The Fintech Open Source Foundation (FINOS), a nonprofit foundation promoting open innovation in financial services, together with OpenFin, the operating system powering digital transformation on financial desktops, today announced the contribution by OpenFin of the FCD3 program into the Foundation’s open source governance framework.

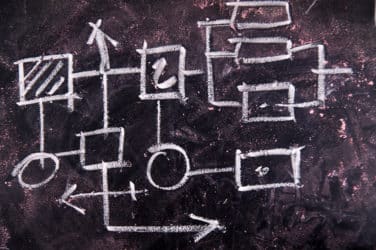

Financial applications are often difficult or impossible to connect to one another, requiring users to continuously re-key information, hampering productivity and creating operational risk. The Financial Desktop Connectivity and Collaboration Consortium (FDC3) solves the problem by providing industry standards for desktop application interoperability.

“Creating interoperability among desktop applications is one of the most important open source initiatives in financial services,” said Brad Levy, Chairman of FINOS. “The FDC3 program in FINOS provides the cross-industry governance framework and the large collaborative community required to advance innovation in the desktop arena.”

FINOS is an independent and neutral, non-profit foundation whose mission is to expand adoption of open source software and open standards in the financial services industry. Under the FINOS framework, the FDC3 standards will enable faster collaboration and innovation on financial desktops across the industry.

Jim Adams, CIB Head of Engineering & Architecture, J.P. Morgan said: “We look forward to actively contributing to the FDC3 Initiative as it develops the open standards and protocols that will be necessary to advance the interoperability of our desktop applications. We are pleased that this will be hosted and driven from the FINOS Foundation, reinforcing its importance in supporting open source initiatives across the financial services industry.”

Today’s announcement is further evidence of support for the Foundation by leading financial services companies. Known previously as the Symphony Software Foundation, the Foundation relaunched in April as the Fintech Open Source Foundation (FINOS) to reflect the Foundation’s expanded mission to serve as an independent forum for high-impact collaboration across the entire financial services ecosystem.

FDC3 was established by OpenFin in October 2017 and has seen rapid success with over 40 members and includes a full cross-section of capital markets participants including major banks, asset managers, hedge funds and cross-industry vendors representing financial data, trading and communications.

“At OpenFin, we share the commitment of FINOS to openness within the financial industry,” said Mazy Dar, CEO of OpenFin. “Operating the FDC3 program within the framework of FINOS means contributors and users alike can rest assured that an independent, neutral third party with expertise in open source will steward the long term growth and adoption of FDC3 standards.”

“What matters most to our Community members is fostering vibrant, market relevant collaborative programs that address the most pressing business needs facing financial services,” said Gabriele Columbro, executive director of FINOS. “By hosting with the Foundation and being open to anyone, we expect these programs will attract a wider set of contributions and diverse input, in turn leading to still greater adoption of the FDC3 standards.”