On July 21, Coinbase Derivatives will launch US Perpetual-Style Futures: a US futures product suite that will closely track spot prices, offer leverage, and remain compliant with CFTC regulations. This will be one of the first products of its kind in the US and aims to fill a critical gap in the domestic derivatives market.

Introducing US Perpetual-Style Futures

We are excited to announce the upcoming launch of US Perpetual-Style Futures on Coinbase Derivatives Exchange, designed to mirror the functionality of global perpetual futures while adhering to US regulatory standards. Internationally, perpetual futures have become the dominant crypto derivatives product, representing upwards of 90% of total crypto trading activity in some reports. However, perpetual futures have been largely unavailable in the US until now.Today, some US-based traders access perpetual futures through offshore exchanges, an approach that introduces regulatory, custody, and counterparty risks. Our new US Perpetual-Style Futures contracts eliminate the need for offshore workarounds, offering traders a domestic, regulated alternative with the same utility: simplified contract expirations, capital efficient trading, long-term strategy execution, and risk management.We are launching two (2) contracts for trade date July 21:

- nano Bitcoin Perpetual-Style Futures (0.01 BTC)

- nano Ether Perpetual-Style Futures (0.10 ETH)

These contracts will provide regulated exposure to the crypto market while offering flexibility in position sizing and capital efficiency.

How do the products work?

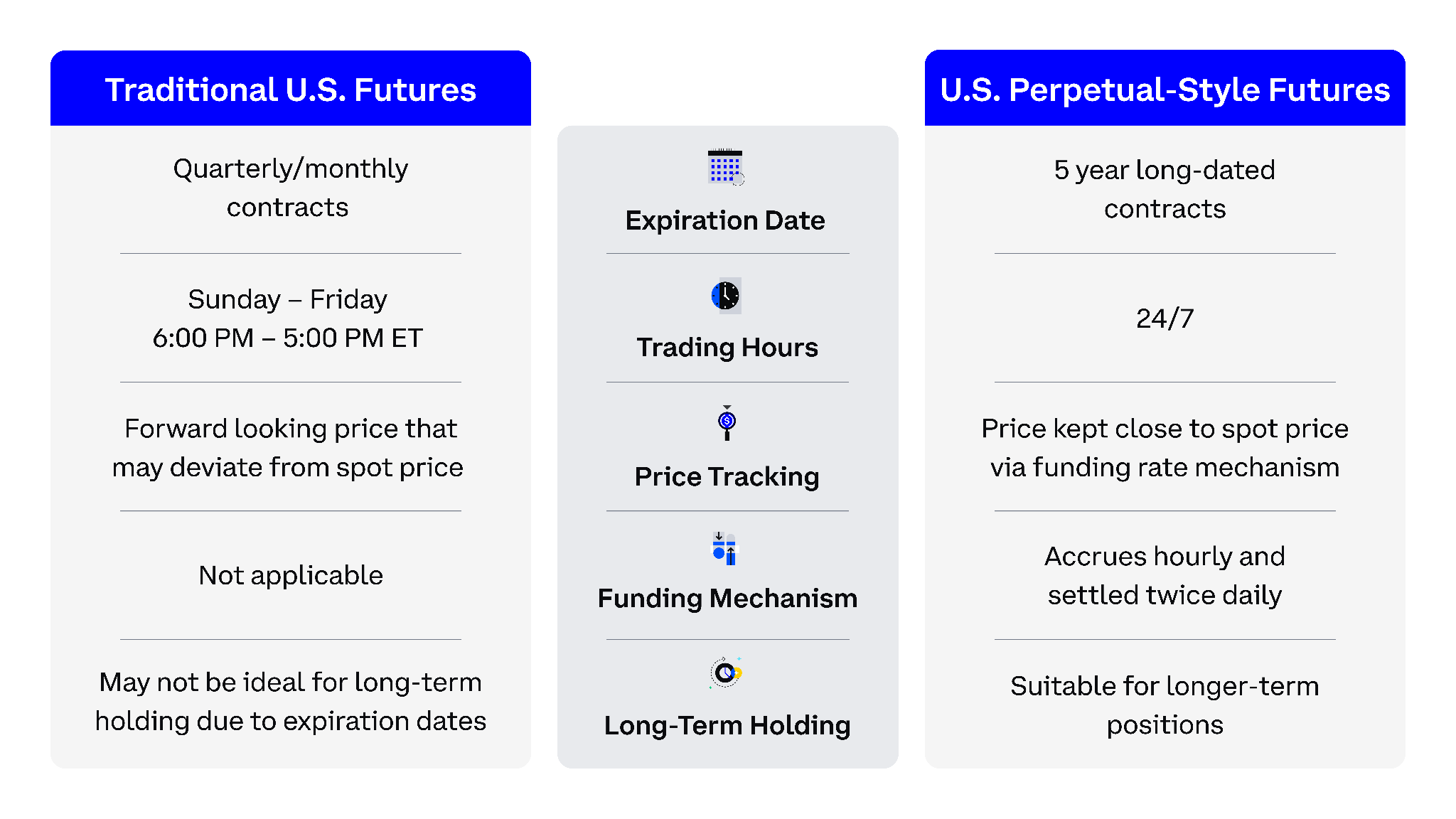

US Perpetual-Style Futures are designed as long-dated futures contracts (5 year expirations) with 24/7 trading hours. They incorporate a funding rate mechanism to keep futures prices closely aligned with spot markets.Here’s how it works:

- Funding accrues hourly and is settled twice daily during designated cash adjustment periods.

- At each settlement period, accrued funding is aggregated and credited or debited to traders’ accounts.

- These mechanics enable a spot-like trading experience with the advantages of leverage and regulated clearing.

US Perpetual-Style Futures vs. Traditional US Futures

Trading the products

More details on how you can trade these new futures contacts on our partner platforms will be shared soon. We are excited to continue our expansion of these products to retail users in the coming months.We’re incredibly proud to bring perpetual-style futures to the US – a transformative milestone that will represent the beginning of a new era in US market access, efficiency, and innovation.

Source: Coinbase