Letter from Abigail P. Johnson, Chairman and Chief Executive Officer:

Fidelity Investments had another year of robust financial and operating performance. While our financial results were boosted by the beneficial stock market and interest rate conditions in 2024, we had many notable accomplishments across our business. Fidelity’s financial strength and operational stability allow us to deliver products and services that meet the needs of our customers through all phases of their lives and all types of economic environments.

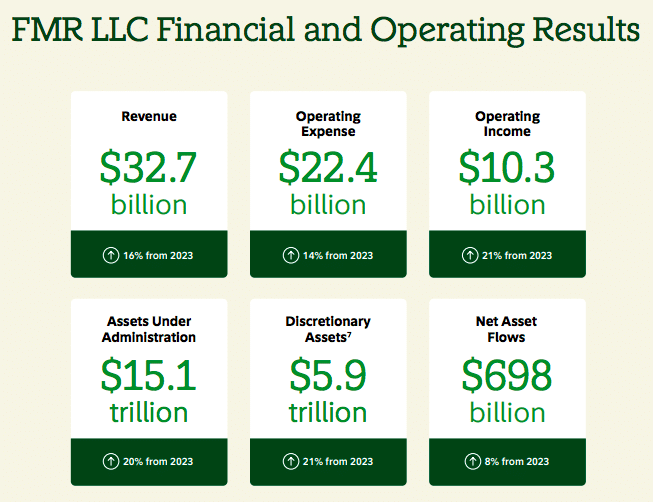

For the year, FMR LLC, comprising Fidelity Financial Services and FMR’s diversified businesses, recorded revenue of $32.7 billion, up 16% from 2023. Operating income, at $10.3 billion, was 21% higher than the prior year. Our stable financial results allowed us to make ongoing enhancements to the products and services we offer and were a continuation of our focus over the past decade to enhance operational quality, reduce unit costs, and build new online tools and capabilities for customers.

Amid the favorable capital markets, we had outstanding longterm performance from our actively managed equity and fixed income funds, which aided asset-based revenue. In addition to strong flows into money market funds, we had healthy flows into direct-sold index products and managed accounts.

As we always have, we prioritized strengthening relationships with customers in 2024. We offered customers multiple ways to interact with us, including through the web, our mobile apps, our 216 Investor Centers in the U.S., phone calls, live chat, and social media. We conducted 5.5 million customer appointments in Investor and Regional Centers and had 2.8 million interactions with customers on social platforms. During the year, 32.8 million unique individuals visited Fidelity.com or used our mobile app, which accounted for 1.7 billion overall visits to our retail website or app.

Strengthening relationships also means creating products that meet customers’ needs. Consequently, we launched new alternative investments and expanded our exchangetraded fund lineup. To meet evolving investor preferences and deliver on our commitment to provide exceptional value to our customers, we expanded our digital assets lineup with two of the industry’s first crypto exchange-traded products. Our workplace business introduced the Student Debt Retirement employer benefit, an innovative solution that helps our clients’ employees boost retirement savings while paying down student loan debt.

Fidelity has always worked hard to enhance the customer experience and we expanded and accelerated these efforts. We continued to invest in technology to make it easier to view and complete transactions, such as launching a unified digital experience for customers to review and change beneficiaries across workplace, brokerage, and wealth accounts. We released a new workflow for opening core brokerage accounts for individual investors that streamlines the online account opening process. In addition, we reaffirmed our commitment to serving wealth management firms of all sizes by introducing new technology offerings for small- and mid-sized registered investment advisors.

A great customer experience is fueled by associates who are engaged in dynamic careers that provide learning opportunities to better understand all facets of Fidelity’s business. This is why we launched a new skills and career development experience that provides our more than 77,000 associates with learning recommendations and tailored career-path guidance. We also refurbished and upgraded many of our facilities around the globe in 2024. Renovations spanned multiple sites, including Massachusetts, Utah, Florida, Colorado, North Carolina, London, and Hong Kong

Looking ahead, the economics of the financial industry will continue to demand efficiency and faster speed to market. We view these competitive dynamics as opportunities to harness the scale of Fidelity’s technology platforms to offer a broad range of digital tools, education, products, and personalized experiences. While few, if any, of our current competitors can match Fidelity’s diverse lineup of businesses, we know this advantage can erode over time, so our focus remains on the future. We are committed to continually improving our products and providing a combination of live, online, and digital service — all with the aim of improving the financial wellness of our customers and clients.

Thank you to all the individual customers, business clients, and institutions who have placed their confidence in Fidelity’s products and services.

The full report can be read here

Source: Fidelity Investments