The US could issue its first sovereign green bond market under the Biden administration which could spark significant growth in the market.

Bram Bos, lead porfolio manager green bond at NN Investment Partners, the Dutch fund manager, said in an email that President-elect Joe Biden’s commitment to rejoining the Paris agreement when he is inaugurated symbolises a broader transformative shift in climate policy.

“The Biden administration will invest heavily in sustainable infrastructure and clean energy, which could lead to an inaugural green US Treasury issue and further boost the global green bond market,” he added.

Bos continued that Biden’s climate and environmental justice proposal equates to federal investment of $1.7 (€1.4) trillion over the next decade with additional private-sector, state and local investments taking the total to more than $5 trillion.

“The need to fund these investments will be a pivotal opportunity for the US to enter the green bond market as a sovereign issuer,” added Bos. “This could prompt other governments worldwide to follow, sparking significant growth in the global green bond market.”

The UK government said yesterday it would issue its first green gilt next year.

Even before Biden @USTreasury #greenbonds (hopefully!), today's @RishiSunak announcement & imminent @MEF_GOV framework mean that suddenly a majority of G7 will be active GB issuers – not just pioneer @aft_france & more recent @BMF_Bund!

— GreenBondsUK (@GreenBondsUK) November 9, 2020

Landmark moment, @ClimateBonds @IIGCCnews! https://t.co/GQ7jtfl6Dg

Total green bond issuance so far this year is $194.5bn according to the Climate Bonds Initiative. The investor-focused not-for-profit organisation has estimated that total green bond issuance this year will be $350bn, a third higher than last year’s $257.5bn.

Fiona Reynolds, chief executive of the United Nations-backed Principles for Responsible Investment said in a blog that the Biden administration must set a pathway to achieve net-zero by 2050.

“An inevitable policy response that is forceful and abrupt is gathering pace, undermining the value of high carbon investments and creating opportunities for green investments and jobs,” she added.

Reynolds said the the Biden administration should reverse the Trump administration’s efforts to roll back progress on environmental. social and governance investing.

She highlighted an executive order from President Trump last year directing the Department of Labor to review regulation of private retirement plan fiduciaries (or “ERISA fiduciaries”) with an eye towards promoting the oil and gas sector

“At a domestic level, the integration of ESG considerations in investment policy and regulation has fallen behind in the last four years compared to progress in Europe and Asia,” added Reynolds. “Simultaneously, the window of opportunity for American investors to remain at the forefront of global financial innovation and competition in navigating and mitigating the realities of climate and transition has begun to close.”

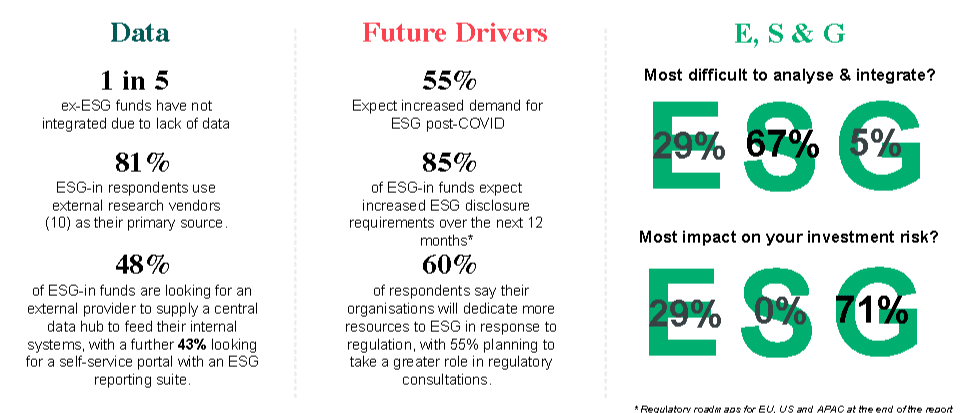

The 2020 RBC Global Asset Management Responsible Investment Survey found that adoption of ESG principles is growing globally with 75% of respondents integrating ESG principles into their investment approach and decision-making, up from 70% last year. However only 65% of investors in the US have adopted ESG compared with 94% in Europe, 89% in Canada and 72% in Asia.

In addition the survey said that 84% investors believe that ESG-integrated portfolios will perform as well or better than non-ESG-integrated investments. However in the US 26% of investors think ESG-integrated portfolios will perform worse than non-ESG-integrated portfolios.

Melanie Adams, head of corporate governance & responsible investment at RBC Global Asset Management told Markets Media there has been less regulatory momentum on ESG in the US.

“The Department of Labor and the Securities and Exchange Commission have had a chilling impact on ESG efforts,” Adams added.

However she noted that US interest in ESG is growing as the Covid-19 pandemic has put a focus on the treatment of employees, health and safety and supply chains.

Securities lending

ESG discussions have also become more prevalent in securities lending. The practice involves temporarily leading securities in return for a fee that is based on the supply and demand for that specific instrument. Last year securities lending generated $8.7bn of revenues for lenders according to a recent survey from The Risk Management Association.

Tom Poppey, co-head of securities lending at Brown Brothers Harriman, told Markets Media: “Securities lending is becoming much more relevant as asset managers, particularly passive funds and ETFs, face fee pressure and this trend is likely to persist.”

Poppey continued that it is rare to be in a client meeting where ESG does not come up.

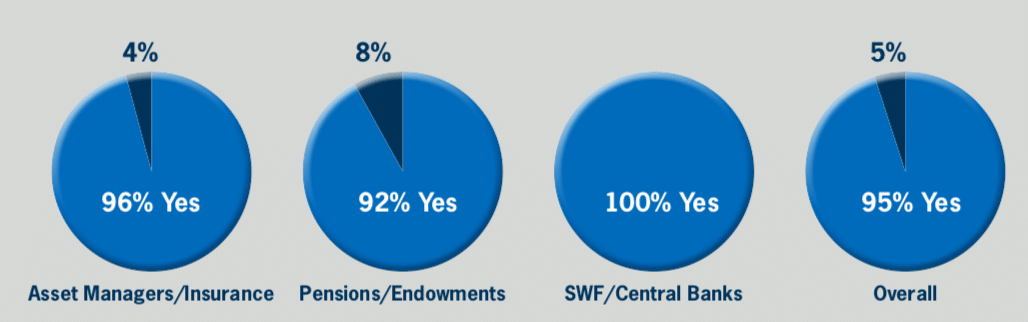

The Risk Management Association’s survey found that 95% of respondents said ESG investing and securities lending can coexist but only 18% always apply ESG principles to their securities lending programs.

“ESG is going to become ubiquitous in securities lending and a more targeted approach to lend while meeting ESG objectives will evolve,” he said.

The lender keeps full exposure to the market performance of the security but can lose the right to vote proxies if it is on loan over the proxy record date. The survey found that a lack of timely information about proxy record dates and voting questions complicates the process of recalling stock that is on loan.

Nearly half, 43%, of respondents said they want more transparency around proxy record dates in order to facilitate using ESG principles in their securities lending program.

Hedge funds

Amongst hedge funds a minority, 40%, include ESG considerations in their investment process according a survey last month from BNP Paribas Corporate and Institutional Banking.

The survey said: “Hedge funds are reaching a tipping point of incorporating ESG into their decision making, finding that the majority of funds will integrate ESG no later than 2022.”

The majority, 60%, do not currently integrate ESG and more than half of these believe their trading strategies/asset classes make ESG irrelevant or impossible to quantify. This was the top barrier to adoption, especially for macro strategies.

Delphine Queniart, global head of sustainable finance & solutions, global markets at BNP Paribas, said in a media briefing that equities were better covered in ESG, while fixed income and derivatives were lagging.

Sandrine Ferdane, global head of financial institutions coverage at BNP Paribas, said in a statement: “As we have seen across the investment landscape, hedge funds are evolving to integrate ESG into their decision making. It is clear that hedge funds are starting to measure and manage certain ESG considerations – especially within their operations.”