By Iseult E.A. Conlin, Managing Director, Head of U.S. Institutional Credit, Tradeweb

The share of U.S. investment-grade (IG) bonds traded electronically is closing in on 50% this year. The mark is significant – it’s a measure of the success of market makers, venues, and investors in bringing transparency, liquidity, and diverse electronic execution options to the world of corporate credit trading.

So, how did we get here? This shift was anything but accidental and did not happen overnight. Behavioral changes by market participants willing to embrace more electronification, the rise of automation and algorithmic trading, the introduction of new trading protocols, and even how these bonds trade have all contributed to this milestone.

While voice execution is still the primary choice for larger or more complex trades, we’re witnessing the creative uptake of diverse tools and emergent liquidity pools to manage an increasingly heavy load of credit trading volumes. As I noted in this December blog, a host of market players have, in their own ways, challenged traditional manual trading conventions to establish a vital role for electronic trading in the credit market. Now, as more and more market participants continue to embrace the benefits of electronification, we’ve reached an inflection point in investment-grade markets.

Growth of IG electronic trading

Consider this – In 2013, just 8% of high-grade bonds and 2% of high-yield bonds outstanding traded electronically. Over the course of the next six years, electronic volume of high-grade bonds persistently edged higher, at an average of about 3% a year. With the onset of Covid and remote work – a digitization accelerant of sorts for fixed income – the share of electronic trading in high-grade bonds increased more rapidly, from 25% in 2019 to about 45% today, according to data provided by Coalition Greenwich. In the past year alone, the share has jumped by 8%. Tradeweb, for our part, has been a strong contributor to this increased adoption, reporting a record 19.7% share of fully electronic U.S. high-grade TRACE in April 2024.

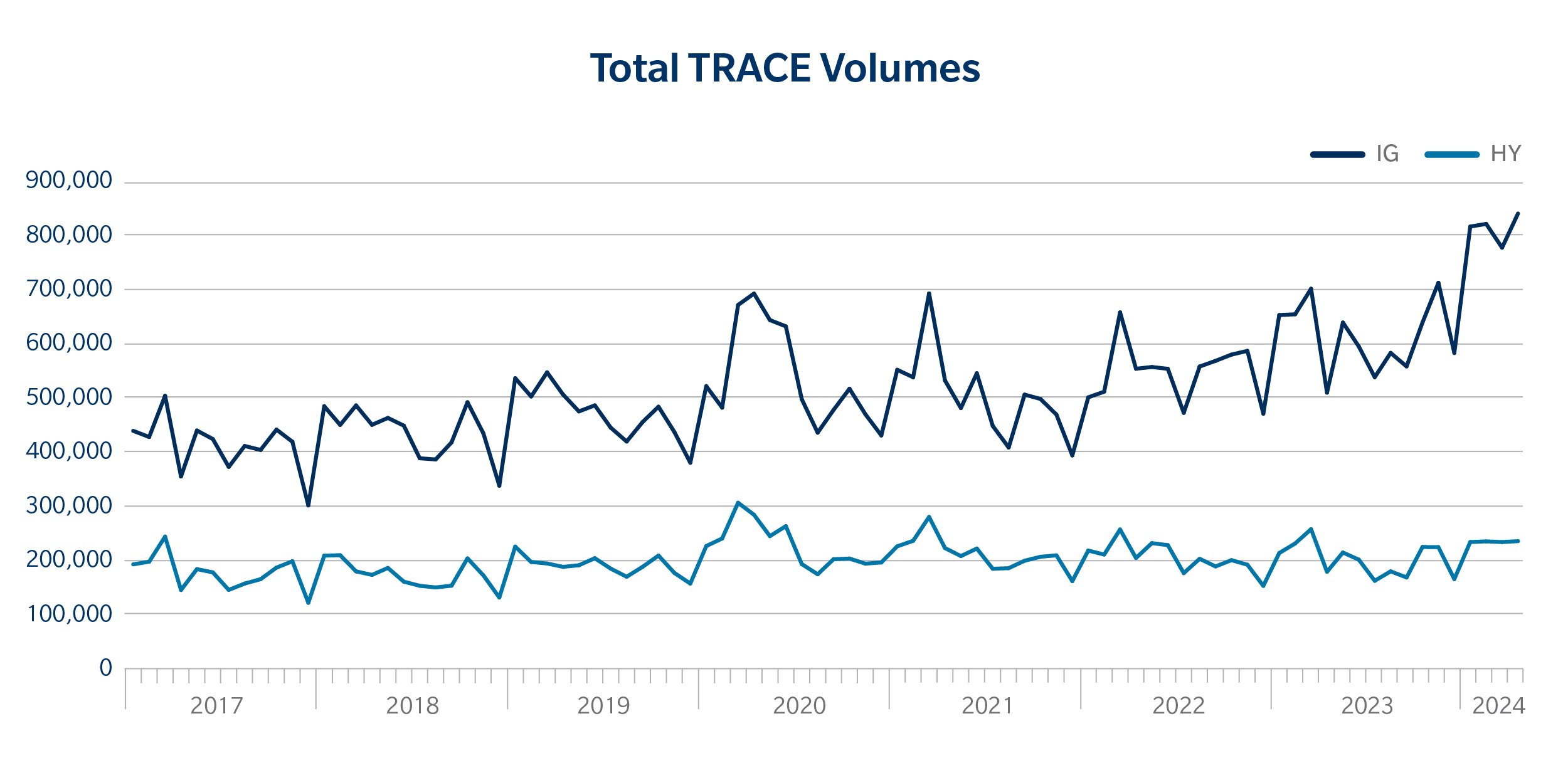

The overall volume of investment-grade trading, too, has reached record highs. In April, market-wide U.S. high-grade TRACE average daily volumes were up 50% year-over-year (YoY). The volume we see across IG has played out on our platform, too; in the first quarter of 2024, Tradeweb saw fully electronic U.S. high-grade average daily volumes rise 62% to $6.7 billion from the same period last year.

Some of this, of course, is situational. In the current interest rate climate, investment-grade bonds offer attractive relative value to high-yield and some other fixed income products. With the path of interest rates becoming less clear as the year progresses, institutional investors are trying to stay ahead of the Fed by repositioning their IG portfolios for whatever they believe lies ahead.

A paradigm shift

Still, something more fundamental is happening in terms of electronification. First, institutional investors have grown to rely on electronic trading for improved liquidity, price transparency, and efficiency. Instead of calling every dealer to trade, they can send out a request-for-quote (RFQ) and almost instantaneously get back multiple quotes. They’re also exploring how to electronically trade large baskets of risk in a more efficient manner through Portfolio Trading.

Second, dealers right now are applying automation and algorithmic techniques to respond to trade requests and execute specific trades. The buyside is catching on to use of the technology, too. That’s increasing both the volume and velocity of high-grade trading.

Third, many firms have been slower to add resources to trade this asset class, despite the uptick in volumes. In response, organizations are taking a harder look at electronic trading for even their more complex trades and portioning some of their business out to electronic trading venues.

Lastly, – and this is where Tradeweb comes in – the protocols, platforms, and functionality we use to trade corporate credit are quickly expanding as automation and AI become more embedded in the electronic trading process and we innovate alongside clients to deliver increasingly advanced features.

The shifts we’ve seen play out in corporate bond markets – both in terms of behavioral and structural market shifts – wouldn’t have been possible without the introduction of electronic protocols and tools, which have laid the foundation for these changes, and, therefore, have been vital to this progression.

Trading protocols – the fundamentals

From the launch of the Trade Reporting and Compliance Engine (TRACE) more than two decades ago, to the development of sophisticated modeling techniques for pricing bonds in near real-time, greater price transparency and the increased diversification of electronic protocols have been leading electronic trading to this point.

To further illustrate this, we can look at RTX 3.03 03/52 as an example. Through April 2024, this bond went through several different electronic trading protocols on Tradeweb, such as portfolio trades, anonymous RFQs, dealer-to-dealer session-based trading and Rematch. By utilizing multiple different trading protocols, this bond, which only had a liquidity score of 7 on our platform (the maximum being 10), gained exposure to more potential bids and different pools of investors. This example illustrates how using different electronic protocols can encourage increased liquidity, velocity and trading efficiency in the corporate bond space at a pace unheard of a decade ago.

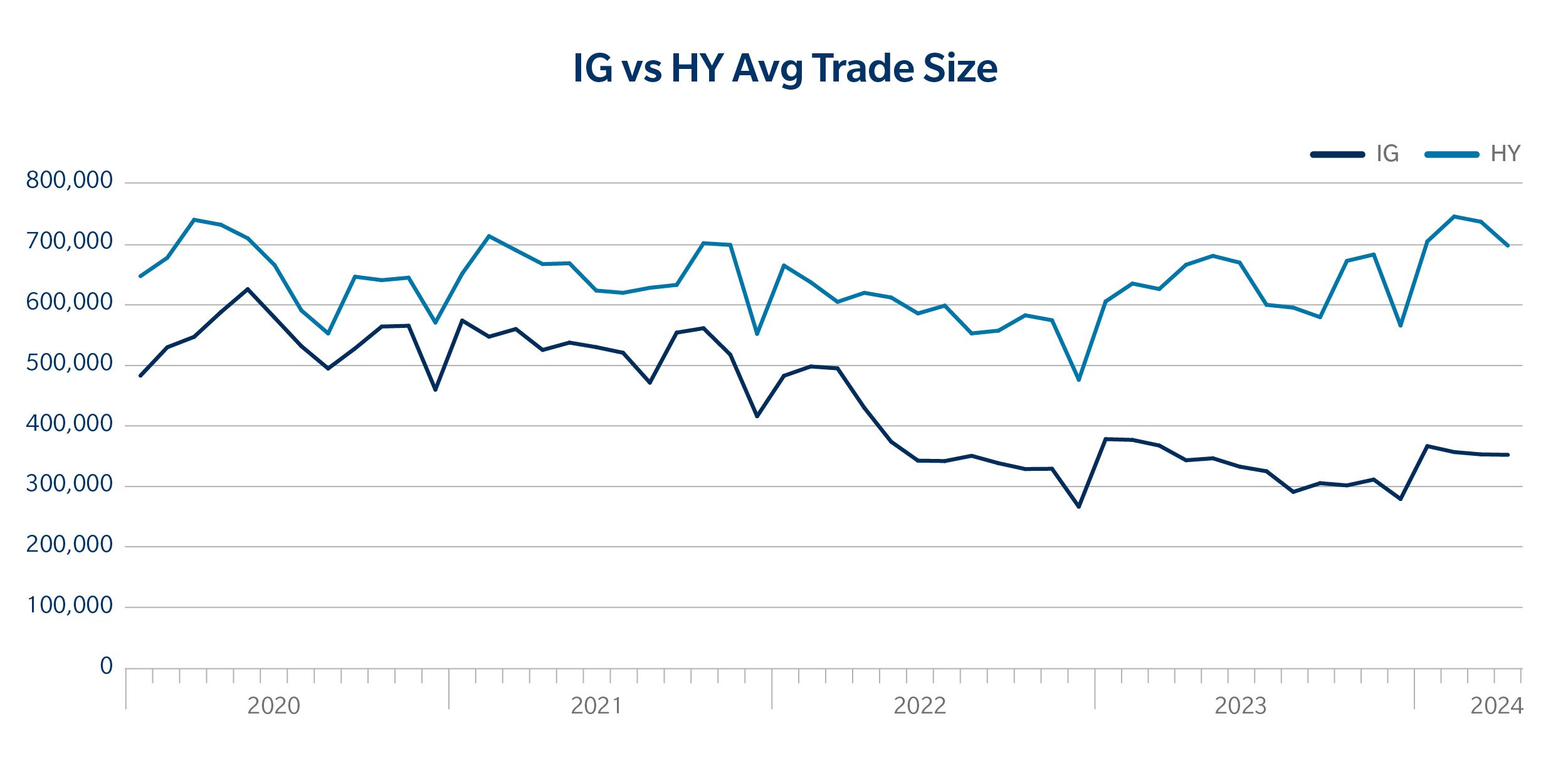

While corporate bond traders regularly favor the phone when doing a larger trade, they send out smaller trade sizes electronically because they can do this more efficiently. This trend of electronification and workflow automation of smaller trades – similar to what we saw happen in equity markets – has resulted in more participation, and, thus, more liquidity in IG markets. We’re seeing this in our data on a global scale, too; in the first quarter of 2024, global credit Automated Intelligent Execution (AiEX) average daily trades increased by 70% year-over-year.

Tracking high-yield’s progression

Meanwhile, the share of high-yield bonds trading electronically remains stuck at about 30%. We can assume that some of the challenges associated with trading high-yield bonds are due to the characteristics of the bonds themselves. High-yield bond deals are often smaller and less liquid than those in the high-grade market, which creates challenges in price discovery/valuation. And credits are often “stories” requiring specialized knowledge of the issuer and a thorough understanding of their operations, which narrows the market of prospective trade partners.

Another key consideration for trading high-yield bonds is how they trade. High-yield bonds trade on price as compared to investment-grade bonds which trade on spread to a benchmark U.S. Treasury bond. Therefore, because of this tie-in to the U.S. Treasury market, investment-grade bonds are exposed to a number of intelligent hedging innovations and capabilities that foster more transparency and growth. For example, a significant driver of IG growth on the platform has been Tradeweb’s Net Spotting technology, which nets hedging activity across Tradeweb clients spotting simultaneously.

For high-yield bond trading to reach new heights in electronification, markets must continue to embrace electronic tools and protocols in different ways. While the rise of algorithmic trading and portfolio trading have been catalysts for the electronification of IG markets, we have yet to see this play out the same way in HY – a more niche, opaque market. Moreover, an illiquid marketplace poses challenges for market makers who may be less inclined toward price transparency. Still, this market is ripe for more electronification, as advancements in data, algo pricing and technology encourage more efficiency.

Room to run

While the market is unlikely to abandon voice trading altogether, it will come to depend on technology more and more, in part because it allows those trading credit to offload quotidian trades to electronic venues and focus on those trades requiring a human’s market guile and discretion. In the past five years alone, our markets have seen incredible growth and innovation in the IG markets, with HY following closely behind. I am optimistic about the opportunities that lie ahead in credit markets and look forward to the next five years.