BNY Mellon announced they are live with the first client for ECPOConnect, a joint collateral optimization service developed in collaboration with Pirum Systems, the post-trade services fintech that has been at the heart of the securities finance industry for over two decades. The inaugural client is a large international Canadian bank.

This new service combines BNY Mellon’s industry-leading collateral management service, ECPO, which optimizes more than $4 trillion in assets globally, with Pirum’s CollateralConnect platform, a SaaS-based solution supporting front-to-back cross-asset margin, collateral and inventory management and optimization.

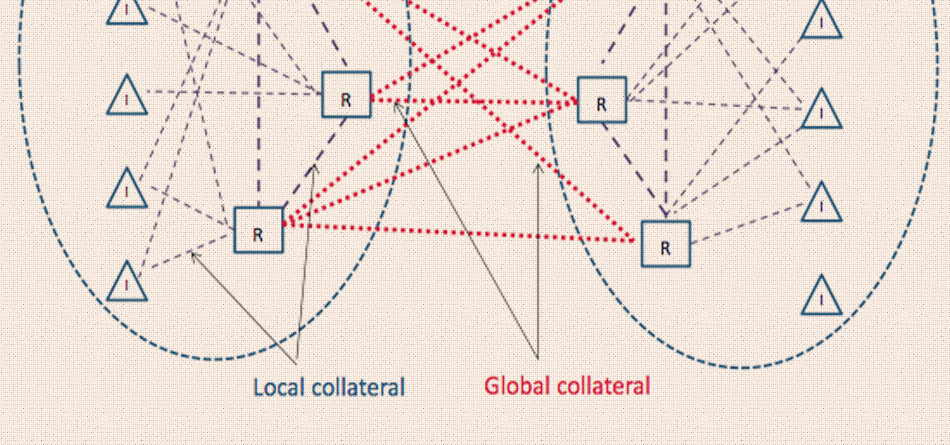

ECPOConnect will benefit collateral providers with improved capabilities to allow them to centralize collateral management across business lines, including securities lending, repos, and derivatives. The solution addresses the need by industry participants to drive better efficiencies and generate material savings on funding, liquidity and capital costs through business process automation and intelligent collateral usage.

“We are pleased to collaborate with Pirum to bring to market ECPOConnect, an industry-leading optimization solution that allows clients to increase profit margins,” said Victor O’Laughlen, Managing Director at BNY Mellon. “Client demand for real-time data-driven efficiencies to navigate complex markets is increasing, and we are building solutions to meet those needs.”

BNY Mellon & Pirum provide firms with the flexibility to utilize their own in-house optimizer or leverage BNY Mellon’s collateral optimizer, ECPO, to support more sophisticated optimization outcomes such as Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR), Risk Weighted Asset (RWA), central counterparty margining, and more.

Todd Crowther, Head of Corporate Development and Collateral Services at Pirum, said, “ECPOConnect is an innovative solution offering industry participants a flexible set of optimization solutions to fit their needs. By combining Pirum’s automation and connectivity capabilities with ECPO, clients gain immediate benefits through more efficient funding, liquidity and capital management. This collaboration represents our drive towards fundamental change of the entire collateral ecosystem and we are excited about the road ahead.”ource

Source: NY Mellon