With global macroeconomic events influencing securities prices perhaps as much as ever before, global macro hedge funds have abundant opportunity to succeed — or fail. The European sovereign-debt crisis and upcoming U.S. presidential election and potential ‘fiscal cliff’ showdown are just a few situations that hedge funds can leverage to make money, provided of course they make the right calls.

Steve Shafer, chief investment officer at Covenant

Covenant Global Investors is based in Oklahoma City, Oklahoma, but it makes investment decisions based on happenings around the world. Markets Media interviewed Steve Shafer, chief investment officer at Covenant, via e-mail on August 8.

Markets Media: Please give a brief overview of the history of Covenant Global Investors.

Steve Shafer: Covenant Global Investors was founded in 1984 as a financial planning firm by Scott Duncan to serve the investment and planning needs of high-net-worth clients. I joined Covenant in 2002 as chief investment officer and launched actively managed separate accounts intended to control risk and generate annual returns that fell within targeted ranges of percentages (like between 6% and 18% over any rolling 12-month period, for example) that aligned with clients’ long-term investment goals. In June of 2008, Covenant launched the first two of its six limited partnership funds which pursued very simi lar investment strategies: the Covenant Global Alpha Fund LP and the Covenant Total Return Fund LP intended for aggressive and moderate investors, respectively.

On January 1, 2009, my partner Steve Hartman, COO, and I completed a buyout of Covenant with the intention of making the firm’s successful investment approach available to both individual and institutional clients with multi-year, risk-controlled, target-return investment mandates. That same day, Covenant Global Investors launched the Covenant Opportunity Capital Fund LP for investors looking for a deep-value vehicle, and September 1 of the same year saw the debut of the Covenant Income Appreciation Fund LP for conservative investors. Over the next two years, offshore versions of the Covenant Global Alpha Fund and the Covenant Total Return Fund were established for tax-exempt U.S. investors and non-U.S. investors.

Covenant is best described as a multistrategy, multi-asset manager focused on protecting capital while seeking to consistently generate targeted, riskcontrolled rates of returns over time. To us, cost is risk. As a fiduciary, we are dedicated to delivering desired results at the lowest cost, the least risk, and with a high degree of liquidity. We believe markets are at times primarily influenced by the gyrations of business cycles, like the 2008 recession (cyclical conditions), and at other times they are driven largely by secular factors, or longer-term trends that manifest themselves throughout all types of cycles, such as the growth of China. We employ a global macro outlook that synthesizes these cyclical and secular views of the dominant global market influences. Understanding what is driving markets today — and what the trend is for tomorrow — is essential to positioning portfolios to achieve targeted returns and to minimize risk.

Different market environments require different strategies and/or asset classes. In 2008, before the market collapse, we began aggressively moving into debt instruments and away from an allocation that saw us invested almost 100% in stocks. By the end of Q1 2009 our funds were made up of almost 100% debt instruments, which served our clients very well. However, in Q4 2011 we again began to see a shifting of market conditions and began a new, fundamental rebalancing of our funds. By the end of this year we expect to greatly reduce our exposure to debt instruments across our portfolios and will generally allocate our assets in equal parts to equities, commodities, and currencies.

MM: What is your AUM and how is this broken down across clients and asset classes?

SS: Our AUM is approximately $310 million with approximately 95% coming from our HNWI clients and 5% from institutional clients.

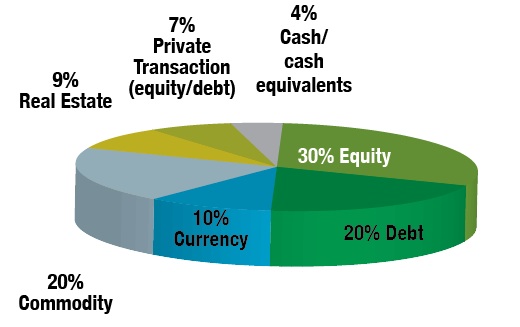

Each fund is different, but generally our current asset-class breakdown is approximately:

MM: Explain your investment strategy.

SS: Rather than simply swing for the fences when managing money, with the result being that we may double the value of our investments one year but then lose 50% the next, we seek to generate returns within a specific, targeted range. For example, in our fund for investors with higher risk tolerance, that range is between 6% and 18% over any rolling 12-month period. Hitting a higher mark would likely mean we took too much risk to generate that return. This strategy is well-suited for individuals and institutions who need solid, predictable returns to meet their liabilities. This unique, reasonable, and realistic approach to meeting our investors’ goals has proven to be a distinct advantage to Covenant and is largely responsible for our 147% growth in AUM over the past four years.

When it comes to picking the investments we use to generate our targeted returns, we start off by using top-down, fundamental, macroeconomic research to identify trends and opportunities that may be worthy of investment. After spotting potentially profitable trends, we then determine what asset classes or investment strategies are ideal to best take advantage of them. Finally, we conduct exhaustive research, both in-house and with the assistance of research partners, to determine what individual securities within those asset classes we should purchase, at what price, and how long we should hold them for. The idea is to be very flexible in our approach to selecting these investments and to be sure that they are as liquid as possible. Our portfolio managers seek to generate returns through income as well as price gains derived from the purchase and sale of long and short investment positions. The portfolio manager may attempt to generate income as a source of return from income-paying securities such as bonds and dividend-paying stocks and from various income-oriented investment strategies such as selling equity options.

We generally focus on generating returns for the fund as a whole over the long term, which, to us, means a period of time that is typically no less than three years, but not more than five. Accordingly, we seek to generate returns on the majority of our established investment positions over holding periods ranging between one year and three years, with 18 months being the average hold time for most securities. However, we may maintain these positions for significantly longer or shorter than that should our regular, proactive reviews and disciplined rebalancing of our holdings indicate to us that changes in opportunity and risk warrant it. Covenant typically categorizes the holding periods for our investments and the associated opportunities and risks into one of three time frames:

- We define short-term opportunities or risks as having a planned holding period of 12 months or less.

- Intermediate-term positions are defined as having a potential holding period of one to three years.

- Long-term investments are typically held for three to five years.

MM: What have been your recent returns compared with the benchmark?

SS: Due to regulatory restrictions, we do not disclose fund performance, but we can say that we continue to meet or exceed our long-term expectations and benchmarks.

MM: What is the value proposition of global macro hedge funds generally? How do you differentiate yourself from other global macro hedge funds?

SS: We view the world in a top-down way, like many other global macro hedge-fund managers, but we are different in that we are opportunistic and will look to express our global macro themes via multiple strategies and asset classes. Most other global macro managers seek to generate alpha in only a handful of asset classes, but we believe you must be more flexible than that. We do not want to be confined to a specific strategy or asset class, but want the ability to execute our themes in the most advantageous manner as possible. Depending on the market environment, we have historically expressed our views via equities, equity options, debt, currencies, commodities, private transactions, real estate, and cash equivalents.

MM: What are your biggest ‘bets’ currently on macro issues? How (if at all) is your investment portfolio positioned for the European debt crises, the upcoming U.S election, and the upcoming U.S. ‘fiscal cliff’?

SS: We continue to monitor those and other macro issues that directly or indirectly relate to the massive amounts of debt that the world’s governments continue to take on relative to their GDP ratios and the eventual contagion that we believe will result. In this regard, we believe we are truly in uncharted waters. Our other investment themes or biggest “bets”’ are as follows:

- China’s continued growth driving a commodities “super cycle”

- The rising middle class of emerging market countries such as China but also including India, Indonesia, and Brazil

- Stores of value as a hedge against inflation – because “all roads lead to inflation”

- Bi-level economy – Increasing bifurcation of the “haves and have-nots”

MM: What are your biggest positions currently? How frequent do you trade/ turn over positions?

SS: While we are not at liberty to discuss our individual holdings, we can provide a snapshot of our current portfolio and the expected hold times of our asset classes. Currently, our largest investments are in equities and debt, but we are currently decreasing our exposure to debt markets and increasing our exposure to equities, currencies, and commodities.

MM: How are you managing through currently challenging markets that include negative sentiment, low volume and low liquidity?

SS: 2012 has proven to be a challenging year to successfully navigate the markets, however we are very encouraged with the direction we are going. We have been transitioning our investments away from the debt instruments that served us so well (and generated the bulk of our returns from late 2008 to the present), and are in the process of migrating to an increased exposure to risk assets including equities, commodities, and currencies. We successfully navigated through a similar transition in mid-2008 when we pivoted our portfolios away from equities into mostly debt instruments including corporate, municipal, and asset backed bonds. We feel that the debt markets are now overbought, and the equity markets are oversold with stock returns hovering at 10-year historical lows.

MM: How are you finding capital raising these days? What are institutional investors most concerned about, and how (if at all) has this changed in recent years?

SS: Capital raising in 2012 has been challenging as many institutional investors are making investments with larger hedge-fund managers with AUM in excess of $1 billion. We are relatively new to institutional capital raising, having only actively entered the space last year, but we are starting to see a growing interest in our company and funds since we have a solid track record going back to 2003 and assets over $300 million. We are also starting to see more demand in the sub-advised 40 Act space as the appetite for alternative investments continues to grow with retail investors.

MM: What are your expectations for Dodd-Frank and other unfolding financial regulation, in terms of how it will affect you?

SS: We are serious about compliance, and utilize some of the industries’ best compliance consultants to help us stay abreast of new rules and regulations. Because Covenant Global Investors was already registered with the SEC, Dodd-Frank’s registration requirements didn’t materially affect us. The new Form PF reporting requirement has needed special attention, but hasn’t proved to be an insurmountable challenge. We are also watching developments related to the Jobs Act with interest, but are waiting for the SEC to issue final rules before we make any decisions on how to proceed.