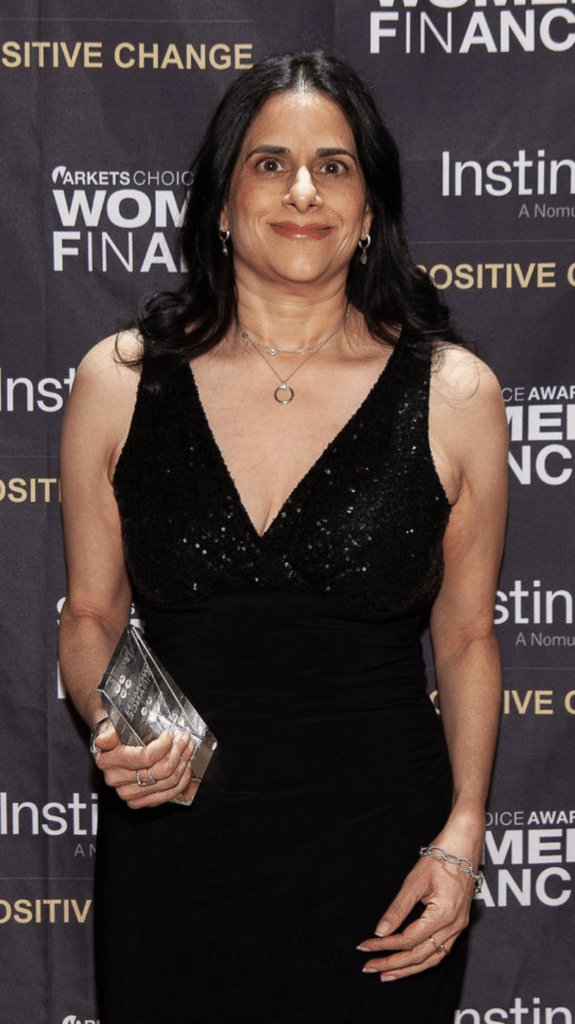

Mitali Sohoni, Managing Director, Head of North America Markets, and Global Head of Asset Backed Finance, Citi, won Leadership award at Markets Media Group’s 2025 U.S. Women in Finance Awards.

Can you share a bit about how you started your education and career?

My career journey began with a unique academic path. I graduated from UC Berkeley with dual degrees in Molecular Biology and Economics. My over two-decade tenure on Wall Street started as an analyst in a Sales and Trading program and led to roles in structured credit and ultimately in other areas of asset-backed finance. Today, I am proud to lead as the Head of North America Markets, where I focus on coordinating strategic initiatives across Markets. I have always viewed education as an ongoing process, a philosophy that has deeply influenced my career trajectory. I’ve actively sought to broaden my understanding in fields I’ve found interesting. In the past decade, I engaged in programs focused on biotechnology and clean energy finance. This continuous learning, even in areas not necessarily directly tied to my immediate work has helped me to be more creative. Today, my focus has shifted to learning about the crucial area of AI Safety and Ethics. As technology rapidly advances, I believe it’s imperative to ensure that artificial intelligence is developed and deployed responsibly.

Which trends in structured finance and asset-backed markets excite you most?

The asset backed markets provide the ability for both banks and private credit providers to co-exist. Regulation and capital pressures have reduced the willingness of banks to lend directly, which have provided a unique opportunity for private credit to step in. This collaboration is creating novel ways for borrowers to access customized financings beyond traditional corporate loans. As a result, a significant amount of capital has been raised by alternative asset managers as they allocate capital away from the public credit and as more insurance companies increase their allocations to private credit. A particularly interesting application of asset-backed finance is to support the high capital expenditure (capex) demands of the AI sector, including data center build and computing needs. As a result, a significant amount of capital has been raised by alternative asset managers in the private credit sector.

What accomplishment in your career are you most proud of?

I always think that what you remember most when you look back on your career are the toughest times you endure and yet still come out of whole. In my case, these were two significant market dislocations. In Decmember of 2008, I was managing a large mark to market loan TRS book while expecting my second child. My team and I performed through extreme market volatility. The second period was during March 2020, when the team underwent a similar situation, but in some ways, even worse because we weren’t together, and the world’s collective future and safety were uncertain. Managing through these periods as a team, and coming out even stronger, will still go down as two of my proudest moments.