- BCBS-CPMI-IOSCO call for interested parties to comment on ten policy proposals which aim to improve central clearing participants’ understanding of initial margin calculations and potential future margin requirements.

- The report proposes that central counterparties (CCPs) should provide additional public disclosures on their margin models and increase the sophistication and accessibility of margin simulation tools.

- Clearing members should provide greater transparency to clients and the CCPs of which they are members.

The Basel Committee on Banking Supervision (BCBS), the Bank for International Settlements’ Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) jointly published a consultative report Transparency and responsiveness of initial margin in centrally cleared markets – review and policy proposals. Interested parties are invited to comment on this report.

The ten policy proposals in the report aim to increase the resilience of the centrally cleared ecosystem by improving participants’ understanding of CCPs’ initial margin calculations and potential future margin requirements.

The proposals cover:

- CCP simulation tools: Margin simulation tools with certain minimum functionality should be made available by CCPs to clearing members and their clients.

- CCP disclosures: CCPs should disclose additional information related to their margin models including on anti-procyclicality tools. CCPs should also report certain public quantitative disclosure elements in a more timely and frequent manner.

- Measurement of initial margin responsiveness: To facilitate the monitoring of margin requirements by clearing members and their clients, CCPs should disclose a standardised metric for measuring initial margin responsiveness.

- Governance frameworks and margin model overrides: CCPs should implement enhanced analytical and governance frameworks for margin models. When CCPs use discretion to override model margin requirements, this should be done within a publicly disclosed analytical and governance framework.

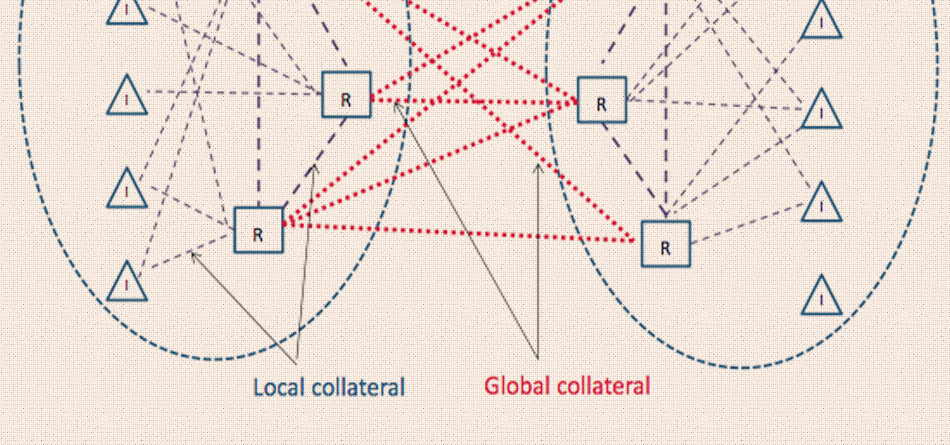

- Clearing member transparency: Clearing members should provide greater transparency to their clients and the CCPs of which they are members. Additionally, they should develop enhanced analytical frameworks for assessing margin responsiveness when passing on margin calls to clients.

This consultative report has been developed pursuant to publication of the BCBS-CPMI-IOSCO Review of margining practices in 2022. In addition to this consultative report published today, there will be two further upcoming reports, a BCBS-IOSCO report Streamlining VM processes and IM responsiveness of margin models in non-centrally cleared markets and a CPMI-IOSCO report Streamlining variation margin in centrally cleared markets – examples of effective practices.

The Financial Stability Board (FSB) is also conducting work to develop high-level, cross-sectoral policy proposals on non-bank market participants’ liquidity preparedness to meet margin and collateral calls. The FSB will publish a consultative report in the first half of 2024.

The BCBS, CPMI and IOSCO invite input on the consultative report by 16 April 2024. Responses should be sent via email to the Secretariats of the BCBS, CPMI and IOSCO (baselcommittee@bis.org; cpmi@bis.org; margin@iosco.org).

Responses will be published on the websites of the BIS and IOSCO unless respondents expressly request otherwise. Commercial or other sensitive information should not be included in the submissions, or may be included, with redactions for publication clearly noted.

Source: BIS