In an attempt to create a common industry standard for trading technology, global banking firm Deutsche Bank has put more than 150,000 lines of its Autobahn code into the public domain.

The move is Deutsche Bank’s first contribution to open source technology, in which firms provide public access to computer code so that other programmers can suggest improvements and new ways of using it, for example to provide new services. It marks a further step in the bank’s strategy of modernising, simplifying and standardising its technology.

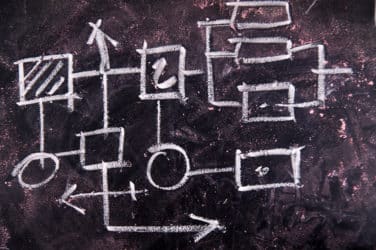

The code, known as Plexus Interop, is designed to connect thousands of different applications from across the financial services industry, enabling banks and clients’ systems to talk to each other. Currently, many market participants use multiple applications for data, news and trading that work independently of each other.

Feedback from clients suggested that they were keen to use a standard platform for trading applications that was not the proprietary solution of a single provider. Deutsche Bank reviewed the commercial products available in the market and decided to create a solution when none of them fulfilled its needs.

Peter Wharton-Hood, Chief Operating Officer of the Corporate & Investment Bank at Deutsche Bank, said: “We want to be a leader in open source technology in the banking sector. By making this code publicly available, we aim to create a common industry standard that will deliver a faster and more convenient service to clients, strengthen controls and reduce costs.”

David Gurle, Founder and CEO of Symphony, said: “We are thrilled to be working with Deutsche Bank on the integration of this open source solution with Symphony. Plexus Interop represents the largest outside contribution to the Symphony Software Foundation since its founding, and underscores the power of the community and our strong partnership with Deutsche Bank.”