What’s new? Ether/Bitcoin Ratio futures arrive on July 31

Ether/Bitcoin Ratio futures will be available starting July 31, pending regulatory review. The new contract enables traders to efficiently capture the relative value between Ether and Bitcoin in a single trade without slippage and will be cash-settled based on the settlement prices of the corresponding futures contracts.

Similar to inter-commodity spreads, ratio futures can help maintain price alignment between the two underlying contracts, potentially improving the bid-ask spreads for the outright contracts.

➜ Find out more

|

|

Rallying crypto prices drive increased institutional demand and record OI in Cryptocurrency futures

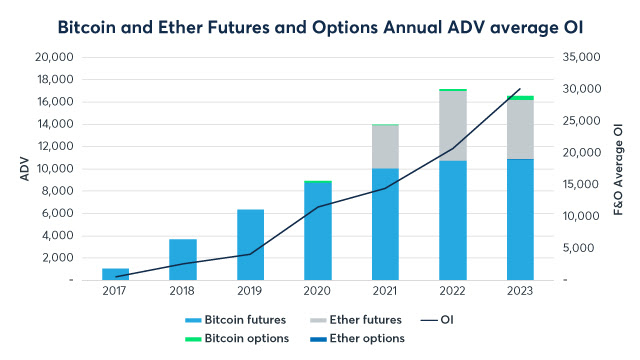

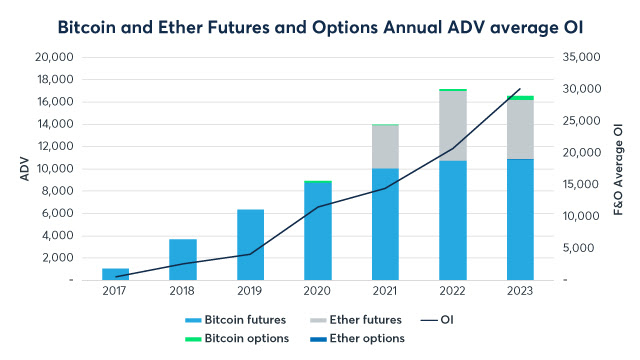

Bitcoin and ether prices have rallied as the cryptocurrency market continues to recover in 2023. Bitcoin’s price increased 81%, while Ether’s price rose 54% since the start of the year. The resiliency of the two leading cryptocurrencies by market capitalization has attracted increased institutional interest for CME Group’s suite of regulated and liquid cryptocurrency products, culminating in record open interest in Q2.

2023 open interest (OI) records:

Source: CME Group

➜ View the full recap

Large open interest holders (LOIH) remain strong across Bitcoin and Ether futures

Bitcoin futures: Institutional interest continued to rise throughout Q2 as investors sought regulated venues and products to hedge market volatility and manage exposure. Q2 2023 ADV reached 10.6K+ contracts and open interest averaged 14.3K contracts. The number of LOIHs averaged a record of 107 in Q2.

Ether futures: Over 3.1M contracts (156M equivalent ether) have traded since launch just over two years ago. LOIH averaged 62 throughout the quarter. Options on Ether futures have now traded over 10K contracts since their September 2022 launch.

Source: CME Group Data as of June 30, 2023, unless otherwise specified.

*A Cryptocurrency futures large open interest holder (LOIH) is defined as any entity that holds at least 25 contracts of the respective futures.

View full version of Crypto Insights online here.

Source: CME

|

|

Q2 2023 VOLUME AND OPEN INTEREST

Cryptocurrency futures and options

ADV: 38.6K contracts

Open interest: 79.2K contracts

| Futures contract |

Q2 ADV |

| BTC |

10.6K |

| ETH |

4.7K |

| MBT |

11.3K |

| MET |

9.8K |

Now live: more weekly options to trade throughout the week

Enjoy greater precision and versatility in managing short-term bitcoin and ether risk with the expansion of weekly options expiries across our Cryptocurrency options suite:

- 10 new Monday – Friday weekly options on Bitcoin futures and Ether futures

- Four new Tuesday and Thursday weekly options on Micro Bitcoin futures and Micro Ether futures

➜ More on options

|

|

|