- Collateral Mapper provides up-to-date data and pre-emptive analytics about collateral portfolios and equity capacities

- The tool allows for higher volumes of transaction execution by more effectively allocating collateral assets

Clearstream has launched a new data-based solution to optimise collateral management: the Collateral Mapper.

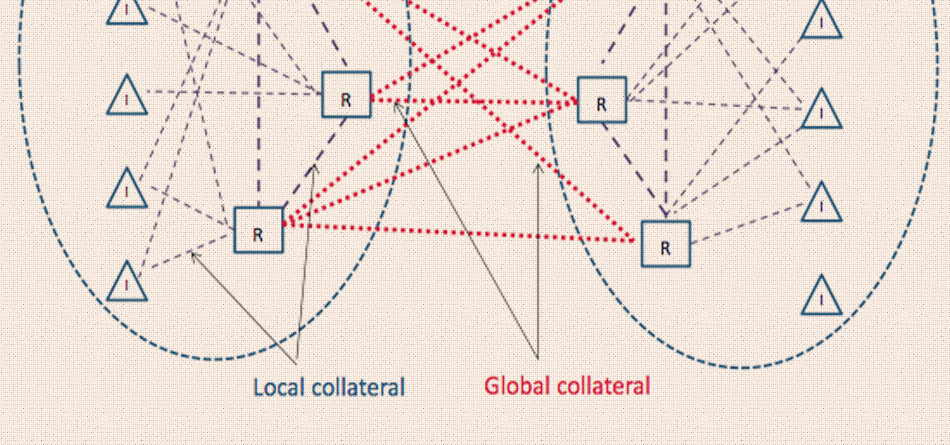

Clearstream’s Collateral Mapper allows clients to make well-informed decisions by providing them with an automated and complete view of their collateral positions. It summarises complex sets of reports on collateral usage in an intuitive dashboard and evaluates the collateral potential of an equity portfolio. Furthermore, it identifies the spare capacity in rebalancing an inventory towards equity thereby highlighting the possibility to free up higher quality assets. The Collateral Mapper eliminates error as it automatically updates based on end-of-day data without manual intervention.

Historically, the collateral management market has been based on comprehensive manual processes, resulting in inefficiencies, high cost and errors throughout the process chain. That is why market participants are continuously looking for ways to make this process faster, more efficient and less error prone.

Priya Sharma, Head of Data & Connectivity at Clearstream, said: “Due to the current changing interest rate climate, market participants are placing a renewed focus on collateral management. We at Clearstream combine the power of high-quality data and pre-emptive analytics to provide clients with innovative and reliable insights. With the Collateral Mapper, we enable them to maximise their collateral pool across different asset classes. Today, more than 10 per cent of triparty repo collateralisation is taking place in equities, bringing potential to optimise eligible inventory.”

Marton Szigeti, Head of Collateral, Lending and Liquidity Solutions at Clearstream, added: “Providing our clients with reliable and scalable state-of-the-art solutions that reduce the frictional costs of trading through transparency and automation is core to our collateral management strategy. We at Clearstream are the innovation partner of choice in digital post-trading, an expertise that we are bringing to bear in the transformation of the collateral management space.”

The Collateral Mapper can be accessed as self-serve tool via Clearstream’s Xact platform and will be available for free in a 3-month trial period starting now.