Plato Partnership is a consortium of European buy-side and sell-side firms committed to improving markets, so they can more efficiently serve society. Plato Partnership’s Market Innovator Group (MI3) engages with its network of senior academics globally and sponsors independent academic research to identify better ways of executing trades, lowering the cost of trading, and improving the quality of processes that support the execution lifecycle.

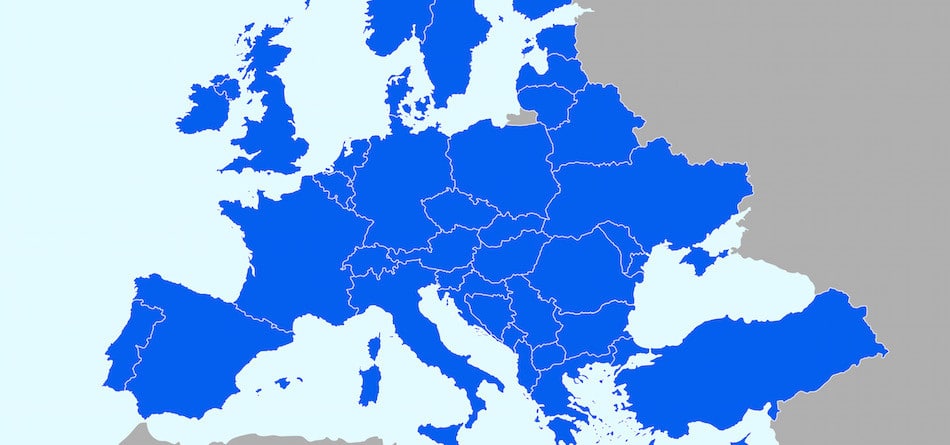

Plato Partnership and its network of senior academics note the recent focus from European policy makers and market participants regarding a consolidated tape for European equities. We strongly believe European policymakers should focus on improving transparency for all market participants through establishing regulations to ensure the creation of a real-time, post-trade consolidated tape (“CT”) for European equites at an affordable user price.

Plato Partnership and its network of senior academics strongly believe the implementation of a real-time post-trade consolidated tape for European equity and equity-like instruments will significantly improve transparency and create a level playing field for all market participants. Intervention from policymakers that addresses and regulates the considerations we have outlined can help ensure a consolidated tape is finally available in European markets.

Download the full letter here

Members of Plato Partnership, and signatories of this letter:

Allianz Global Investors, Axa Investment Managers, Baillie Gifford, BlackRock, Capital Group, Cedar Rock Capital, DWS Group, Fidelity International, Invesco, Janus Henderson, Legal & General Investment Management, Liontrust, MFS International, Norges Bank Investment Management, Schroders, T. Rowe Price, Union Investment, Barclays, Bank of America Securities, Citi, Exane BNP Paribas, Goldman Sachs, Instinet Europe Ltd, Jefferies, J.P. Morgan, Morgan Stanley, RBC Capital Markets, Redburn, Société Générale and UBS.

Academic signatories of this letter:

Albert Menkveld, Professor of Finance at Vrije Universiteit Amsterdam

Sabrina Buti, Professor of Finance, Paris Dauphine University

Björn Hagströmer, Professor of Finance, Stockholm Business School

Hans Degryse, Professor of Finance, KU Leuven

Carole Comerton-Forde, Professor of Finance, UNSW Business School

Francesco Franzoni, Professor of Finance, USI Lugano

Laurence Daures-Lescourret, Associate Professor of Finance, ESSEC Business School

Barbara Rindi, Associate Professor of Finance, University Bocconi

Andrei Kirilenko, Professor of Finance, University of Cambridge Judge Business School

Giovanni Cespa, Professor of Finance, Bayes Business School (formerly Cass)

Marti G. Subrahmanyam, Professor of Finance and Economics, NYU Stern School of Business

James Brugler, Assistant Professor of Finance, University of Melbourne

James J. Angel Associate Professor of Finance, Georgetown University

Charles M. Jones, Professor of Finance and Economics, Columbia Business School

Chester Spatt, Professor of Finance, Carnegie Mellon University

Roberto Ricco’, Assistant Professor of Finance, NHH Norwegian School of Economics

About Plato Partnership Limited

Plato Partnership Limited, a not-for-profit company comprising European buy-side and sell-side member firms, was formed in September 2016 with a vision of bringing creative solutions and efficiencies to today’s equity marketplace. The group’s key aims are to reduce trading costs and simplify market structure for the benefit of all market participants, and to act as a champion for end investors. Central to this vision is Plato Partnership’s Market Innovator Group (MI3) that sponsors independent academic research to identify better ways of executing trades, lowering the cost of trading, and improving the quality of processes that support the execution lifecycle. Plato Partnership co-operates with industry providers to implement its research findings into solutions for all market participants.

Source: Plato Partnership