On September 22, Coinbase Derivatives is expanding its product suite with the launch of equity index futures. Introducing Mag7 + Crypto Equity Index Futures: the first to offer combined exposure to both traditional equities and cryptocurrency ETFs.

We’re diversifying our US derivatives platform beyond single-asset offerings for the first time, launching a new equity index product that provides thematic exposure to a wide range of innovation and growth assets.

Introducing Mag7 + Crypto Equity Index FuturesCoinbase Derivatives is continuously expanding its product suite, introducing innovative solutions designed to provide comprehensive access across asset classes to investors. Investor demand has grown significantly for products that provide dual exposure to traditional financial instruments and digital assets.

As part of our strategy, we are excited to announce the upcoming launch of Mag7 + Crypto Equity Index Futures. Historically, there has been no US-listed derivative that provides access to both equities and cryptocurrencies within a futures product.

By introducing this contract, we are offering a diversified, capital-efficient tool that provides:

- Thematic Exposure to Innovation & Growth: Captures the combined performance of transformative technologies and blockchain-native assets in a single instrument.

- Diversification in a Unified Product: Built-in diversification across asset classes that have traditionally traded separately.

- Strategic Risk Management: Combined exposure that enables investors to manage multi-asset risk and hedge portfolios more effectively.

Equity index futures mark the next evolution of our product suite and pave the way for a new era of multi-asset derivatives that broaden access, efficiency, and opportunity for investors.

Index Composition

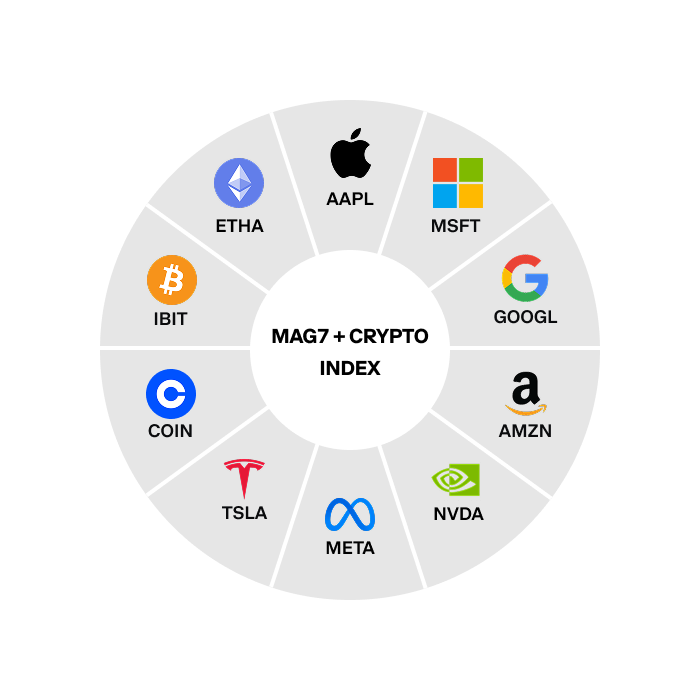

The Mag7 + Crypto Equity Index (“Index”) is a hybrid index composed of both traditional equities and cryptocurrencies. Components of the Index include:

- “Magnificent 7” Stocks: The top seven (7) technology companies in the US stock market.

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Alphabet Inc. (GOOGL)

- Amazon.com Inc. (AMZN)

- NVIDIA Corporation (NVDA)

- Meta Platforms Inc. (META)

- Tesla Inc. (TSLA)

- Coinbase Global Inc. (COIN) Stock

- Cryptocurrency ETFs

- iShares Bitcoin Trust ETF (IBIT)

- iShares Ethereum Trust ETF (ETHA)

*Components subject to change. The Index will follow an even-weighting methodology, with each of the 10 components representing 10% of the Index. The Index will be rebalanced quarterly to reflect any market changes. As component prices move up and down, component percentages may shift above or below 10%. The rebalancing will reset all components to equal weightings. MarketVector has been designated as the official Index provider.

Trading the Futures

Mag7 + Crypto Equity Index Futures are monthly, cash-settled contracts. Each contract represents $1x the Index. At an example Index price of $3000, the notional value of each contract would be $3000 (i.e., $1 x $3000).More details on how you can trade our new Mag7 + Crypto Equity Index Futures on our partner platforms will be shared soon. We look forward to continuing our expansion of these products to be available for retail users in the coming months.

Source: Coinbase