The post-Covid, post-easy money era poses significant challenges for banks as deal flow dries up and market uncertainties increase, but there are opportunities too. Sell-side firms are cost cutting across the entire business, yet technology budgets continue to increase. To remain competitive, banks know that cutting technology investment is not an option, but they can struggle to understand where to focus that spend. Celent’s latest research suggests that examining value in technology opportunities, similar to what investors do for assets, can be a powerful tool in determining prioritization when it comes to fixed income* trading technology.

Focusing on Value When Evaluating Tech Opportunities

Inefficient manual workflows remain hallmarks of primary and secondary trading activity in many fixed income asset classes. Manual inputs, phone calls, emails, and spreadsheets remain common. Though the most liquid markets (in government bonds, interest rate swaps, and some credit and credit derivatives) trade electronically, full trading workflow digitalization is not yet widespread. Reasons for this include resistance to change, the lack of industry-wide standards, information, and transparency, and complex and outdated in-house-built tech stacks.

Multiple factors compete for a share of already stretched technology budgets. The care of aging tech stacks, the need to meet regulatory standards, and the focus on remaining competitive (rather than on innovation) often prevent progress. As a result, inefficiencies persist despite decades of modernization efforts, and value creation is unlikely.

Fortunately, fixed income can do all of the above and create value with its tech spend. Celent’s report, The Future of Fixed Income Tech: The Allure of Small Steps, provides a value analysis of opportunities to advance strategic initiatives for the fixed income market through carefully considered technology investment. When evaluating technology, investment firms must consider the technology opportunity’s alignment across implementation costs, enterprise costs, risks, and revenue potential with organizational needs and goals.

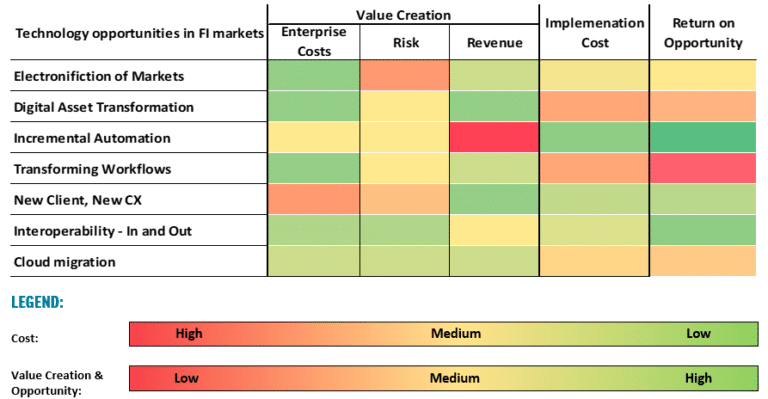

Celent’s research offers overviews and a qualitative value analysis that may aid sell-side firms in evaluating various technology opportunities. This research compared the risk-adjusted value of technology investment opportunities in fixed income markets, considering value creation and implementation costs to determine the relative return. It found that incremental automation, interoperability, and client experience offered the best return (see Figure 1).

Figure 1: Comparing risk-adjusted values of technology investment opportunities in fixed income markets. (Source: Celent.)

- Automation

Two types of automation hold significant potential value for fixed income:

- Incremental automation

- Transforming workflows

Incremental automation automates manual processes to deliver cost savings and efficiency gains, mitigating the risks associated with human error and clearing. Examples of manual workflows that are increasingly automated include: shifting to automated central clearing and away from manual email and phone communications for confirmation, reconciliation, and onboarding processes.

Plenty of relatively low-cost opportunities remain for incremental automation in fixed income: reworking new issuance workflows, increased settlement, allocation, matching, and netting speeds, graphic user interfaces (GUIs), and automated forms to speed up the onboarding and compliance experience. Many fintechs that aim to create efficiency for sell-side vendors offer incremental automation solutions.

Transforming workflows completely revises workflows to deliver efficiency and revenue while eliminating friction points. This transformation may include use cases such as improving transparency for traders by allowing interactions between previously siloed information streams (e.g., digital platforms, internal data, and voice broking). Artificial intelligence (AI), including machine learning (ML) and natural language processing (NLP), or desktop interop, are examples of technologies leveraged here. Transforming workflows can help mitigate risks; however, caution is critical to guard against new risks that may come with new processes.

2. Cloud migration

Though potentially a high-cost investment due to the need to refactor legacy technology, cloud migration (which leverages now relatively mature technologies and approaches) creates a necessary foundation for other initiatives. Increasingly relied on for capital markets trading, cloud technologies support significant flexibility with tech solutions and allow for efficiency and savings.

Like all firms, sell-side firms must consider the challenges of moving to the cloud. Flexera’s annual survey of cloud decision-makers ranked managing cloud spend, security, and lack of resources/expertise as the top three challenges across all organizations.

3. Customer experience

Changes in customer behaviors and expectations around electronic communications and trading mean that sell-side firms should use technology to improve the customer experience (CX) in fixed income. A new approach that fully uses customer data and supports customer loyalty is necessary in this post-pandemic world where clients have new digital engagement expectations.

Contemporary CX can take various forms, such as building AI-based tools to aid salespeople with relationship building, advanced data analysis to provide clarity into client trading behavior and optimize electronic offerings, or enterprise data management approaches to offer adjacent services from the firm to its top clients. Advanced data management approaches, often leveraging cloud approaches, can help transform CX, drawing on various data sources: e-trading venue data, messaging, and chat history, manually-input data from sales teams, or mining client interactions, e.g., research content that a client accessed. Once the data has been collected, wrangled, cleaned, and stored in a way that safely allows maximum usage, firms can build solutions to help salespeople provide the customer with additional value, deliver statistical techniques that offer customization for electronic clients, or conversational AI systems (including chatbots) that perform simple processes.

4. Digital Assets and Blockchain

Digital assets claim to offer advantages over traditional securities, including improved transparency, reduced transaction costs, and the ability to invest fractionally. Specific attributes of Blockchain (including atomic settlement, immutability, and permeance) can reduce certain operational and market risks.

Incumbents and tech vendors are examining forms of smart contracts, tokenization, and Blockchain-based platforms for issuing, trading, and settling securities. The latter remains limited within fixed income. The areas of repo and collateral, however, have several options. Solutions in these areas include Broadridge’s Distributed Ledger Repo, J.P. Morgan’s Onyx Digital Assets, HQLAx, Fnality and Finteum.

Digital assets and Blockchain offer two main categories of use cases for fixed income. In one, digital assets transform workflows without changes to the marketplace. In another, digital assets can create entirely new products or open new industries to clients who previously had been excluded; an example would be creating a secondary market for private assets, including streamlining the gathering and disseminating information through a single source of truth on the Blockchain.

5. Electronification of markets

Efforts by regulators and market participants are resulting in an increase in transparency and efficiency of e-trading. New technologies (e.g., for automation, data management, and tokenization) can help make information about the asset public and instantaneously available and can support more asset classes to go digital. Over the short- to medium-term, supporting electronification will likely be seen as an investment required to be competitive rather than value for money—meeting regulatory and client pressures for improved electronic offerings and transparency.

However, the increased prevalence of electronic trading supports data collection; that data offers new business opportunities (often by implementing statistical techniques, AI/ML, and NLP). The increase in data extends to fixed income operations, which also have opportunities to identify ways to monetize that data, such as through initiatives to provide more targeted CX to clients.

6. Interoperability

Pursuing interoperability is an excellent way to unlock efficiencies in a technology stack. This means confirming that every element of the tech stack—from the trading GUI or API to the settlement system—is architected to communicate with other elements effectively. Moving from monolithic structures to more dynamic microservices may aid this goal. Interoperability on a high level refers to seamless integration between different platforms and solutions. The integration solution can be on the server (back end), e.g., open APIs, or the application side (front end), e.g., desktop interop. Offers for the latter include Interop.io (the recently merged Glue42 and Finsemble) and OpenFin. Open source software and standards like those managed via the Fintech Open Source Foundation (FINOS) can help drive improvements while addressing fears of vendor lock-in.

Sell-side firms understand the importance of sustained technology investment. Understanding the value across diverse investment opportunities can help firms focus efforts and make effective decisions about technology strategy and spending.

*The fixed income market includes corporate and government bonds, interest rate futures/forwards, interest rate swaps, mortgage-backed securities (MBS), repurchase agreements (repos), and swaptions. Typically the largest asset class by value, fixed income represents approximately US$127 trillion of assets globally (as of 2021), in addition to US$79 trillion notional of exchange-traded derivatives and US$503 trillion of over-the-counter (OTC) derivatives, as estimated by the Bank for International Settlements (BIS).

Patrick Wegner is a senior analyst at Celent, where he focuses on technology innovation across capital markets.