Baton Systems, the market solution transforming asset movements and settlements, announced that it has completed connecting to Intercontinental Exchange, a leading global provider of data, technology, and market infrastructure, making ICE Clear Europe the 5th major global CCP available on the Baton network.

We're delighted to announce @batonsystems has completed connecting to Intercontinental Exchange, Inc. (NYSE:ICE), making ICE Clear Europe the 5th major global #CCP available on the Baton #network: https://t.co/Kk9Q14Dyji

— Baton Systems (@batonsystems) August 19, 2021

All FCMs using Baton will now be able to automate and optimise collateral holdings and expedite the movement of cash and securities with the CCPs of greatest strategic importance to their business. These firms include the world’s largest financial institutions, responsible for managing 43% of the funds held by global CCPs.

Citi recently became the first FCM to connect to ICE Clear Europe and benefit from the extended CCP network.

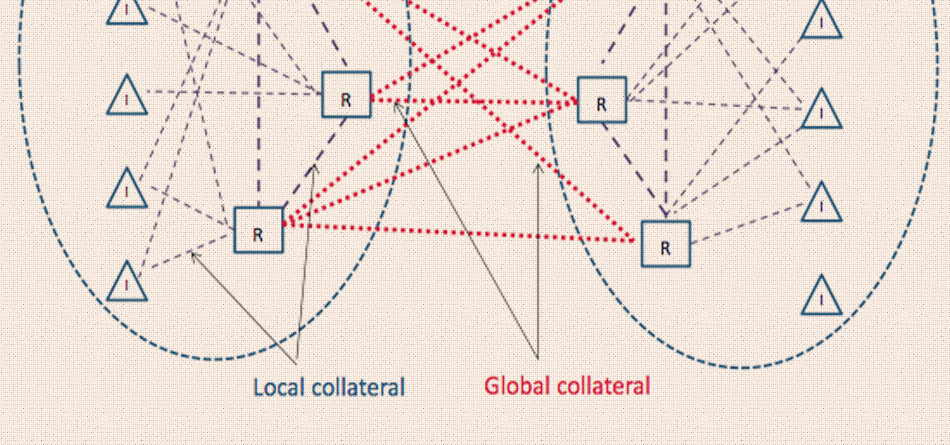

The Baton network is trusted to facilitate the movement of billions of dollars every day, connecting the world’s largest exchange operators, FCMs, custodians and banks. Using Baton for automated collateral management allows market participants to access CCP account balances and acceptable collateral lists on-demand and view all assets deposited at external custody banks and CCPs. FCMs can also be automatically alerted to changes and introduce zero-friction workflows to optimise allocation and accelerate productivity by instructing multiple cash and securities movements via the Baton interface.

Mariam Rafi, Managing Director, Americas head of Clearing and FXPB and Global head of Financial Resource Management, Futures, Clearing and FXPB, Citi said “With Baton we have been able to accelerate our innovation agenda and drive efficiencies throughout our entire clearing process. Our Collateral Management team can now access information in real-time and dynamically manage our inventory of eligible collateral across the network of CCPs we interact with the most, which enables us to better serve our clients.”

J. Christopher Giancarlo, Senior Advisor to Baton and former Chairman of the United States Commodity Futures Trading Commission (CFTC) commented, “What we are now seeing is a real shift in the collateral management landscape. The world’s largest FCMs are connecting directly with the world’s largest CCPs – this means that for the first time in history it will be possible for a significant proportion of the total collateral held with CCPs globally to be automatically optimised.” adding “As the network expands the benefits derived by all participants are only likely to increase. This presents huge potential for the industry as a whole to eliminate unnecessary risks.”

“We are always focused on how we can help our customers bring efficiencies to their processes,” said Chris Edmonds, Global Head of Clearing and Risk at ICE. “With Baton completing a connection to the ICE Collateral API, our clearing members can further optimize their collateral and margin management processes. We are now facilitating additional ICE CCPs with Baton, so we can assist more of our clearing members globally across the numerous asset classes we clear.”

ICE Clear Europe is the first member of the ICE Group to go-live on the Baton platform. Baton is now working on a structured roll-out plan that should see ICE Clear U.S. and ICE Clear Credit connected in coming months.

Tucker Dona, Head of Business Development and Client Success at Baton Systems added “The market coverage that’s now possible via the Baton network is remarkable – as is the speed that we can bring new participants on-board. We can now get new clearing firms live on the platform, with full access to our extended CCP network, in a matter of weeks.”

Source: Baton