Axa Investment Managers is many things to many people, but one thing it is not: a niche provider. The Paris-based behemoth manages about 540 billion euros ($671 billion), or more than the respective GDPs of Switzerland and Saudi Arabia. Axa IM Chief Executive Dominique Carrel-Billiard notes the asset base supports a supermarket-like selection which in turn attracts more assets.

Axa IM, a unit of French insurance giant Axa S.A., was the world’s 15th-largest asset manager as of year-end 2011, according to the company. Of Axa IM’s assets, about 360 billion euros ($447 billion) is managed on behalf of the parent company and 180 billion euros ($224 billion) is managed for external clients, either institutions or distributors.

As of year-end 2010, Axa Group’s $1.46 trillion under management ranked seventh among global investment managers, according to a joint Pensions and Investments/ Towers Watson report. Axa ranked behind BlackRock, State Street, Allianz, Fidelity, Vanguard, and Deutsche Bank, and ahead of BNP Paribas, JPMorgan Chase, and Capital Group. The P&I/Towers Watson rankings for the previous year are published in October.

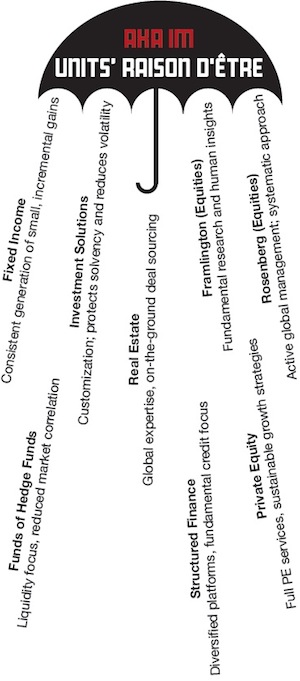

As would be expected for an asset-management arm of an insurance company, Axa IM’s asset base is skewed towards bonds. Axa IM manages about 300 billion euros ($370 billion) of fixed-income assets, 42 billion euros ($52 billion) of real-estate assets, 20 billion euros ($25 billion) of private equity, and 25 billion euros ($31 billion) of structured credit. Its Framlington and Rosenberg equity groups manage 25 billion and 15 billion euros ($19 billion), respectively.

“The fixed-income asset class is critical for investors who have long-dated liabilities and commitments and need a way to generate regular income and earnings,” Carrel-Billiard told Markets Media in a July 25 interview at Axa’s London office, near St. Paul’s Cathedral. “This will probably remain a foundation asset class for most institutional investors, therefore being strong in fixed income is important.”

Dominique Carrel-Billiard

“Markets are not very bullish… and there are a number of structural issues that are effectively overhanging market.”

Axa Group was created in 1817 via the merger of several insurance companies. The Axa name is not an acronym, but rather was coined because it can be easily pronounced by speakers of many different languages.

Axa’s asset-management group was founded in 1994 with the spin-off of the investment functions of the insurance company, combined with acquisitions such as Framlington and Rosenberg, plus creations such as Axa Private Equity and Axa Real Estate. The unit was first known as Axa Asset Management Europe, before a subsequent name change to Axa Investment Managers.

LARGE INSTITUTION, LARGE INVESTORS

Axa IM’s history and relationship with Axa Group make it most compatible with institutions such as pensions, insurance companies, corporations and sovereign wealth funds, which can have billions of dollars to invest. “Given our DNA was to serve the Axa Group, we serve quite sophisticated and very large investors that have broad portfolio needs,” Carrel-Billiard said. “To address those needs, we need to have a full range of capabilities in terms of asset classes.”

In conjunction with the range of asset classes, Axa IM offers investment solutions as a “layer on top” that can link otherwise separate portions of a portfolio. “Each expertise is focused on an asset class except the investment-solutions expertise, which is multi-asset class and based on allocation, structuring and selection,” Carrel-Billiard said. “That way we can be relevant for large institutional investors with diverse portfolio needs, and we can have fairly sophisticated conversations with them on how they can structure their portfolios, including risk management, derivatives overlays, and managing the various components.”

Axa IM has about 2,400 employees worldwide, located in 23 countries in Europe, Asia, the Middle East, and North America. Investment teams are organized on a global basis to develop global views on markets, “and that knowledge and insight is then delivered to local clients,” Carrel- Billiard said. “The distribution is local, and the asset-management function is global by nature. Global investment teams with local customer-facing teams deliver global insights locally to investors.”

Carrel-Billiard said the “vast majority” of clients are in Europe, and about 85% of Axa IM’s assets were raised in Europe. There is little opportunity to grow the business in Axa IM’s home country of France, but the U.K., Holland, Germany, and Switzerland are among European markets with upside.

More importantly, the asset manager is looking at huge untapped markets to the east and to the west. “We are currently expanding our distribution capabilities in the U.S. and Asia,” Carrel-Billiard said. “We have money-management teams in the U.S. that manage probably about 60 billion euros, but these are not assets sourced from the U.S. So the question is, based on the capabilities that we have to manage U.S. assets: how do we then attract U.S. investors to those U.S. capabilities?”

Carrel-Billiard, 46 years of age, was in charge of U.S. insurance as well as asset management and reinsurance for Axa Group before joining Axa IM in 2006. Previously, he was a partner at consultancy McKinsey, where he worked from 1992 to 2004. He holds academic degrees from HEC Paris and Harvard Business School.

Axa IM has significantly improved its investment performance over the past six years, according to Carrel-Billiard, and the firm has won a number of awards including equity manager of the year from UK Pensions Awards for two consecutive years.

“It is not a business where you can be two men and a dog in a garage anymore.”

Dominique Carrel-Billiard

consecutive years. Another accomplishment Carrel-Billiard cited can be described as organizational streamlining, or as the CEO termed it, “building from this very heterogeneous space of businesses a rather homogenous and consistent group of investment experts where the organizational model is very clear, the strategy is clear and everyone is effectively aligned behind the vision.”

“Our expertise are actually all structured along the same lines, which is they control everything they need for their investment process for management of the money, and they have the product specialists with them,” Carrel-Billiard explained. “The rest of the functions — support, control, distribution — are shared across our expertise. Having that model of clarity is important as it helps us to move and steer our way through an industry which is incredibly mobile, and markets that are very volatile.”

Dominique Carrel-Billiard

“The fixed income asset class is critical for investors who have long-dated liabilities and commitments and need a way to generate regular income and earnings.”

Axa Group competes with a wide range of companies across the spectrum of financial products and services, and around the globe. Its closest-peer group includes large multinational insurance companies such as Munich-based Allianz Group and Londonbased Aviva Plc.

As an asset manager, Axa IM’s breadth of offerings is a differentiating factor, Carrel- Billiard noted.

The firm’s affiliation with Axa Group is another selling point. “It gives us a longterm perspective on investments and a personality in terms of the way we manage risks and returns that is attractive to many institutional investors,” Carrel-Billiard said. “These investors are not only insurance companies, but pension funds and endowment foundations, where essentially the philosophy we have developed in being active, reliable and repeatable in terms of investment performance is going to strike a chord.”

SOUP TO NUTS

Axa IM is well-positioned to gain market share for at least two reasons, said Jean-Francois Bay, chief executive of Morningstar Paris. As a very large firm, Axa IM can offer an integrated suite of products rather than just products on a one-off basis; and as a unit of an insurance giant, Axa IM stands to benefit from currently negative sentiment towards investment banks and by extension, their asset-management units.

Jean-Francois Bay, chief executive of Morningstar Paris

“An advantage for a large company like Axa is that they do not just offer product; they have a solutions approach.”

“When you manage balanced portfolios you have to be very strong in asset allocation. It’s not just bond picking or stock picking, it’s also the ability to manage the asset allocation and be tactical and flexible,” Bay told Markets Media in a telephone interview. “An advantage for a large company like Axa is that they do not just offer product; they have a solutions approach. The idea is to be able to offer retirement solutions for individual investors and capital solutions for institutional investors.” “Banks do not have a good image,” Bay continued. Especially when competing for retail investors, “clearly the advantage is with a life-insurance company,” he said.

Axa IM investment professionals try to outperform indexes. “We are active managers,” said Carrel-Billiard, a Parisian with an easy and amicable demeanor. “We believe the active part of the asset management value-added that we bring can be captured by the products we have.”

The company recently introduced its Smart- Beta product, which is meant to bridge the gap between active and passive management of credit portfolios. Because corporate-bond indexes are capitalization-weighted, passive managers may end up with more-than-optimal exposure to the most-indebted companies. SmartBeta essentially redefines an index with what Axa IM asserts is a more attractive risk-return tradeoff.

“We call that an intelligent investment universe with the right type of filtering,” Carrel- Billiard said.

About 120 billion euros ($148 billion) of Axa IM’s assets are managed to a benchmark, and Carrel-Billiard said that money showed more than 75 basis points, or 0.75%, of weighted outperformance last year. Going further back, Carrel-Billiard said he was “very pleased” with the firms’ investment performance over the past five to six years.

As of year-end 2010. Source: Pensions and Investments/Towers Watson

Rather than absolute measures of outperformance or underperformance, Axa IM favors information ratios, which adjust for risk by factoring in volatility and consistency of returns; a higher information ratio implies a more efficient portfolio. Interpretations of an information ratio can vary, but one rule of thumb holds that a ratio of 0.5 is good, 0.75 is very good, and 1 is outstanding.

Information ratios in Axa Fixed Income, Axa Framlington, and Axa Rosenberg “more often than not” exceed 0.5, and ratios on a good portion of Framlington assets exceed 1, according to Carrel-Billiard. “The investment track record is pretty strong, and it helps us drive flows to the better-performing products,” Carrel-Billiard said. “Framlington so far (this year) is in positive territory, which is no mean feat given what is happening in the equity markets, and given that we have a European bias. It is pretty strong to be in positive territory when the rest of the market is in negative territory.”

Axa IM saw outflows of about 20 billion euros ($25 billion) each year in 2009 and 2010, followed by stabilization in 2011. Carrel-Billiard noted “very significant” ongoing flows into credit and other fixed-income products; joint ventures in Asia, alternative investments and some actively managed equity platforms have also taken in money, while Rosenberg has seen substantial outflows since 2007.

To be sure, Axa is not alone as an asset manager struggling to move forward against the macro headwinds of the past half-decade. Global assets under management industry-wide increased just 6% between 2007 and 2010, an annual rate of less than 2%, according to industry figures. Between 2002 and 2007, the sector expanded at closer to 15% annually.

MACRO HEADWIND

“One of the key challenges industry-wide is growth,” Carrel-Billiard. “For an industry that was used to a very fast pace of growth, it has slowed down considerably. And you see a number of challenges in terms of profitability.”

Market participants say that very large asset managers such as Axa have been cushioned from the past few years’ economic and market turmoil to a certain extent, as investors favor the perceived safety of ‘brand’ names. Customizing a market axiom, it can be said that no investor will get fired for allocating money to Axa.

Still, Axa is not standing pat. “Priorities going forward are to make sure we serve our clients best so that we are on a positive growth trajectory, preferably in excess of the industry. We are focusing on clients, making sure we deliver the right level of performance and the right type of advice, of course at the right price,” Carrel-Billiard said. Coming to market with new initiatives and new offerings is important.”

Aside from its SmartBeta initiative, Axa IM is ramping up its loans offering, Carrel- Billiard said. The firm is supplementing its 3.5-billion-euro ($4.3 billion) portfolio with newer offerings of loans of mediumsized corporations as well as U.S. loans. The most attractive expansion opportunities for Axa IM lie outside Europe and also in some “satellite” asset classes such as high yield and inflation-protected bonds, according to Morningstar’s Bay.

As an active manager, Axa IM must stay abreast of developing macro events, of which there is no shortage heading into the fourth quarter. European sovereign debt problems, an upcoming U.S. presidential election, and persistent global economic slowness are just a few of the issues with the potential to roil investment portfolios.

Another implication of being an active investment manager is the need to manage trading costs and minimize trading friction. For Axa IM, this can be especially challenging in two ways: one, the firm’s massive assets under management can complicate the task of getting in and out of positions without moving markets, and two, its multi-asset-class model requires multiple sets of trading expertise and architecture, as trading a corporate bond is different than trading a real-estate loan.

“Trading performance is key to the investment process of Axa IM, where liquidity must be found across all asset classes and in any market conditions,” Christophe Roupie, global head of trading and securities financing at Axa IM, wrote in an e-mail to Markets Media.

Axa IM’s trading desks use Straight- Through Processing, a protocol that optimizes electronic trading and lessens, but does not eliminate, the need for high-touch service. “Straight-Through Processing is deployed to increase operational efficiency, minimize risk and allow flexibility in the way we manage our flows,” Roupie said. However, “nothing can replace the qualitative value added by our traders in the way they interact with their clients and their brokers.”

Christophe Roupie, global head of trading and securities financing at Axa IM

“Straight Through Processing is deployed to increase operational efficiency, minimize risk and allow flexibility.”

For Axa IM, the broad investment thesis is caution for the near term, but optimism farther out. “We are witnessing a slowdown of economic expansion pretty much everywhere — in Europe to start with, but also in the U.S., China, and Asia,” Carrel-Billiard said. “Markets are not very bullish given that environment, and there are a number of structural issues that are effectively overhanging market sentiment. Structural imbalances in European public finance are the most visible.”

“Structural imbalances in public finance are everywhere, there are trade imbalances, and I think the monetary system overall is an issue,” Carrel-Billiard continued. “And there are some geo-strategic risks around what’s happening in the Middle East… Overall, we live in a turbulent environment where effectively being cautious is probably a good short-term attitude.”

EUROPE IN FOCUS

Regarding Europe specifically, Carrel-Billiard noted that investors need to look at political factors first and foremost, as even the most carefully crafted economic and financial forecasts may get upended depending on whether European governments push for more convergence or back off.

“The outcome of the black scenario, where the euro is being severely challenged, is such that it should probably provide incentives for governments to do whatever it takes to solve the situation,” Carrel-Billiard said, adding that he expects “a gradual scenario every step of the way, like we have been through for the past three to four years essentially.”

Developing regulation is very much on Axa IM’s radar, and Carrel-Billiard noted there is plenty going on in this area to keep European investment managers busy trying to stay abreast.

“The regulatory agenda is very, very deep,” he said. “There is a lot of regulation, and while for banking and insurance companies you have Basel III and Solvency II, in asset management we are affected by most regulation that affects financial services,” such as Markets in Financial Instruments Directive (MiFID), European Market Infrastructure Regulation (Emir), Alternative Investment Fund Managers Directive (AIFMD), and Undertakings for Collective Investment in Transferable Securities (Ucits 5).

“The cost of regulation is increasing all the time,” Carrel-Billiard continued. “There are regulatory priorities like Ucits 4 that were meant to enhance the quality of service to investors, and I think it is probably achieving that in some areas. In other areas, like the idea that we should make funds larger and cheaper like in the U.S., there are still lots of barriers. So the ambition of having a unified European market with larger, cheaper funds is still some ways away.”

Carrel-Billiard weighed in on the French proposal to tax financial transactions, which may be finalized in September and may or may not be consistent with those spelled out by regulatory regimes in other countries. A financial-transaction tax “should be applied universally so that it does not create distortions from a competition point of view,” he said.

In Carrel-Billiard’s view, the size of an asset manager will become increasingly important as a criteria for investors. “With size come advantages in terms of market access, brand awareness, the ability to attract, retain and motivate the right talent, and the ability to absorb the increasingly high cost of regulation,” he said. “There will always be a polarization between large and boutique managers, but it is not a business where you can be two men and a dog in a garage anymore.”

Investment management is a cyclical business that is now in the down phase of the cycle, which “should put some players under pressure and trigger some consolidation,” Carrel-Billiard said. “The question is then, how will consolidation happen?”

Carrel-Billiard opined that consolidation is already happening in the investment management business; not the Fidelity-buys-Vanguard kind of consolidation that generates headlines, but rather an ongoing rich-get-richer dynamic.

“You have a group of players — not many more than five to seven — that are concentrating net new money flows in the industry, and are in very positive territory at the expense of everyone else,” Carrel-Billiard said. “They are consolidating the industry organically…Consolidation will take place more through organic market-share gains and natural attrition.”

TOUGH SET

Axa IM generated revenue of 610 million euros ($753 million) in the first half of 2012, down 6% from the year-earlier period. The company cited lower performance fees and lower real-estate transaction fees for the decline.

Carrel-Billiard, married with three children, enjoys playing tennis in his spare time. In tennis parlance, his investment view can be likened to the economy and financial markets laboring through a difficult set in a doubles match against bearishness and growth depressors, but the former duo is in a good position to gain the upper hand in subsequent sets.

“Crises are a recurring phenomenon of capitalism; I think this is just one of those, but it is particularly severe,” Carrel- Billiard said. “Long term, one can only be optimistic because history has proven we get out of crises.”