By Roman Ginis, Founder & CEO at Imperative Execution

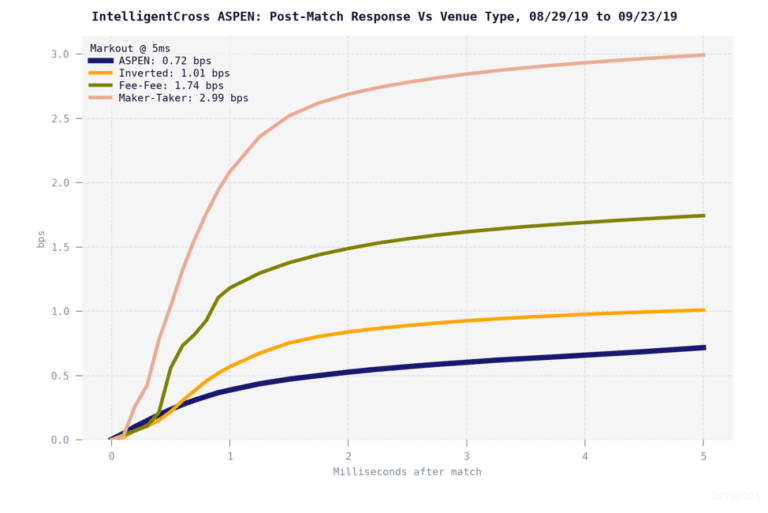

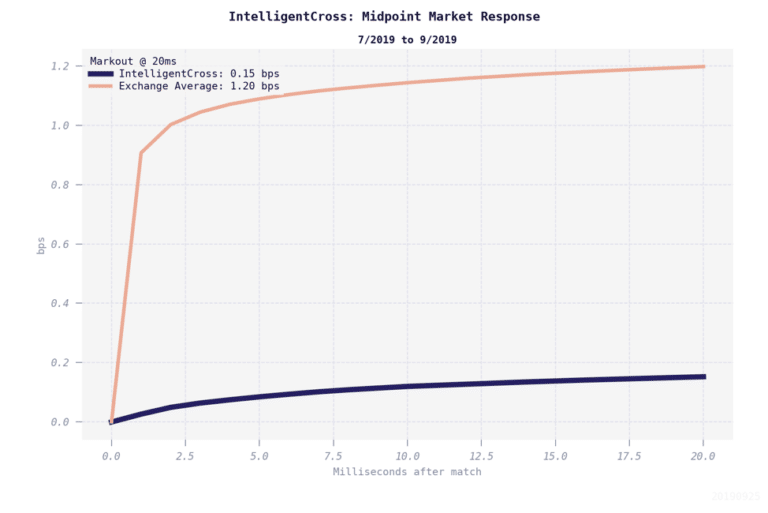

A year ago we set out to create a venue that minimizes market impact and allows market participants to trade as efficiently as the best firms on the street. Today, with over 3 billion shares matched, IntelligentCross performs about 8x better than the exchanges at the midpoint (0.15bps vs 1.2bps), measured by market impact, and as much as 4x better at adverse selection at the touch (0.72bps vs 2.99bps – see chart below). This is no accident – IntelligentCross is designed to ‘solve for’ these objectives with an AI-based optimization of the matching process. We believe this approach to venue design – starting with an objective and optimizing the matching logic to achieve it — is the best way to create an efficient market.

Thanks to the SEC’s adoption of Reg ATS, innovation in matching has been happening for two decades. And now, for the first time in history, investors have a venue that uses AI to help materially improve their execution quality. Every basis point of execution efficiency–assuming the turnover in US equities of $400B/day–saves investors $10 billion/year. These savings compound and will enable investors to grow their wealth faster. The lower cost of trading will also grow the broader market, as capital that was too expensive to deploy, will more easily flow into public companies.

What’s in the name IntelligentCross? Unlike traditional exchanges, that mechanically match up buyers and sellers as soon as and as often as they can, IntelligentCross focuses on the quality of the match. We aim to minimize market impact and adverse selection as measured by price movement and quote stability after a trade. The ‘intelligence’ of our venue is in its unique ability to measure and optimize its own performance. IntelligentCross matches orders at discrete times, at the micro/millisecond scale, calibrating the timing of matches to pair up bids and offers that are most likely to achieve institutional traders’ objectives.

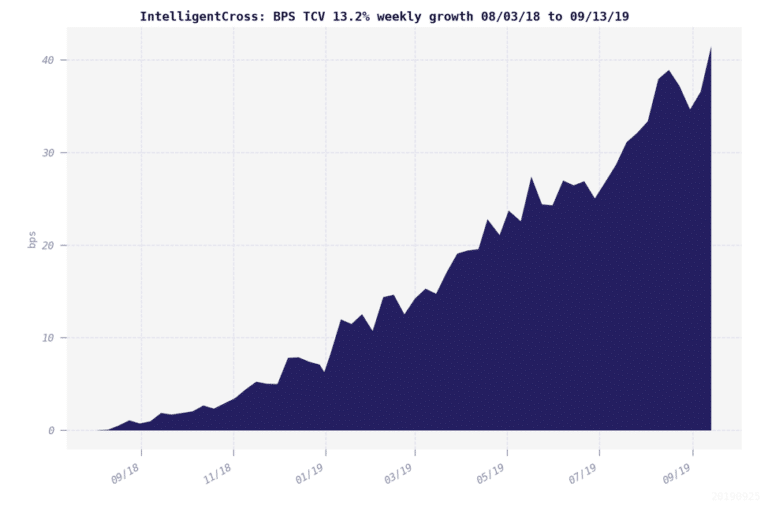

How can investors access us? IntelligentCross is available through virtually every major broker in the US market. Execution algorithms, such as VWAP and POV, can trade it like any exchange (via regular order types) to improve their implementation performance. Our adoption rate reflects our strong results. We are growing at about 13% per week (see chart) and Rosenblatt’s leading independent market structure experts referred to IntelligentCross launch as one of the “strongest… ATS debuts ever.” We thank our subscribers for this support and using our venue more and more to optimize the execution of their orders.

Where do we go from here? IntelligentCross is ready to display our subscribers quotes as part of the national market system and contribute to price discovery. Our displayed bid/offer book, called ASPEN (Adverse Selection Protection Engine) is delivering the lowest adverse selection in the market. This performance provides meaningful benefits to the market as a whole — enabling tighter spreads, increased book depth and greater quote stability. Displaying ASPEN quotes ‘on the tape’ would benefit all investors and we are looking for ways to make this happen next year.