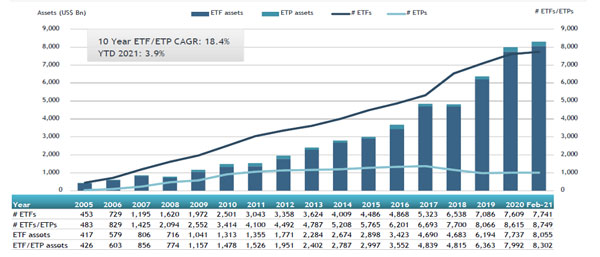

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported that reports assets invested in ETFs and ETPs listed around the world reach a new record of US$8.30 trillion at the end of February. ETFs and ETPs listed globally gathered the highest ever monthly net inflows of US$139.46 billion during February, bringing year-to-date net inflows to a record level of US$222.54 billion. Assets invested in the global ETFs/ETPs industry have increased by 3.0% from US$8.06 trillion at the end of January 2021, to US$8.30 trillion at the end of February, according to ETFGI’s February 2021 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs and ETPs listed globally reach a new record of $8.30 trillion at the end of February.

- Net inflows of $139.46 Bn in February are the highest ever beating the prior record of $131.99 Bn set in Nov 2020

- YTD net inflows are a record $222.54 Bn ahead of the $98.31 Bn in 2020 and beating the prior record of $130.95 set in February 2017

- $110.80 Bn of net inflows went into Equity products during February.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%) .“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Global ETF and ETP assets as of the end of February 2021

The Global ETF/ETP industry had had 8,749 ETFs/ETPs, with 17,421 listings, assets of $8.30 trillion, from 528 providers listed on 77 exchanges in 62 countries at the end of February.

During February 2021, ETFs/ETPs listed globally gathered net inflows of $139.46 Bn Equity ETFs/ETPs listed globally gathered net inflows of $110.80 Bn over February, bringing net inflows for 2021 to $159.89 Bn, greater than the $37.87 Bn in net inflows equity products had attracted YTD in 2020. Fixed Income ETFs/ETPs reported $9.08 Bn in net inflows bringing net inflows for 2021 to $22.33 Bn, which is lower than the $35.74 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs saw net outflows of $2.04 Bn in February, bringing YTD net inflows to $791 Mn, which is much less than the net inflows of $9.29 Bn over the same period last year. Active ETFs/ETPs listed globally reported net inflows of $16.90 Bn during February, bringing net inflows for 2021 to $33.80 Bn, much higher than the $12.47 Bn in net inflows active products had attracted YTD in 2020

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $60.61 Bn during February, Vanguard S&P 500 ETF (VOO US) gathered $11.53 billion.

Source: ETFGI