Clearstream and the securities finance automation provider Pirum have extended their services to offer new collateral connectivity. This allows mutual clients to automate the calculation, matching, submission and validation of collateral requirements and allocations for securities lending, repo and OTC derivative transactions. The extended connectivity assists clients with agreeing collateral on a real-time basis, reducing collateralisation timeframes and increasing efficiencies along the value chain, from improving settlement rates and reducing fails and SDR penalties to optimising collateral more efficiently.

Together with @PirumSystems, we extend our #collateral connectivity. Clients can automate calculation, matching, submission and validation of collateral requirements and allocations for securities lending, #repo and #OTC derivative transactions. https://t.co/IfesEvp3LX pic.twitter.com/nADBgkvF3h

— Clearstream (@Clearstream) August 4, 2022

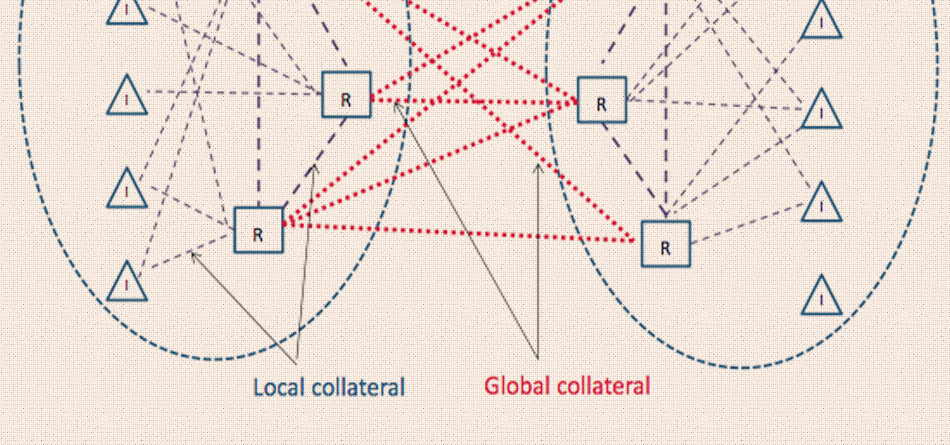

Pirum’s Head of Collateral Services, Todd Crowther, commented: “We are delighted to extend our connectivity with Clearstream and to work together to help mutual clients achieve improved exposure management and collateral optimisation results. Pirum’s aim is to support the industry’s need to extend interoperability and automation across the wider collateral ecosystem and support market participants’ drive to streamline and centralise margin management across all collateralised products.”

Jean-Robert Wilkin, Banking, Funding & Financing at Clearstream, added: “At Clearstream, providing user-friendly, efficient services supported by best-in-class technology is at the heart of our mission. We are very happy to extend our existing connectivity with Pirum, which contributes perfectly to this goal. By automating collateral management services, we increase interoperability and reduce complexity throughout the entire process for our mutual clients and the whole market.”

Pirum’s CollateralConnect and ExposureConnect services automate in excess of $1.5 trillion of tri-party collateral across more than 50,000 accounts and covering 70+ global clients each day.

Source: Clearstream