Interim results for the six months ended 30 June 2024

Continued strategic progress across all divisions

Investment in Technologies division to support conversion of growing, high-quality pipeline

Aquis Exchange, the creator and facilitator of next-generation financial markets, is pleased to announce its unaudited results for the six months ended 30 June 2024.

Operational highlights

· Strategic delivery across all divisions:

– Aquis Technologies: strong growth in contract pipeline; more than half are for national exchanges or central banks, demonstrating the evolution of the division’s client profile.

– Aquis Markets: market share up to 5.20% (FY23: 4.85%), as the benefits of the change to the proprietary trading rule continue to flow through and members adapt to the change.

– Aquis Data: increase in revenue, driven by new data fees for members which came into effect in the second quarter, with further positive impact expected as the year progresses.

– Aquis Stock Exchange: strong growth in trading, with volumes up 44% on the prior year and £87m of funds raised, against a challenging market backdrop.

·Post-period end:

– Announced £6.2m strategic investment in the Technologies division over the next three financial years, to capitalise on the significant pipeline of opportunities.

– Increased stake in OptimX Markets to 10.2%, adding additional connectivity to Aquis Matching Pool (AMP).

Outlook

· Current trading is in line with the Board’s expectations set out in theAugust 2024 trading update.

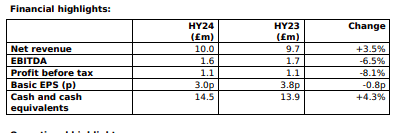

· The Group has a strong cash position of£14.5m as at 30 June 2024, providing capacity to continue to invest in growth opportunities, in line with its medium-term strategy.

Aquis CEO, Alasdair Haynes, said: “I am pleased with the progress made by Aquis in the first half of 2024, as we continued to deliver against our strategy at pace. We have made meaningful progress across all of our divisions, the majority of which have increased revenues and maintained stable PBT, reflecting the investment plans we communicated last year.

There is real momentum across the business. Our pipeline in the Technologies division has increased materially since last year and now stands at record levels, with notable growth in the quality of the pipeline as well. Our strategic investment in this division demonstrates our commitment to strengthen the Group’s ability to capitalise on this pipeline, and drive further scale.

I am excited about the future as Aquis remains well-placed to pursue the opportunities that lie ahead, as we continue to execute our long-term growth plan.”

Source: Aquis Exchange