrated in short duration,” Johnson added.

Strategic partnership

Johnson continued that one of Franklin Templeton’s strategic priorities has been increasing the diversification of its business and its relevance in certain key segments of the industry. The strategy has been focused on expanding investment capabilities, vehicles and client segments across geographies to respond to market changes and demand.

“While we are always focused on organic priorities, we have stated our interest in distribution-led strategic transactions that would further diversify our business and accelerate growth in key markets,” she added. “The partnership with Power Corporation and Great-West exemplifies this and, most importantly, accomplishes our objective of offering more choice to more clients in important sectors.”

She said Franklin Templeton is a global asset manager with $1.4 trillion in assets under management across a broad range of investment and distribution capabilities.

“Franklin Templeton’s diverse specialist investment managers and wealth management business are complementary to the Power Group and we are excited about the numerous opportunities to collaborate on a global scale,” Johnson added.

Great West is the sixth largest insurer in North America and the partnership will expand Franklin Templeton’s insurance related assets under management to approximately $150bn.

Under the partnership Great-West will allocate an initial $25bn of assets to Franklin Templeton within 12 months of the closing of the acquisition, which is anticipated in the fourth quarter of this year, and that amount is expected to increase over the next several years. Franklin Templeton will pay up to $375m in contingent consideration tied to revenue growth targets from the partnership.

This initial commitment expands the existing relationship with an important client and aligns with Franklin Templeton’s strategic focus according to Johnson.

“The insurance segment is a multi-trillion dollar asset base and strategically important to both the traditional and alternative asset management industry,” added Johnson. “Our overall assets under management will increase to $1.56 trillion and retail assets to $774bn, excluding the incremental Great-West commitment.”

Matthew Nicholls, chief financial officer of Franklin Templeton, said on the investor call that approximately two thirds of the initial $25bn from Great-West is likely to be invested in core and investment grade fixed income.

“$25bn is a very promising starting point for the strategic relationship but the potential to expand beyond that is quite considerable given the breadth of our capabilities and the needs on the company’s side,” he added.

M&A strategy

Nicholls continued that the transaction is structured to maintain Franklin Templeton’s financial flexibility and promote continuing investments in the business as cash and investments will remain at current levels of $6.5bn and there will not be any issue of new debt for the transaction. The structure also provides protection in the event of continued challenging market conditions as Great-West will become a long term strategic shareholder.

Ardea Partners was lead financial advisor and Broadhaven Capital Partners provided financial advice to Franklin Templeton with Willkie Farr & Gallagher as legal counsel. Morgan Stanley and Rockefeller Capital Management were financial advisors to Lifeco and Putnam Investments and Sullivan & Cromwell was legal counsel.

Johnson agreed that using stock in this transaction provides continued financial flexibility if Franklin Templeton becomes interested in doing another deal.

She said Franklin Templeton has been consistent in focusing in M&A on product and distribution capabilities. The asset manager has emphasised the alternatives space, where it sees a secular change as more investors are allocating into the private markets.

“The only area that we really see is still open for us in alternatives that we would be interested in acquiring is in infrastructure,” she added.

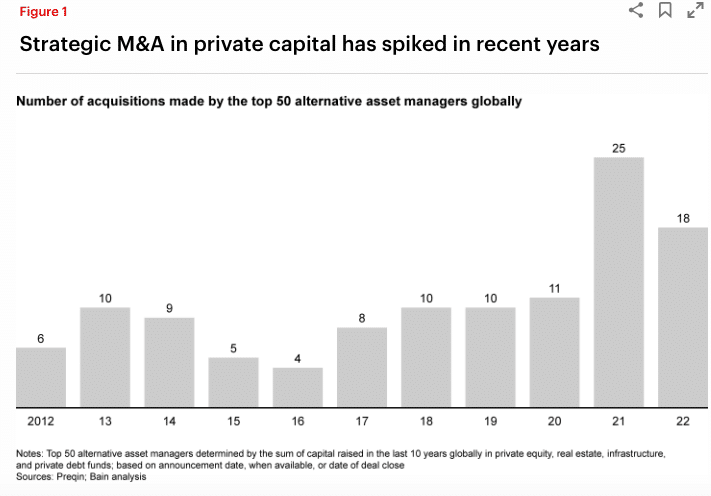

However, consultancy Bain & Company said in a report in May 2023 that consolidation has largely been a nonstarter in the private capital industry, although it highlighted Blackstone’s acquisition of credit firm GSO Capital Partners in 2008 as an example of a large deal that worked out well.

“Firms have tried over time to expand geographically or add an asset class through M&A,” said Bain. “But very often, mergers have foundered on the many levels of integration complexity that arise when private partnerships try to combine.

However, that is changing as the race to expand assets under management is putting pressure on firms to find new ways to grow and smaller firms face more difficult fund-raising conditions.

Using data from Preqin, Bain said the number of strategic acquisitions and strategic minority investments globally has accelerated in recent years among the top 50 alternative asset managers by AUM, with a sharp spike in 2021. The top 50 firms have done a total of just 116 strategic deals since 2012, and more than half of that group (29 firms) haven’t done a deal at all but the trend suggests that firms are increasingly looking for ways to make M&A work according to the report.

“Firms like T. Rowe Price, Franklin Templeton, Nuveen, and BlackRock have been actively chasing the outsize growth of private capital in recent years,” added Bain. “ Those four and others have been snapping up private firms like Oak Hill Advisors and Lexington Partners, seeing real opportunity in providing access to private capital through their extensive distribution networks.”

Nicholls agreed that Franklin Templeton still has the ability to move in M&A and is very focused on alternative assets.

“But we’ve never taken our foot off the gas in terms of deeply exploring what else we can do in traditional asset management,” he said. “Both are really important as the industry continues to evolve, and not in a slow way as clients demand more.”