- Forge is a leading global secondary marketplace for private company shares in the US and has partnered with Deutsche Börse to expand into Europe.

- Forge Europe hires four seasoned executives based in London and Germany to drive European expansion.

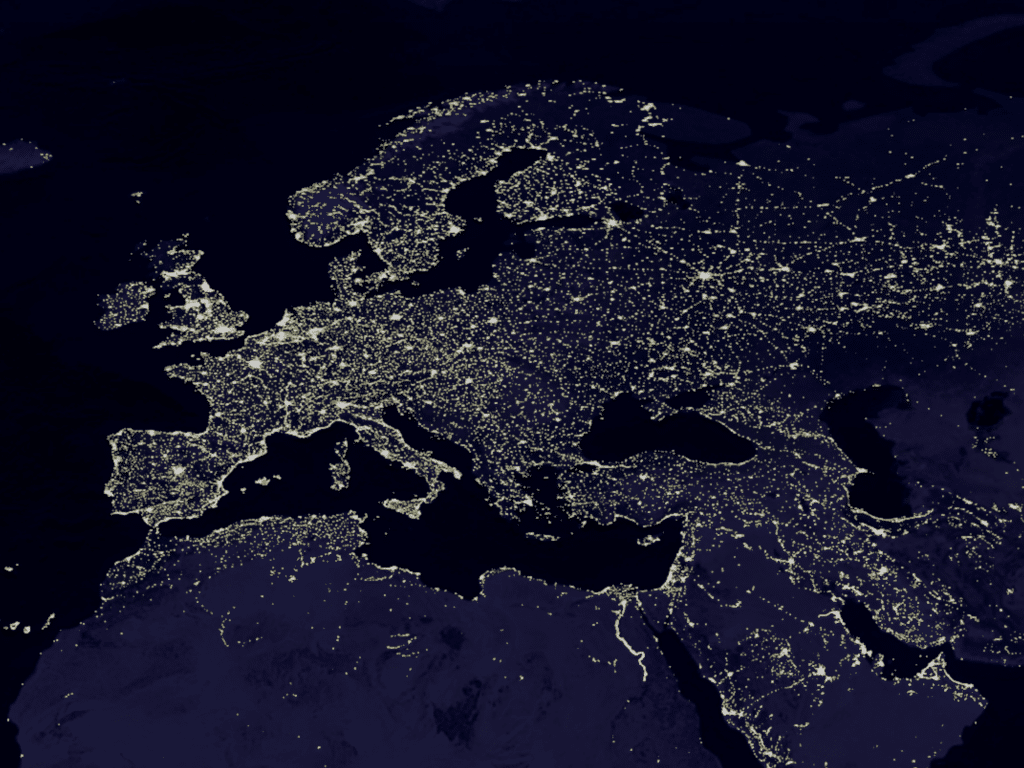

- The number of international buyers and sellers on the Forge platform demonstrates the growing demand for private shares in Europe and globally.

Forge Global Holdings, a leading provider of marketplace infrastructure, data services and technology solutions for private market participants, announces it has successfully launched Forge in Europe.

Forge Europe, a subsidiary of Forge, is spearheaded by a team of senior executives with decades of collective experience at companies including Charles Schwab, Bank of America, Freshfields Bruckhaus Deringer, Seedrs and Nuri. Thomas Davies, Managing Director and President of Forge Europe, Christoph Iwaniez, Managing Director, Finance & Operations, Toby Kendall, Managing Director, Technology and Edward Wales, Head of European Sales, bring invaluable local expertise to build out the company’s presence and growth in the European market.

With the official launch, Forge Europe capitalizes on the success of its parent company Forge, which stands as one of the largest global secondary marketplaces in the world. By connecting directly to the global interest book and leveraging Forge’s infrastructure, data services and technology solutions, Forge Europe is able to provide sellers with access to an extensive pool of liquidity and buyers with the opportunity to buy shares in some of the world’s most exciting growth companies. With operational hubs in Berlin, Germany, integrated within the Deutsche Börse network, as well as in London, UK, Forge Europe has now closed its first trades in cooperation with local partners and is planning to further expand across Europe into Austria, Switzerland and France.

Thomas Davies, Managing Director and President of Forge Europe said: “We have built an incredible team here in Europe with one simple aim: To be the largest and most liquid marketplace for private company shares in Europe. With unparalleled access to the experience and infrastructure of Forge in the US, as well as the support and network of Deutsche Börse, we are well on track to achieving this aim.”

“Demand for buying and selling private company shares is rapidly gaining pace in Europe,” Davies said. “We are building Europe’s most professional, trusted and data-driven solution for private companies and their investors to address this demand.”

Eric Leupold, Head of Cash Markets at Deutsche Börse said: “With the maturing European tech ecosystem and the continued growth of investment in private companies over the past decade it has become clear to us that there is a need for an efficient, data driven and technology-enabled marketplace for the trading of private company shares in Europe.”

“With Forge’s strong track record in the US and Deutsche Börse’s extensive experience in operating trusted and scalable market infrastructure, I am confident that Forge Europe will be the pioneer in addressing the late-stage and pre-IPO liquidity needs of private companies and investors in Europe, thereby strengthening the tech ecosystem.”

Kelly Rodriques, CEO of Forge Global said: “We know that in order to succeed in Europe we need local experts who understand the nuances of the local markets. With the expertise and network of our partner Deutsche Börse, and the team we’ve selected to drive this effort, Forge Europe is applying our learnings from pioneering private market solutions in the US to the unique needs of Europe’s distinct jurisdictions. Thomas has built an incredible team with exactly the local expertise that we need in order to capitalise on this fast-growing and rapidly changing market.”

“With over $14 billion traded on our platform in more than 500 private companies including Klarna and Spotify (now public), as well as our Forge Pro trading management solution and the Forge Private Market Index, Forge Europe is integrated into one of the largest global marketplaces for private company share trading in the world. We are confident that we have the right team, at the right time, to accelerate access to this asset class in Europe.”

Market Trends

Forge Global has targeted Europe as the number of unicorn companies located in Europe grows and as global demand for private shares trading grows with it.

The Forge platform has seen the proportion of private market transactions with international buyers or sellers increase over time to 26% in 2024, up from about 13% in 2018, according to Forge’s latest Forge Investment Outlook, released April 18.

Overall, the market for secondary shares trading through the Forge platform saw an increase in activity in Q1 2024, according to the Forge Investment Outlook. Indications of interest submitted rose 45% in Q1 over Q4 2023, and there was a notable shift in the market in Q1 as buyers made up a greater proportion of total interest than did sellers for the first time in more than two years.

In addition, the report showed that the Forge Private Market Index, which tracks the 75 most liquid names in the private market, rose 4.5% in Q1 2024.

Source: Forge