New web page provides ongoing latency transparency

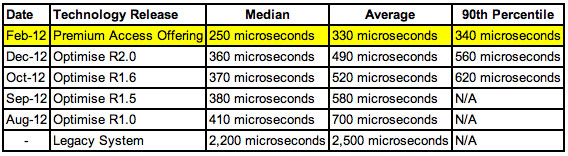

New York, March 13, 2012 – The International Securities Exchange (ISE) announced that current median latency for its Optimise™ trading system equals 250 microseconds. This represents a reduction of approximately 39% since the completion of the Optimise rollout in August 2011. Significantly, ISE has reduced the latency tail so that 90% of all quotes submitted to the system are acknowledged within 340 microseconds, representing a 45% reduction in the past six months.

ISE is also now publishing its latency statistics for Optimise on a new, dedicated webpage, www.ise.com/latencystats . The latest statistics are measured and reported via the CorvilNet performance monitoring solution, which was implemented in February 2012. As part of ISE’s commitment to continually enhance its leading technology platform, the statistics will be updated approximately every two months, following each new technology release.

Daniel Friel, ISE’s Chief Information Officer, said, “We were extremely proud of the enormous improvement in ISE’s latency profile when we completed the rollout of Optimise last August. Since implementation of the initial Optimise release, our technology team has remained solidly focused on continuing to improve the system’s performance and implementing cutting-edge technology solutions to lower latency. With a median latency figure of 250 microseconds combined with its industry-leading functionality, Optimise is at the forefront of options trading platforms globally.”

Optimise Performance Metrics*

*Latency figures represent roundtrip mass quote entry to acknowledgement for ISE’s 10 Gigabit Ethernet connection. This includes transit time from the entry point to ISE’s network through the matching engine and back.

About Optimise™

Optimise™, the core, proprietary global trading architecture of Deutsche Börse Group, represents a world-class, state-of-the-art trading system. The defining attributes of Optimise™ are speed, performance, efficiency, capacity, throughput, reliability and availability. The global trading infrastructure meets customer needs by minimizing latency and maximizing throughput while maintaining high standards of reliability and excellence. Its flexible design allows the creation of applications and functionalities unique to each market structure and client base as well as rapid technology upgrades. Therefore, it can serve as the common technology backbone for other Deutsche Börse Group exchanges.

About ISE

The International Securities Exchange (ISE) operates a leading U.S. options exchange and offers options trading on over 2,000 underlying equity, ETF, index, and FX products. As the first all-electronic options exchange in the U.S., ISE transformed the options industry by creating efficient markets through innovative market structure and technology. Regulated by the Securities and Exchange Commission (SEC) and a member-owner of The Options Clearing Corporation (OCC), ISE provides investors with a transparent marketplace for price and liquidity discovery on centrally cleared options products. ISE continues to expand its marketplace through the ongoing development of enhanced trading functionality, new products, and market data services. As a complement to its options business, ISE has expanded its reach into multiple asset classes through strategic investments in financial marketplaces and services that foster technology innovation and market efficiency. Through minority investments, ISE participates in the securities lending and equities markets. ISE also licenses its proprietary Longitude technology for trading in event-driven derivatives markets.

ISE is a wholly owned subsidiary of Eurex, a leading global derivatives exchange. Eurex itself is jointly operated by Deutsche Börse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex and ISE are the global market leader in individual equity and equity index derivatives. For more information, visit www.ise.com.

CONTACT:

International Securities Exchange:

Molly McGregor

212-897-0275

mmcgregor@ise.com