We have also leveraged its position as Europe’s leading asset manager, as our clients look for greater diversification in their allocations, with a renewed interest in Europe. With €2.3tn in assets under management, we are the only European player among the top 10 global asset managers, and a preferred gateway for players wishing to invest on the continent. Our comprehensive range of solutions enables investors to finance European companies and economies, and we continue to expand, through ETFs and actively managed funds focused on European sovereignty.”

Valérie Baudson, Chief Executive Officer, said:

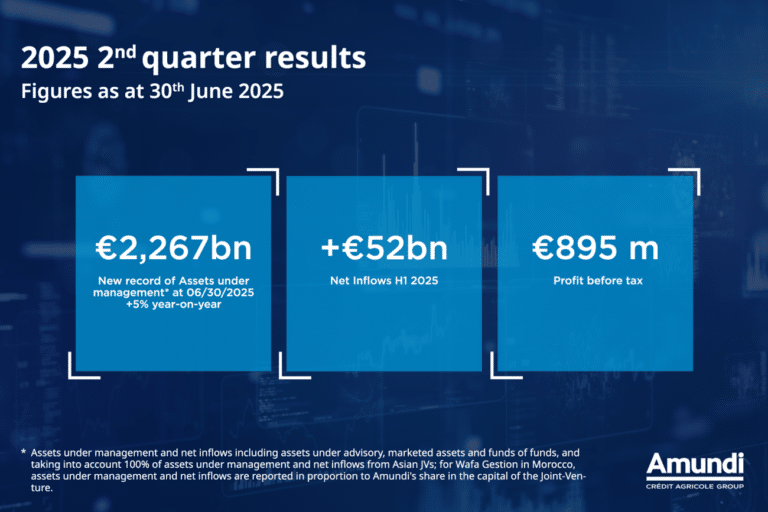

“With net inflows of +€52bn, our performance in the first half of the year was equivalent to the whole of 2024. The depth of our offering and our extensive expertise allow us to respond effectively to our clients’ needs, through our active strategies, passive management, responsible investment, employee savings schemes, technology services and fund distribution solutions.

We have continued to grow both in terms of activity and results, with first half revenues1 up +5% and profit before tax1 up +4% year-on-year.

Continued organic growth thanks to confirmed successes in the strategic pillars

2025 is the last year of implementation of the 2025 Ambitions plan, which sets a number of strategic pillars to accelerate the diversification of the Group’s growth drivers and exploit development opportunities. After a year 2024 during which several objectives were achieved, the first half of 2025 confirmed Amundi’s growth momentum

Amundi, the European expert

We are the leading European asset manager, and the only European player among the top 10 in the world3. This positioning allows it to manage €1,700bn in assets under management on behalf of European clients, who have entrusted it with +€29bn€ more to manage during the semester.

We invest, on behalf of our clients, more than half of our assets4 in euro securities. This rare European expertise is a strong differentiator for our comprehensive and innovative platform. The launch of new products, such as ETFs or actively managed funds to invest in the European defense sector, make it possible to nurture this distinctive element strongly quarter after quarter.

The Institutional division

The Institutional division generated high net inflows this half-year, at +€31bn, thanks to the win of the Defined Contribution mandate in the United Kingdom with The People’s Pension, successes in Asia, and record net inflows in Employee Savings and Retirement and the renewed interest in France in life insurance contracts in euros.

In addition, several innovative mandates were won, for example in private debt via the expertise of Amundi Alpha Associates, which attracted a German pension fund, or the index and ESG expertise, which made it possible to win a low-carbon mandate for Chile’s sovereign wealth fund.

The Third-Party Distribution

The Third-Party Distribution recorded assets under management up more of over +18% year-on-year5, thanks to 12-month net inflows of +€33bn, of which +€13bn6 in the first half of 2025, mainly in Medium to Long-Term assets6, (+€12.1bn).

Net inflows are driven by ETFs and positive in active management, diversified by geographical areas and positive in terms of Medium to Long-Term assets in almost all countries, particularly in Asia (+€3bn).

The strong commercial momentum with digital platforms is confirmed, with this type of customer accounting for around 40% of net inflows for the first half; it should be noted that a presentation dedicated to Third-Party Distribution was held on 19 June in London to highlight the growth potential of this strategic focus of the MTP.

Asia

Assets under management were up +2% year-on-year despite the decline in the US dollar and the Indian rupee, to reach €460bn; half-year net inflows reached +€22bn, of which +€14bn in the second quarter.

Half-year net inflows comes from the Joint Ventures for +€14bn and for +€8bn from direct distribution. It is also diversified by country: India (+€7bn), China (+€5bn), Korea (+€5bn), Hong Kong (+€3bn) and Singapore (+€1bn).

ETFs

ETFs gathered +€19bn this half-year to reached €288bn in assets, placing us in second place in the European ETF market in both net inflows and assets under management.

This high level of activity was achieved thanks to the diversification of the business line by client types, geographies and asset classes covered. Asia and Latin America, for example, contributed +€4bn in net inflows over the half-year.

Amundi Technology continues to grow

Its revenues increased by +48% H1/H1, thanks to a strong organic growth amplified by the integration of aixigo.

Fund Channel

The fund distribution platform, has exceeded its target of the Ambitions 2025 strategic plan six months ahead of schedule, with €613bn in assets under distribution. The subsidiary has launched, in partnership with the Liquidity Solutions teams of Amundi and CACEIS, Fund Channel Liquidity, a multi-management platform for treasury products, which has already been awarded the Liquidity Solutions the innovation of the AFTE.

New three-year strategic plan

Following the success of Ambitions 2025, a new three-year strategic plan will be presented in the fourth quarter.

Partnership with Victory Capital

On April 1st, the partnership with Victory Capital was finalized and Amundi received 26% of Victory’s share capital in remuneration for the contribution of Amundi US.

This stake is consolidated in the second quarter accounts under the equity method, with a one-quarter lag compared to Victory’s publications because the company, listed on the Nasdaq, publishes its accounts after those of Amundi (on August 8 for its second quarter 2025 results).

26% of assets under management are consolidated in a separate line for assets under management distributed to US clients and 100% for the portion of assets under management managed by Victory but distributed by Amundi to clients outside the United States.

FitchRatings

In a press release dated 4 July, the rating agency FitchRatings confirmed Amundi’s A+ issuer rating7 with a stable outlook, the best in the sector.

Source: Amundi