11.26.2020

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in US gained net inflows of US$33.36 billion during October, bringing year-to-date net inflows to US$333.23 billion which is higher than the US$223.14 billion net inflows gathered at this point last year as well as greater than the US$330.24 billion gathered in all of 2019. Assets invested in the US ETFs/ETPs industry have decreased by 0.8%, from US$4.73 trillion at the end of September, to US$4.69 trillion, according to ETFGI’s October 2020 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

@ETFGI reports year to date net inflows of $333.23 Bn into ETFs and ETPs listed in #UnitedStates as of the end of October are greater than full year 2019 net inflows https://t.co/mmo7NxBr7p

— Deborah Fuhr, ETFGI (@deborahfuhr) November 25, 2020

Highlights

- Year-to-date net inflows of $333.23 billion are much higher than the $223.14 billion had gathered by end of October 2019 as well as the $330.24 billion gathered in all of 2019.

- During October 2020, ETFs/ETPs listed in US attracted $33.36 billion in net inflows with Fixed Income products being the most attractive among all asset classes.

- Assets of $4.69 trillion invested in ETFs/ETPs listed in US at the end of October are the 3rd highest on record.

“During October, the S&P 500 decreased by 2.66% due to the uncertainty of US election while the pandemic still rising around the world. Regarding US companies, the negative movement of oil prices leaded the energy stocks down, although the four tech giants remain in positive sign. Developed markets outside the U.S. fell 3.56% during October, with Japan (24.7%), UK (11.2%) and Canada (8.5%) were the leaders. However, Emerging markets reported positive return of 2.04% through October.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

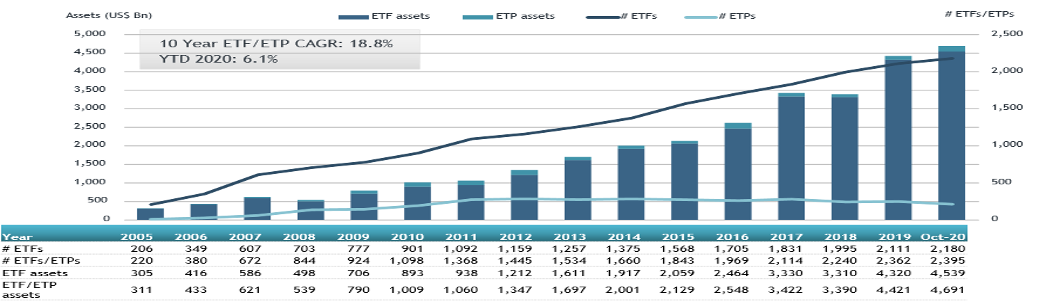

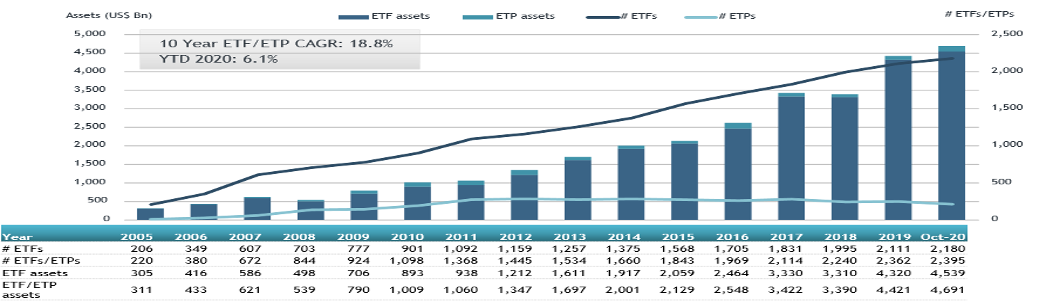

Growth in US ETF and ETP assets as of the end of October 2020

The US ETF/ETP industry had 2,395 ETFs/ETPs, assets of $4.69 Tn, from 167 providers on 3 exchanges at the end of October 2020.

During October 2020, ETFs/ETPs gathered net inflows of $33.36 billion. Fixed income ETFs/ETPs listed in US reported net inflows of $16.55 billion during October, bringing YTD net inflows for 2020 to $146.94 billion, which is greater than the $108.82 billion in net inflows in the corresponding period through October 2019. Equity ETFs/ETPs listed in US reported net inflows of $12.03 billion over October, bringing YTD net inflows for 2020 to $88.40 billion, more than the $84.36 billion in net inflows Equity products had attracted for the corresponding period through October 2019. Commodity ETFs/ETPs saw net outflows of $291 million in October. Year to date, net inflows are at $44.27 Billion, significantly more than the net inflows of $9.71 billion over the same period last year.

Active ETFs/ETPs gathered net inflows of $5.47 billion, bringing the YTD net inflows to $41.61 billion for 2020, which is higher than the $20.84 billion in net inflows for the corresponding period to October 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $28.35 billion during October. The Vanguard Total Stock Market ETF (VTI US) gathered 3.69 billion alone.

Source: ETFGI