09.29.2021

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$11.24 billion during August, bringing year-to-date net inflows to a record US$108.73 billion which is much higher than the US$41.47 billion gathered at this point last year and US$20.25 billion over the full year 2020 record net inflows US$88.45 billion.

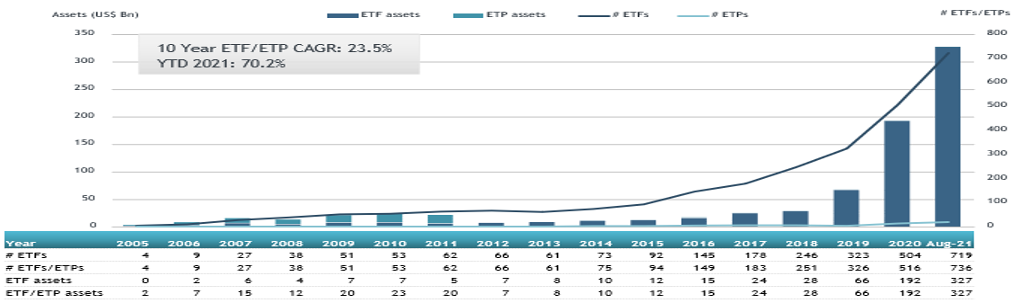

Total assets invested in ESG ETFs and ETPs increased by 6.1% from US$308 billion at the end of June 2021 to US$327 billion and 69% YTD in 2021, according to ETFGI’s August 2021 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record assets of $327 billion invested in ETFs and ETPs listed globally at the end of August 2021.

- Record YTD 2021 net inflows of $108.73 Bn beating the prior record of $41.47 Bn gathered in YTD 2020.

- $108.73 Bn YTD net inflows are just $20.25 Bn over full year 2020 record net inflows $88.45 Bn.

- $155.7 billion in net inflows gathered in the past 12 months.

- Assets increased 69% YTD in 2021, going from US$193 billion at end of 2020, to US$327 trillion.

- 66th month of consecutive net inflows.

- Equity ETFs and ETPs listed globally gathered a record $81.20 Bn in YTD net inflows 2021.

“At the end of August, the S&P 500 posted its 7th straight month of gains, up 3.0% in the month, benefitting from continued support from the Fed and as positive earnings. Developed ex-U.S. markets gained 1.8% in August as most countries advanced, while Korea (down 1.3%) and Hong Kong (down 0.9%) declined the most, due in part to concerns of the new announced regulatory requirements set to take effect in China. Emerging markets were up 3.0% with Thailand (up 10.8%) and the Philippines (up 10.4%) leading the gains at the end of August.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global ESG ETFs and ETPs landscape had 736 products, with 2,085 listings, assets of $327 Bn, from 160 providers listed on 39 exchanges in 31 countries at the end of August.

Global ESG ETF and ETP asset growth as at end of August 2021

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 736 ESG ETFs/ETPs and 2,085 listings globally at the end of August 2021.

During August, 36 new ESG ETFs/ETPs were launched.

Source: ETFGI