The European Union passed a legal framework for crypto-assets in the region in April this year, covering markets that are not regulated by existing financial services legislation. The approval of the Markets in Crypto-assets (MiCA) regulation means the EU is one of the first jurisdictions in the world to introduce comprehensive rules on crypto-assets which aims to protect consumers and financial stability while encouraging innovation.

MiCA is expected to come into force in 2024 and includes provisions covering transparency, disclosure, authorisation and supervision of transactions, as well as regulating public offers of crypto-assets. The agreed text also incorporates measures against market manipulation and to prevent money laundering, terrorist financing and other criminal activities.

The UK Government has also been consulting on its proposals for regulating crypto-assets. Innovate Finance, the trade body representing UK fintechs, said it welcomed the broad approach whilst identifying areas where more work is needed such as the overall burden on trading venues; lending and decentralized finance (DeFi).

SEC Commissioner Hester Peirce said at the Financial Times’ crypto and digital assets summit in May this year that both the UK approach and MiCA can be a model for the US. She said: “I think we’re shooting ourselves in the foot by not having a regulatory regime in the US.”

Stefan Berger, lead MEP for the MiCA regulation, said in a statement that MiCA puts the EU at the forefront of the token economy. He added: “This regulation brings a competitive advantage for the EU. The European crypto-asset industry has regulatory clarity that does not exist in countries like the US.”

Tokenization

Competitive advantage is important due to the potential size of the token economy. Sir Jon Cunliffe, deputy governor for financial stability at the Bank of England, said in a recent speech that technologies pioneered and refined in the crypto world, such as tokenization, encryption, distribution, atomic settlement and smart contracts are already finding their way into conventional finance.

“They offer the prospect of what is loosely called the ‘tokenization’ of financial and other assets – including the ‘money’ that is used to settle – and thereby a more extensive, faster and more secure programming/automation of transactions,” he added. “And they offer new ways to record the ownership and the transferring of ownership of assets – again including the transfer of money – which we generally call payments.”

In wholesale financial transactions this new technology may allow intermediaries to be removed, and may also make trading and settlement instantaneous. However, Cunliffe highlighted that new unimagined use cases may prove to be the most important by using the analogy of smartphones. The iPhone was introduced in 2007 with just 15 apps, and there are now more than two million apps.

Citi GPS said the potential for tokenization via blockchain is approaching an inflection point in a report, ‘Money, Tokens and Games: Blockchain’s Next Billion Users and Trillions in Value.’.

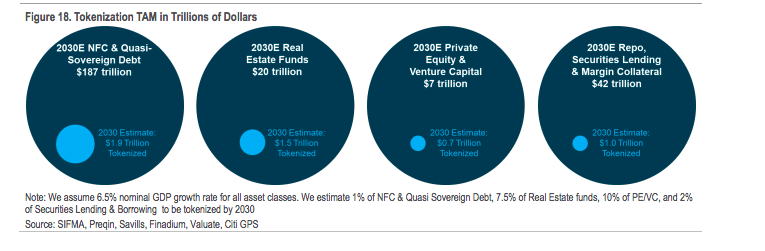

“Almost anything of value can be tokenized and tokenization of financial and real-world assets could be the “killer use-case” blockchain needs to drive a breakthrough,” added Citi GPS. “We forecast $4 trillion to $5 trillion of tokenized digital securities and $1 trillion of distributed ledger technology (DLT)-based trade finance volumes by 2030.”

Private market tokenization is expected to reach $4 trillion, with another $1 trillion from the repo, securities financing and collateral market by 2030, although mass adoption is expected to be six to eight years away according to the bank.

Tokenization allows monetization of illiquid assets such as art or real estate, and provides new ways of financing infrastructure such as roads, heavy machinery. Benefits, especially for private funds and securities, include not requiring expensive reconciliations, cutting settlement failures, increasing operational efficiencies, fractionalization, providing access to a wider range of market participants. Atomic settlement, the instant exchange of two tokenized assets on-chain on the condition that they are simultaneously transferred, has the potential to cut settlement times from the current one to two days for most traditional securities.

For example, the repo market transacts over $2 trillion each month, but the market is still largely manual and inefficient. As a result several new DLT-based digitization and tokenization initiatives have emerged including HQLAX, JPMorgan’s Onyx repo platform, and Broadridge’s DLT Repo to bring operational and capital savings to the industry.

“Given current industry momentum, it seems feasible that digital collateral markets could become the first scaled use cases for digital tokenized securities flows,” said Citi GPS.

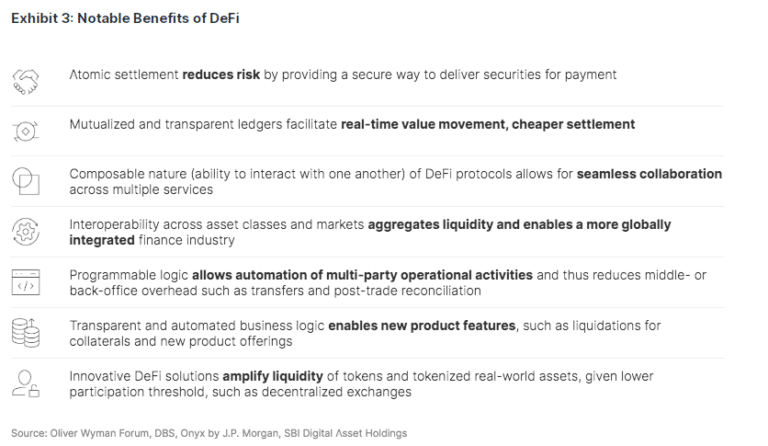

The potential for institutional DeFi to transform global markets was also highlighted in a paper by the Oliver Wyman Forum, the global management consultancy’s think tank, and co-authors DBS, Onyx by J.P. Morgan, and Japan’s SBI Digital Assets Holding at the end of last year. They define Institutional DeFi as the application of DeFi protocols to tokenized real-world assets, combined with appropriate safeguards to ensure financial integrity, regulatory compliance, and customer protection (not institutional players participating in crypto DeFi).

“The prize for innovators who hone this model for use in the world’s trillion-dollar finance industry could be substantial,” said the report.

The report cited research from Celent which found that 70% of institutional investors were willing to pay extra for increased liquidity and faster asset turnover.

Implementation

The Oliver Wyman Forum said the rapid evolution of blockchain technology and its potential disruption requires institutions to form a house view on the future of DeFi and the implications for their business in order to define their operating model.

In order to operate in this new environment, traditional finance can learn a lot from crypto and DeFi markets as tokenisation will enable more streamlined introduction of new asset types.

Lalin Dias, co-founder and chief executive at Yaala Labs, said: “Decentralised capabilities have already paved the way for new market models – more targeted and sophisticated price discovery, and new liquidity provision models. These benefits, alongside true 24/7 operations and native cloud infrastructures, set these newer, more agile venues apart from their regulated counterparts.”

Yaala Labs helps customers optimize the operation of their traditional or digital marketplaces by offering issuance, price discovery, order matching and settlement capabilities that are tailored to their objectives. The firm’s P8 platform already supports traditional securities, carbon markets, crypto exchanges and NFT marketplaces.

At the same time, there are also aspects of the traditional finance (TradFi) world that crypto should not ignore. MiCA, along with its sister regulation DORA in the EU’s digital finance package, mandates stringent requirements for the newly-regulated DeFi entities, covering not only investor protection and financial stability but also ICT resilience and cyber security.

Dias added that crypto and DeFi venues should be considering these requirements ahead of the MiCA deadline as they may need to re-platform or rearchitect platforms for resilience and security, as well as integrate surveillance and reporting systems which requires experience and planning.

The stakes are high. The Oliver Wyman Forum said: “From the carrier pigeon to the telegraph, the transistor to the mainframe, technology has shaped the finance industry for generations. We believe institutional DeFi has the potential to be the next great transformative force.”