As the volume of ESG data continues to rise, firms are grappling with the best way to manage this information, according to a new Bloomberg survey of approximately 200 financial market participants based in Europe. The survey, taken by respondents from London, Stockholm, Geneva, Amsterdam, Frankfurt, Paris, and Milan throughout 2023, posed questions about ESG data prioritization, challenges, and data management practices.

Respondents reported that fulfilling regulatory requirements was the highest priority (35%) for accessing ESG data, followed by meeting climate risk and net zero objectives (18%). Potentially inhibiting these priorities are coverage and quality issues with company-reported ESG data, which unsurprisingly was cited by 63% of respondents as their biggest concern. With the entry into force of the Corporate Sustainability Reporting Directive (CSRD) in the EU, the quantity and quality of company-reported ESG data is expected to increase over the coming years. However, with this increased availability, the need for seamless integration and management of this data will become more pressing, or risk slowing investment decisions.

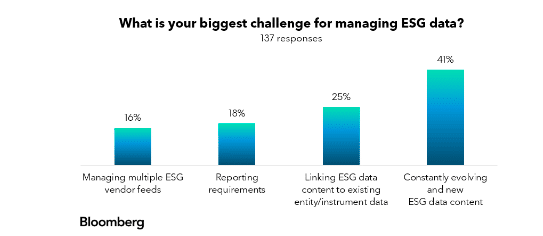

According to the survey, the leading ESG data management challenge was handling constantly evolving and new data content (41%). Linking ESG data content to existing entity and instrument data was the next biggest challenge (25%), followed by meeting reporting requirements (18%), and managing multiple ESG vendor feeds (16%). While ESG data coverage gaps are problematic, onboarding new ESG data can be a time and resource intensive process that firms may not have the bandwidth to do more than once or twice a year.

In the face of these challenges, firms are still deciding on how to best manage growing volumes of ESG data. Approximately a third (38%) managed their ESG data centrally with a proprietary solution, another third (32%) said it’s managed individually by each business unit, 10% outsourced to a third-party vendor, and 20% were still considering their data management strategy.

“While quality and comparability remain a global challenge, data management is coming into sharp focus for firms in Europe. If firms cannot organize their ESG data, they cannot effectively make decisions using that information,” said Nadia Humphreys, Head of Sustainable Finance Data Solutions at Bloomberg. “To help firms derive more insights from their data faster, Bloomberg’s sustainability data is modelled and linked to Bloomberg’s industry leading corporate structure, security master, and other foundational data for ease of use. Moreover, Bloomberg provides a fully managed service with Data License Plus (DL+) ESG Manager so customers can focus on making investment decisions rather than data wrangling.”

Bloomberg’s ESG data, research, and analytics span regulatory compliance, carbon emissions, sustainable debt, scores, indices, climate risk, and more. Clients can readily access this data on the Bloomberg Terminal via {ESGD <GO>} or across their enterprise via Data License at data.bloomberg.com for use in proprietary or third-party applications. Through Data License Plus (DL+) ESG Manager, Bloomberg connects customers’ ESG data workflows to the full power of Bloomberg’s datasets as well as data from vendor partners, so clients can unlock maximum value with ease. To learn more, visit our website here.

To view the full results of the survey, please click here.

Source: Bloomberg