Coinbase Derivatives and Nodal Clear are partnering to integrate USDC as collateral for US futures trading, working with the CFTC to bring this to market. This is expected to be the first regulated use case of USDC as collateral and will leverage Coinbase Custody Trust as the custodian.

As part of a multi-year renewal agreement, Coinbase Derivatives, a CFTC-regulated designated contract market, and Nodal Clear are partnering to integrate USDC as eligible collateral for futures targeting next year. This will mark a meaningful milestone in our push to establish USDC as a true cash equivalent, while also offering increased efficiency through near-instant money movement and secure custody. This also underscores USDC’s reliability, operational advantages, and growing acceptance in traditional financial markets.

Nodal Clear is a CFTC-regulated derivatives clearing organization, which is part of EEX Group, a Deutsche Börse company. As one of the most trusted stablecoins with transparent reserves and strong regulatory oversight, USDC aligns seamlessly with Nodal Clear’s rigorous risk management framework, making it a natural fit for inclusion as eligible collateral. This is a significant advancement in the growth of our continued partnership with Nodal Clear.

“Our commitment to integrate USDC as collateral reflects our dedication to enhance trading capabilities for US market participants, improve operational efficiency through almost instant money movement, and ensure secure custody via Coinbase Custody Trust, a Qualified Custodian regulated by the New York Department of Financial Services.” – Boris Ilyevsky, CEO, Coinbase Derivatives, LLC

“Working with Coinbase Derivatives, we are excited to continue our relationship and provide innovation to the industry, such as our introduction of the first 24×7 margined futures in May 2025. The plans to integrate USDC as collateral represent our continued commitment to seek to be responsive to market needs and innovate. We look forward to engaging with our clearing members and the CFTC in seeking to make this a reality” – Paul Cusenza, Chairman and CEO, Nodal Clear

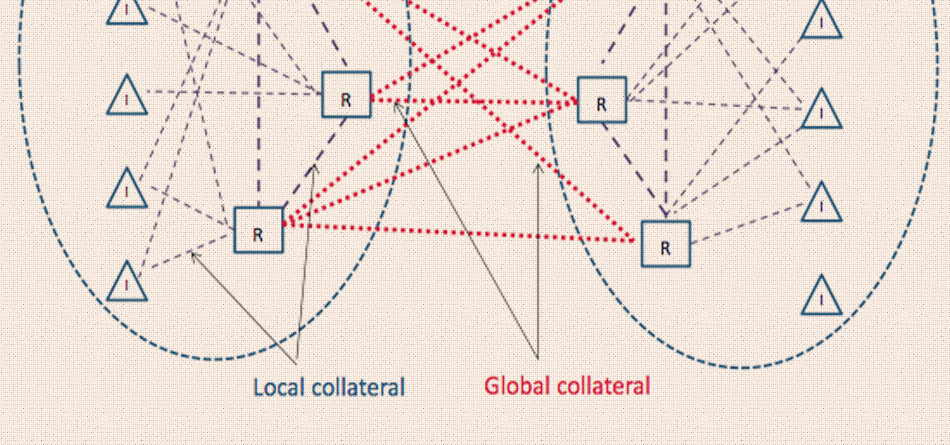

As markets continue to evolve, stablecoins address a growing need for a more flexible and modern financial ecosystem. US regulators and legislators are making meaningful strides to support this new wave of innovation, evidenced by Congress’s momentum toward passing landmark legislation that would affirm the cash equivalence of USDC and the CFTC’s ongoing efforts to advance the recognition of stablecoins. The CFTC’s Global Markets Advisory Committee, sponsored by current Acting Chairman Caroline D. Pham, on November 21st, 2024 advanced a recommendation to expand the use of non-cash collateral through the use of distributed ledger technology.

The heightened focus and continued progress of regulators is paving the way for widespread adoption of USDC. Coinbase is proud to drive the next chapter forward with USDC at the core of revolutionizing the global financial system.

Why USDC?

USDC is a fully-reserved US dollar-backed stablecoin co-founded by Circle and Coinbase. As a regulated and widely adopted digital dollar, USDC enables near instant transactions and has become foundational infrastructure across both centralized and decentralized financial platforms. Its reliability and compliance-first framework make it uniquely suited for integration into traditional financial markets.

Source: Coinbase Derivatives