As regulatory and technological changes roil capital markets, Oracle Corp. is channeling its considerable IT muscle into building products that can scale to burgeoning data-management requirements.

Rapidly evolving market structures are “creating the need for data to come together and for intensive analytical computations to be performed with a great deal of immediacy and ad hoc, ‘what-if-ness’,” said Subramanian Ramakrishnan, group vice president and general manager of Oracle’s Financial Services Analytical Applications Group. “That is fortuitously being demanded at the same time as we are developing hardware and engineered systems to deal with it.”

Oracle, based in Redwood City, California, is a multinational provider of computer hardware and enterprise software. Headed by chief executive Larry Ellison, the tech giant employs more than 110,000 people worldwide and ranks behind only Microsoft and IBM in software sales.

While Oracle is known more for its technology savvy generally rather than on Wall Street specifically, the company’s reach extends throughout capital markets on both the buy and sell sides. According to Oracle, nine of the 10 biggest securities firms use its applications, as do four of the five biggest mutual-fund companies and four of the five biggest global stock exchanges.

Rapidly evolving market structures are “creating the need for data to come together and for intensive analytical computations to be performed with a great deal of immediacy and ad hoc, ‘what-if-ness’. Subramanian Ramakrishnan, group vice president and general manager of Oracle’s Financial Services Analytical Applications Group

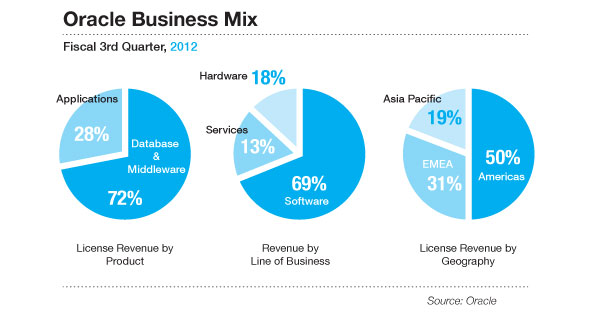

Oracle’s total revenue for the nine months ended February 29, 2012 increased 5.5% to $26.2 billion. The company’s fiscal year ends on May 31. Capital markets, and vertical markets in general, are making up an increasing proportion of Oracle’s business, according to Ramakrishnan, a 25-year financial-technology veteran.

Questions Answered

Ramakrishnan is responsible for Oracle’s Financial Services Global Business Unit Analytical Applications for enterprise risk management, enterprise performance management, governance, risk, and compliance, and customer insight.

“We help businesses answer such fundamental questions as: are you assuming too much risk? Are you taking on the right customers? Are they profitable?” Ramakrishnan said. “Our mission is to help them to put it all together in an analytical sense.”

Ramakrishnan and his team develop products that address capital markets firms’ profitability and performance measurement, as well as risk management, compliance, and customer segmentation. All have in common a heavy dependence on data management, which is Oracle’s raison d’etre.

Risk management, being integral to capital markets, is one of the major pain points that Oracle is seeking to address through analytical applications. “Risk reporting, risk quantification — whether credit, market or operational — and increasingly specialized capabilities around regulatory computations like risk-weighted assets and capital adequacy are major requirements,” Ramakrishnan told Markets Media.

With increased regulatory pressure on financial institutions to manage counterparty credit risk, robust real-time risk analytics for credit valuation adjustment, or CVA, are necessary. Europe’s Basel III will require that banks calculate CVA and hold capital against this measure. “The measurement of CVA and counterparty credit risk is a major computational effort,” said Ramakrishnan.

CVA is typically defined as the difference between the value of a derivative, assuming the counterparty is default-risk free, and the value reflecting default risk of the counterparty.

Similarly, regulations will also require banks to adjust the value of their derivative holdings to account for fluctuations in the bank’s credit risk, known as debit valuation adjustment (DVA).

Liquidity management is another pain point for capital markets.

We have announced interfaces that allow you to take your Hadoop systems and connect them to Oracle systems. Larry Ellison, Oracle chief executive

“Doing an intraday liquidity test is mandatory under both Basel III and Dodd-Frank,” said Ramakrishnan. “Stress testing and what-if testing under a variety of adverse circumstances are being driven by new regulations.”

Oracle has a highly developed capital-markets portfolio, addressing all facets of industry-related business issues.

“We offer products for risk management, compliance, profitability and customer segmentation,” said Ramakrishnan. “We have strong offerings in liquidity and interest-rate risk, counterparty credit risk, liquidity” and asset/liability management, he said.

For instance, Oracle Financial Services Market Risk group performs computations to enable institutions to evaluate and manage market risk across the enterprise. Institutions can leverage this data to estimate market risk through risk estimation measures such as value at risk and conditional value at risk.

“These risk measures are estimated based on user-defined parameters, such as confidence level horizon, number of iterations, and decay factor, and can be used for both risk management and regulatory reporting,” said Ramakrishnan.

Asia Capital PLC, an investment bank based in Sri Lanka, has deployed business intelligence software from Oracle to enable senior managers to uncover stock trends and business performance by channel, region, investment advisor, and customer segments.

“Oracle Business Intelligence gives our strategic and tactical business managers insight to manage the business and make the right investment decisions, based on the true value of each stock,” said Dishan Fernando, project manager, strategic initiatives at Asia Capital PLC. “This significantly improves the service they provide to clients.”

Intra-Firm Coordination

As a specialized product group within Oracle, Ramakrishnan’s group is able to orchestrate the company’s numerous horizontal products, such as Oracle Exadata Database Machine and Oracle Big Data Appliance, to solve the problems of participants in capital markets.

“We are a part of the larger team, and we work with other product development teams throughout Oracle,” said Ramakrishnan. “There’s a lot of cross-stack synergy because Oracle is such a broad company.”

In recent years, Oracle has repositioned itself as a soup-to-nuts hardware and software provider, and accordingly the company has expanded its offerings. “Oracle is engineering many of its assets to work with hardware, so that extreme performance is visible to customers at many levels of the stack,” said Ramakrishnan.

An example is Oracle Exadata, Oracle’s database for large-scale structured data applications, which is designed to enable customers to store more data and perform searches faster than with conventional relational database-management systems.

“Oracle Exadata is the marrying of hardware technology with database technology by engineering them together,” Ramakrishnan said. “Oracle has created Oracle Exadata as a database appliance which powers databases at extreme performance levels.”

It’s not uncommon for database tasks to be speeded up multifold. “Many applications have sprung up which were hitherto impractical to implement but have now become possible because of Oracle Exadata,” Ramakrishnan said.

The new hardware and database architecture lends itself to this extreme performance. A notable example is a very large liquidity stress test involving $200 million in cash flows, on which Oracle Exadata executed numerous scenarios and computed the liquidity impact in 10 minutes.

“There are many such problems which require large amounts of data to be processed with a great deal of immediacy, in which Oracle Exadata has produced very good results,” said Ramakrishnan. “Such performance was inconceivable previously.”

Oracle offers clustering capabilities through its Oracle Real Application Clusters, which allows multiple computers to run Oracle Database software while accessing a single database.

In an Oracle RAC environment, two or more computers concurrently access a single database, allowing an application or user to connect with either computer and have access to a single coordinated set of data.

“Oracle has long offered clustering technology spanning multiple machines, where individual machine capacity was inadequate to cope with the business load,” said Ramakrishnan. “We developed Oracle RAC technology 10 years ago and deployed that with purpose-designed hardware that provides high-speed interconnects between nodes.”

Sun Legacy

Oracle Exadata is essentially RAC on steroids, employing hardware from Oracle’s Sun Microsystems, based on Intel Xeon processors. Oracle Exadata had been in the works since before Oracle acquired Sun in 2009, but gathered momentum following the acquisition.

“Oracle had built out the hardware stack in advance of acquiring Sun,” said Ramakrishnan. “Following the Sun acquisition, version 2 of Oracle Exadata was launched, where we took technologies that we acquired from Sun and married that with earlier Oracle RAC technology.”

Capital markets firms are harnessing new technology to make sense of high-volume real-time event streams and perform analytics. Such systems leverage massively parallel processing architectures, in-memory processing and appliance technologies for predictive analytics on structured information, Hadoop appliances for unstructured information and purpose-built appliances for simulations.

Oracle synthesizes traditional database technology for structured data with emerging Big Data technologies for unstructured data.

“Big Data goes beyond the ability to handle large quantities of structured data,” said Ramakrishnan. “It also involves the ability to handle large quantities of unstructured data.”

The high-volume unstructured data-handling process is now separately addressed by Oracle through its Big Data Appliance, which is the analog to Oracle Exadata on the structured-data side.

“Oracle Big Data Appliance is an engineered system that combines optimized hardware with specialized software for acquiring and organizing Big Data,” Ramakrishnan said.

Technologies which could have an impact on Big Data in capital markets — such as massively parallel processing databases, MapReduce frameworks such as Apache Hadoop, and NoSQL databases — are in the early stages of implementation.

“Hadoop and all of the associated utilities with Hadoop, which uses the term Big Data, is going to be one of the feeder systems to the Oracle Database,” CEO Ellison said on a recent conference call to discuss the company’s earnings. “We have announced interfaces that allow you to take your Hadoop systems and connect them to Oracle systems.”

“After Hadoop finishes filtering the data, the place you want to put that data is an Oracle Database, and that’s what a lot of our customers are doing,” Ellison continued. “We are exploiting the trend, the big-data technology and the big-data trend, if you prefer, by building a Hadoop appliance that attaches to the Oracle Exadata database or any Oracle Database.”

Customers aren’t required to purchase Oracle’s Hadoop appliance, rather, they can plug in whatever servers they want running Hadoop, and Oracle will provide the plumbing between Hadoop and the Oracle Database.

“The idea is you should be able to put all of your data regardless of data type into the Oracle Database, where it can be stored securely and reliably,” Ellison said. “And you could search it and get answers to your questions very quickly.”