Traditionally, illiquid assets, such as real estate, venture capital and private credit, as well as liquid assets such as public equity and some bonds, can all be tokenized.

Tokenization allows traditional capital markets participants to harness the benefits of blockchain technology—such as an immutable ledger of ownership, transaction history and rapid settlement. In 2022, traditional financial assets including securities are increasingly on the tokenization roadmaps of issuers and services providers, including the broader ecosystem of broker-dealers, alternative trading systems (ATSs), transfer agents, technology firms, and custodians.

*New by @deasthope* While digital asset securities remain rare, they are growing in importance & number. These assets demonstrate how we can move beyond simple ledgers to a connected ecosystem of market participants & service providers https://t.co/SEe256wKBN

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) April 12, 2022

Digitization efforts bring numerous benefits. For instance, smart contracts bring programmatic compliance to these traditional financial assets. Issuers and agents of securities-backed tokens can ensure U.S. Securities and Exchange Commission (SEC)-compliant features, such as transfer restrictions, lock-ups, and holding periods. Thus, within regulated securities, we believe asset tokenization is not a solution in search of a problem, but rather an enabler of a new path forward.

Methodology

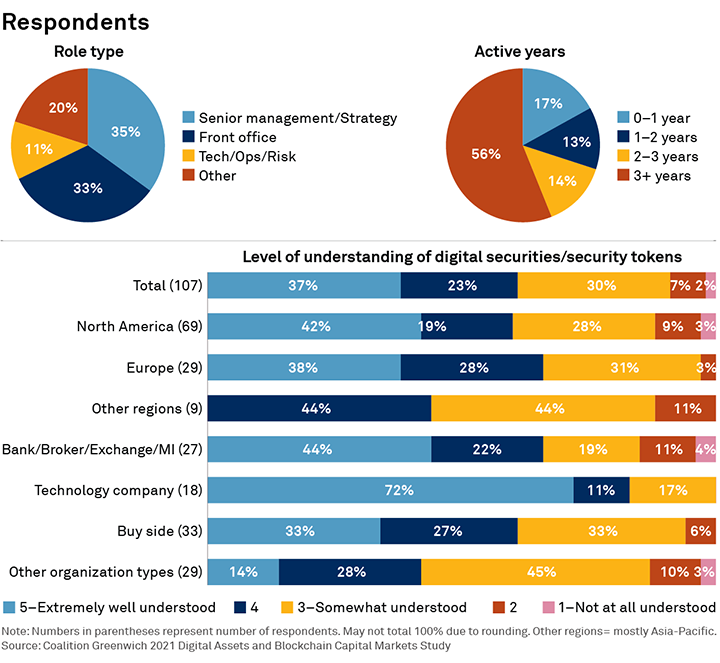

In July of 2021, we interviewed 108 executives at financial institutions and technology firms around the world to better understand use cases, deployments, preferences, benefits, disadvantages, and the overall appeal of digital assets. Respondents comprised asset managers, banks, brokers, exchanges, market infrastructures, technology companies, and other market participants. We spoke with professionals in various roles across the front office, technology/operations/risk, senior management, and strategy teams. Over half of the respondents have been active in digital assets or blockchain technology for three years or more.

Source: Coalition Greenwich