03.23.2021

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally reached a record US$226.75 billion at the end of February.

ESG ETFs gathered net inflows of US$20.87 billion during February, bringing year-to-date net inflows to a record US$40.67 billion which is much higher than the US$13.61 billion gathered at this point last year which was the prior record.

Assets invested in ESG ETFs and ETPs increased by 8.8% from US$208.28 billion at the end of January 2021 to US$226.75 billion, according to ETFGI’s February 2021 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ESG ETFs and ETPs listed globally reached a record $226.75 Bn at the end of February.

- During February ESG ETFs and ETPs gathered a record $20.87 Bn in net inflows beating the prior record of $19.79 Bn set in January 2021.

- YTD net inflows of $40.67 Bn are a record, passing the $13.61 Bn gathered at this point last year and beating the prior record of $13.61 Bn set in February 2020.

@ETFGI reports assets invested in ESG #ETFs and #ETPs listed globally reached a record US$227 billion at end of February 2021

Read More – https://t.co/3FY8uAcnLJ

— ETFGI (@etfgi) March 22, 2021

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

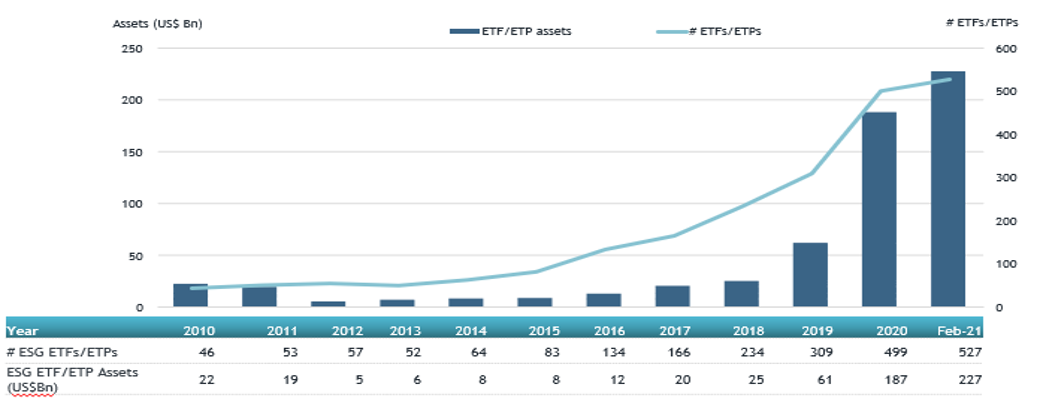

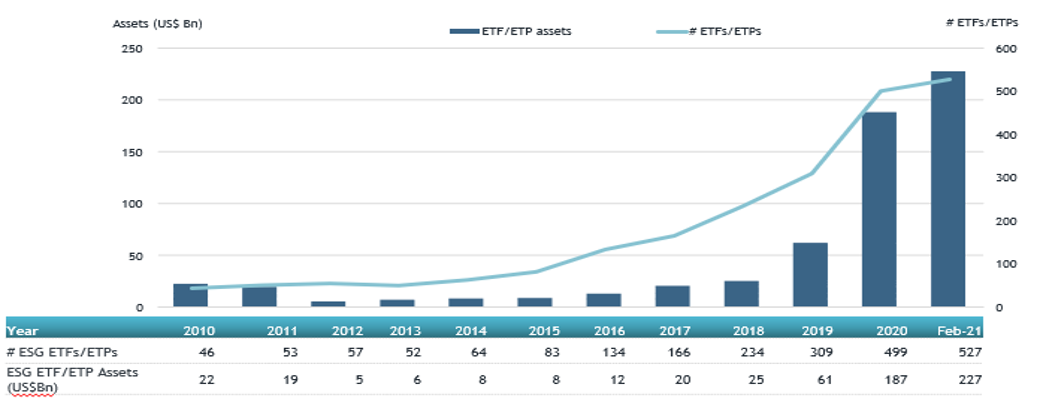

Global ESG ETF and ETP asset growth as at end of February 2021

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily. Globally there are 527 ESG ETFs and ETPs, with 1,537 listings, assets of US$226.75 Bn, from 123 providers on listed 35 exchanges in 28 countries at the end of February.

Substantial inflows can be attributed to the top 20 ETFs and ETPs ranked by net new assets, which collectively gathered $12.54 Bn at the end of February. SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF – Acc (SPPU US) gathered $5.54 Bn.

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Source: ETFGI