Boerse Stuttgart Group continues its structural growth

High turnover in securitized derivatives and growth in bond trading // Number of customers in digital business grows despite difficult market environment

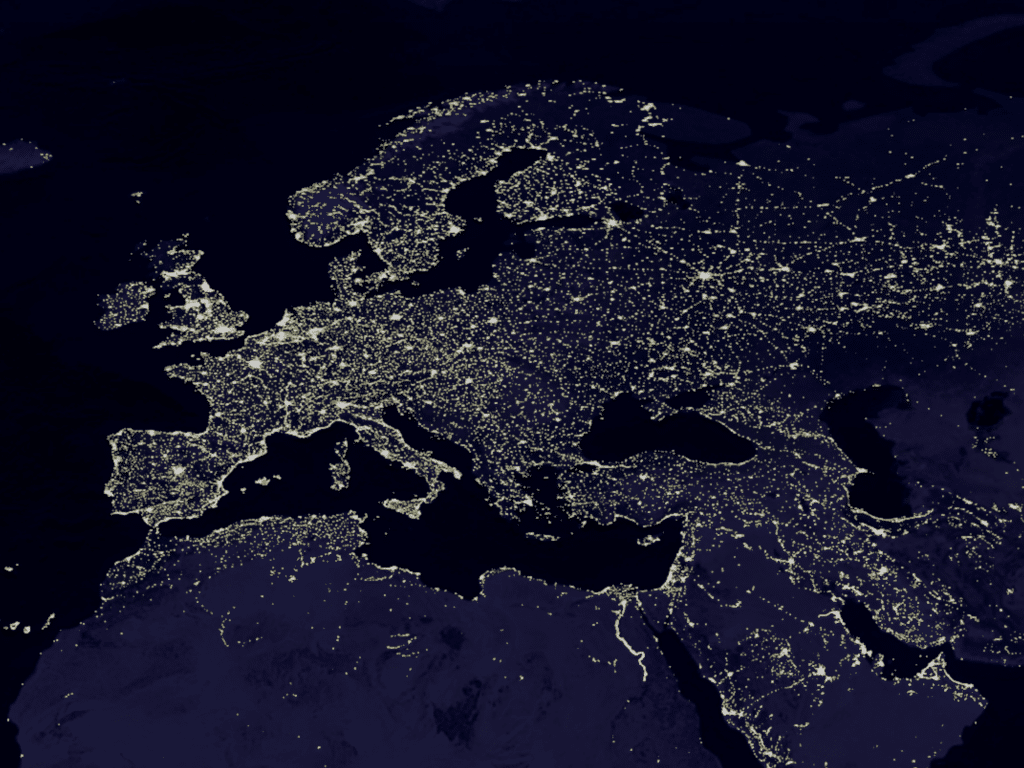

Following an eventful year on the markets, Boerse Stuttgart Group draws a positive conclusion: “In the challenging environment of 2022, we have successfully continued our structural growth – in the capital markets business and in the digital business. We have developed innovative market models and products, acquired new customers, and advanced our presence in Europe,” says Dr. Matthias Voelkel, CEO of Boerse Stuttgart Group: “In securities trading, we have entered the zero-fee space with innovative offerings in Germany and Switzerland in order to actively shape this market. Our Swedish subsidiary exchange NGM has set a new record for trading volume in 2022, as it did in the previous year. In our digital business, we have increased the number of both our institutional and retail customers significantly and entered the Swiss market. Overall, 2022 has demonstrated the strength of our business model, which is not dependent on individual asset classes or countries.”

The challenging market environment is reflected in securities trading at the German trading venue of Boerse Stuttgart Group: The trading volume is expected to be around EUR 91.1 billion in 2022, including a projection for the last three trading days of December. This means that turnover across all securities classes is around 15 percent below the level of the previous year, which was very strong due to corona effects. In securitised derivatives trading, turnover falls only slightly to around EUR 42.3 billion. With a market share of around 63 percent, Boerse Stuttgart remains the market leader for exchange-based trading in securitised derivatives in Germany. In bond trading, turnover rises by about 6 percent to around EUR 9.4 billion, in a year that was dominated by the central banks’ turnaround in interest rates.

Even in the very tough market environment for cryptocurrencies, Boerse Stuttgart Group continued to achieve strong structural growth in its digital business: The offerings BISON and BSDEX for retail investors and institutional players together now reach around 810,000 end customers, representing growth of around 29 percent. Ten additional cryptocurrencies were introduced to trading in 2022. However, the trading volume declined significantly compared to the particularly strong previous year and amounted to around EUR 3.3 billion – in line with the negative cyclicality in the overall market.

SOURCE: Boerse Stuttgart Group