CloudMargin, creator of the world’s first and only collateral and margin management solution native to the cloud, announced enhancements to facilitate clients’ preparedness for the Uncleared Margin Rules (UMR) for those firms that have just fallen under the scope of Phase 5 or will fall under the scope of Phase 6 as of next September.

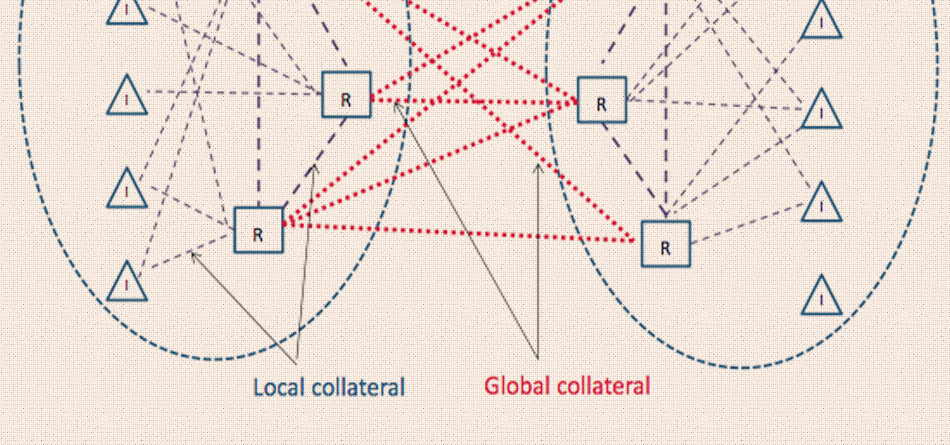

The firm is now connected to nearly 60 custodians globally for cash, securities and third-party SWIFT settlement, in addition to its long-established SWIFT connectivity to the four major triparty agents.

In January 2016, CloudMargin became the first collateral management technology provider to offer direct connectivity to SWIFT’s global network of financial institutions.

CloudMargin clients and their partners are able to leverage the network of custodians out-of-the-box. They can issue instructions automatically, with real-time settlement status consumed back into the platform, allowing firms to maintain tight control of their risk and liquidity as they meet their new margin requirements for non-centrally cleared derivatives.

Simon Millington, CloudMargin Head of Business Development, said: “We successfully onboarded a whole host of clients that fell under the scope of Phase 5 onto UMR-ready features to ensure compliance in time for the 1 September deadline that just passed. A number of these clients wanted to connect to custodians, and we anticipate this will be a growing trend as we move into Phase 6 that impacts so many more firms. By continually adding custodians to our market-leading network, we’ll help our clients meet the challenges of connecting not only to their third-party custodian of choice but also to those of their counterparties for UMR. For banks, in particular, with a large number of in-scope counterparties, this capability can significantly reduce the connectivity burden. For the buy side there is also significant appeal; they can leverage our triparty connectivity for their bank counterparty relationships, and we likely are already connected to their custodians.”

Millington added that UMR readiness can take time, and CloudMargin can help Phase 6 firms take steps immediately to ensure they have put all of the proper procedures in place for a smooth transition.

Other CloudMargin platform enhancements since the UMR Phase 4 deadline include the rollout of a robust reporting suite that gives firms open access to centralised, structured trade and collateral data, facilitating their ability to meet regulatory reporting requirements and achieve greater credit risk transparency.

Source: CloudMargin