Analysis of recent S&P 500 stock splits illustrated that changing the round lot in high-priced stocks could save investors $2bn per year.

Adrian Griffiths, head of market structure at exchange MEMX, reviewed recent stock splits by Amazon, Alphabet, and Tesla and found that changing the round lot in high-priced stocks could benefit investors by narrowing spreads and reducing related transaction costs.

MEMX Head of Market Structure Adrian Griffiths examines recent S&P 500 stock splits to illustrate how changing the round lot in high-priced stocks could save investors $2 billion by narrowing spreads and reducing related transaction costs. Read the report: https://t.co/3YS8oCmYWK pic.twitter.com/aHHOO67jrZ

— MEMX (@memxtrading) November 29, 2022

A round lot is usually for 100 shares, and MEMX said the stick price has an important impact on quoted prices in the market. For example, Apple currently trades at around $140 per share, so a round lot has a notional value of $14,000 in order to set the national best bid and offer (NBBO).

Griffiths reviewed trading data before and after stock splits to examine the potential impact that eliminating artificial round lot constraints could have in those securities in a report, “Round Lot Reform: Was Amazon too Expensive?”

For example, Amazon closed at $2,447 on 3 June 2022, the last trading day before a stock split, so a round lot was valued at almost $250,000 in order to set the NBBO. However, the average trade size was only 15 shares, or about $37,000.

Amazon is one of the most active securities in terms of notional value traded and on 3 June it was second most actively traded corporate stock for that day with a volume of $12bn.

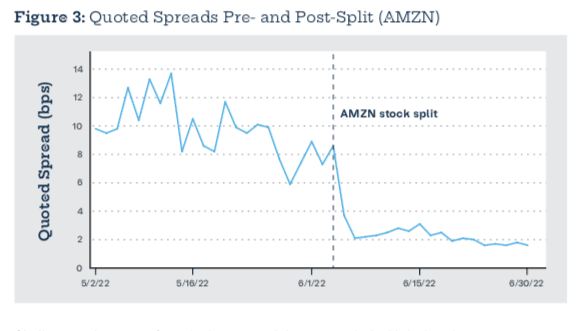

Griffiths said: “Yet, with an average quoted spread of 8.6 basis points and average effective spread of 4.8 basis points, it was much more expensive to trade Amazon on that day than other similarly active names.”

Once Amazon began trading on a split-adjusted basis on 6 June 2022, spreads became significantly narrower and Griffiths said they are now generally in line with those seen for other similarly active securities.

“Even accounting for the difference in notional value traded each month, it would have cost $49m to trade an equivalent dollar volume of AMZN in May, meaning investor savings of $30m per month,” he added.

Griffiths note there are more than 150 NMS stocks priced over $250 per share that would benefit immensely from round lot reform. In October, they collectively traded about $116bn in daily volume and accounted for 20% of notional value traded in the U.S. equity market. As a result, investors will continue to experience higher transaction costs.

He calculated that spread costs for investors in NMS stocks still priced over $250 totaled $309m in October. If they had stock splits and made similar spread cost reductions to the securities examined in the paper, investors would save $171m each month.

“Annualized, this represents investor savings just north of $2bn a year in stocks that are still round lot constrained,” he added. “It’s therefore not enough to simply wait and rely on issuers to split their stocks to address the inefficiencies in trading high-priced NMS stocks.”

In June 2021 MEMX issued a white paper that illustrated the need to expedite round lot reform under the market data infrastructure rule.

Griffiths said: “Since the primary listing exchanges have been reluctant to address these issues—and in fact have sought to delay the overall implementation of these rules—the Securities and Exchange Commission must act to protect the needs of the investing public. As illustrated by these recent S&P 500 stock splits, the cost of inaction is simply too high.”