BNP Paribas’ Securities Services business, a leading global custodian with USD 15.4 trillion in assets under custody[1], has launched on its NeoLink client platform the Schedule Manager, a new triparty collateral management solution that enables clients to enhance collateral optimisation.

The Schedule Manager, the latest module of BNP Paribas’ Securities Services business’ triparty collateral suite of adaptive and innovative tools and services, enables its clients to easily define, update, monitor and share their collateral schedules, in a real-time and connected manner. Supported by other existing optimisation features, the app facilitates more effective decision making and enhances efficiency throughout the lifecycle of clients’ collateral.

Key features include:

- A smart schedule builder that narrows negotiations to critical parameters and converts them into terms and conditions in the contractual document

- An intuitive workflow that visualises every schedule’s progress, updates history and pending actions

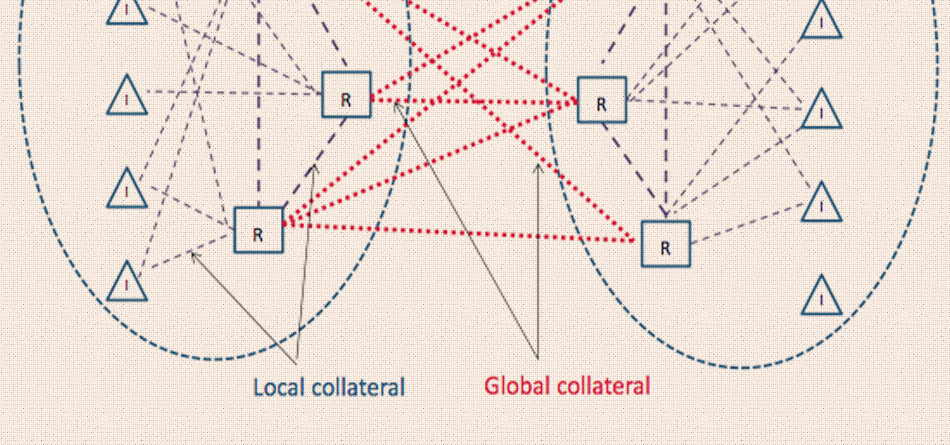

- An adaptive and connected solution that allows clients to integrate their digitalised schedule with collateral optimisers, accessible via APIs (Application Programming Interfaces)

- Clients’ collateral optimisation is enriched with a suite of simulation tools and allocation strategies, leveraging complementary data points, including market cut-offs, concentration limits, and corporate actions

Andrew Geggus, Global Head of Agency Securities Lending, Triparty Services, Securities Services, BNP Paribas, commented: “In a context of increasing volumes and diversity of instruments, clients are asking for triparty collateral management services that enables them to optimise securities financing transactions with select assets.

“The launch of the Schedule Manager as part of our Triparty Collateral app on NeoLink demonstrates how we drive-up efficiency by supporting our clients’ collateral optimisation cross-activities and achieving a superior level of collateral mobility.”

Source: BNP Paribas