03.16.2023

Regulators and capital markets industry groups worldwide are pushing to shorten settlement cycles in equity trading.

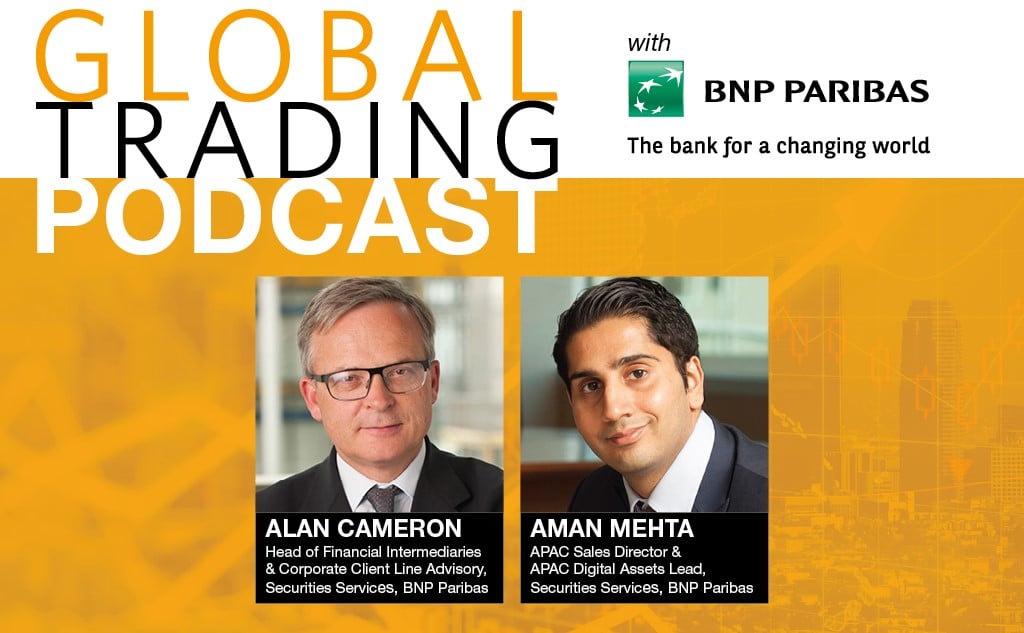

Aman Mehta, APAC Sales Director and APAC Digital Assets Lead for Securities Services at BNP Paribas, and Alan Cameron, Head of Financial Intermediaries and Corporates Client Line Advisory for Securities Services at BNP Paribas, spoke with GlobalTrading Editor Terry Flanagan about this long-term trend and its implications for market participants.

Discussion points included reasons for shortening the settlement cycle, differences in settlement cycles across geographic regions, and the role of the securities service provider in helping investment firms navigate shortened settlement.