Flows into US exchange-trade funds in the first seven months of this year have been more than the total for the whole of 2020 according to research provider Morningstar.

Ben Johnson, director of global ETF research for Morningstar and Ryan Jackson, associate manager research analyst, said in a report that inflows in the year to the end of July were $512bn (€433bn), eclipsing the $500bn total for 2020, despite July having the smallest monthly inflows in 2021.

Record-breaking flows into #ETFs surpass last year’s historic record. YTD through July, ETFs pulled in $512B as compared with $500B in all of 2020. Overall, ETFs hold $6.6T of investments. In this article we breakdown where #investors put their money: https://t.co/q7WzcYKpPs pic.twitter.com/8RuU8l0tXk

— Dave Sekera, Morningstar Chief Market Strategist (@MstarMarkets) August 4, 2021

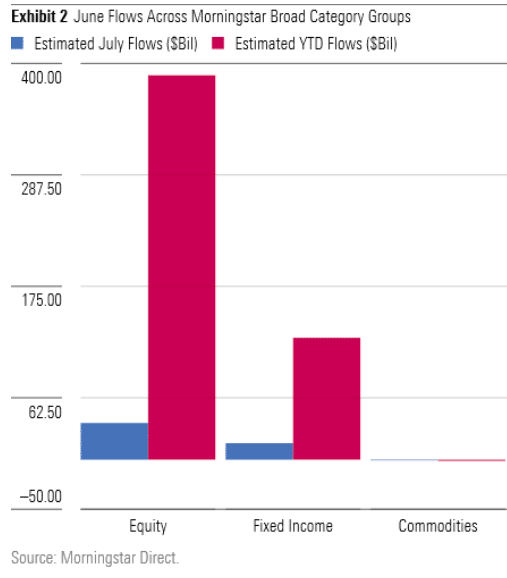

ETF inflows in July were $54bn, while the previous monthly low this year was the $66bn in May according to Morningstar. Equity ETFs have comprised three quarters of inflows for the first seven months of this year, compared to less than half, 46%, in 2020.

“Although July flows cooled off from the previous few months, investors maintained their conviction in stock ETFs despite a richly valued market and looming COVID-19-induced economic obstacles,” added Morningstar.

Source: Morningstar.

Equity ETFs collected $37bn in July, higher than the $17bn for bond ETFs.

Morningstar said shorter-term bond funds continued to lead the way due to concerns over rising rates and inflation-protected bond ETFs also continued their momentum.

“They raked in $4.2bn in July, marking their second consecutive month with over $3bn in flows and indicating that inflation remains at the front of many investors’ minds,” said the report.

ETF launches

Trends toward ETFs, illiquid alternatives, and customization will continue according to The Cerulli Edge—U.S. Monthly Product Trends, July 2021 Issue, due to the low interest rate environment, investor awareness of product costs, and advances in technology allowing greater customization and easier linking of investors to alternative exposures.

“While only a handful of individual hold-out firms have either not launched or announced launching ETF products, the rollout of active ETF strategies remains in the early stages,” said Cerulli. “Managers must decide whether to convert their mutual funds to ETFs or launch new ETFs, which can either be clones or tweaks of prior strategies.”

Our latest Edge analyzes mutual fund and #ETF product trends as of June 2021, including an increased interest in ETFs from asset managers, a rapid buildout of direct indexing capabilities, and fee compression among index and active mutual funds. Read more: https://t.co/9VSTe7BTRe pic.twitter.com/cDn3d3XoBP

— Cerulli Associates (@cerulli_assoc) August 3, 2021

Nuveen said in a statement on 5 August that the manager has launched its first suite of active semi-transparent ETFs. Holdings will be disclosed on a monthly basis, similar to mutual funds within the same fund family. The semi-transparent structure also allows portfolio managers to actively manage the strategy without the risk of signaling position changes to the market.

Hear from @NuveenInv's Jordan Farris on how the ETF wrapper is resonating with more investors as the company expands its lineup with the launch of three new active ETFs using the NYSE Active Proxy Structure pic.twitter.com/zsfetDKaWa

— NYSE ? (@NYSE) August 5, 2021

The asset manager said the three semi-transparent active ETFs combine the structural advantages of both ETF and mutual fund wrappers.

Jordan Farris, head of ETF product at Nuveen, said in a statement: “These proven equity strategies incorporate our unique combination of expertise in stock selection, analytics and portfolio modeling with product structuring capabilities across the scale of our $1.2 trillion platform. We are committed to providing choice to clients within their preferred wrapper and the opportunity to build portfolios across our range of products, including mutual funds, closed-end funds, and both index and active ETF options.”

Cerulli highlighted that more than 200 ETFs have launched in the first half of 2021.

“ETF issuers must do more than ever to stand out, culminating in a notable surge in the number of niche and thematic ETF launches in 2021,” said Cerulli. “These products are often rules-based strategies and have far-ranging themes, including environmental, social, and governance (ESG) topics, artificial intelligence, and social media conversation.”