This is to announce that, with cooperations of the stakeholders, starting from January 2023, Japan Securities Clearing Corporation implements a blockchain technology in the settlement by delivery of rubber futures as detailed below, as a first shot of its utilization of a blockchain technology.

News Release

-CCP’s Blockchain Technology Utilization – Implement for Rubber Futures Settlement by Delivery as a First Shot –https://t.co/5ww9jce8kG— Japan Exchange Group EN (@JPX_official_EN) January 30, 2023

Subject

Settlement by delivery of Rubber (RSS3) Futures* at Osaka Exchange, Inc.

* Futures Contracts on RSS (Ribbed Smoked Sheet) No.3 which is the most standard natural rubber graded by international organizations or public authorities of the countries of production

Utilization Details

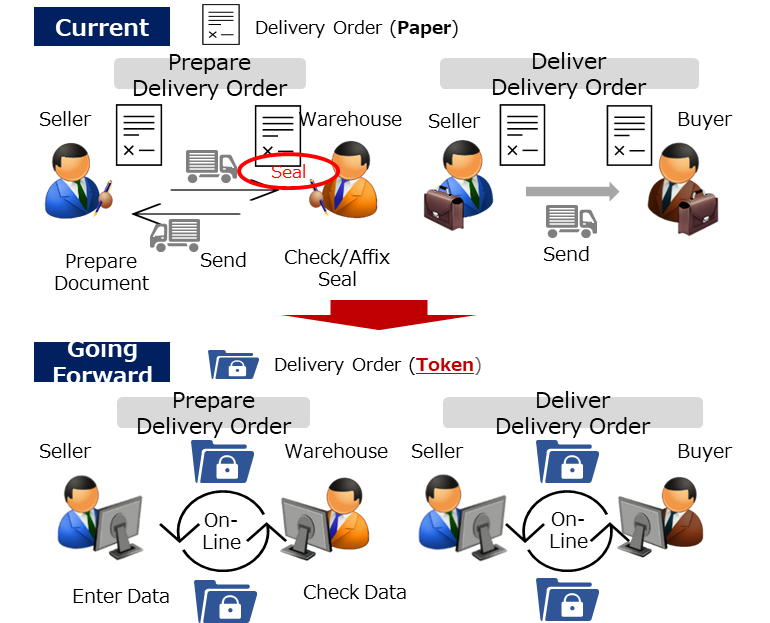

Currently, a settlement by delivery of Rubber Futures is performed through an exchange of a document called “delivery order,” which allows its holder to receive a delivery of rubber. Going forward, the delivery method will migrate to an on-line exchange of a token recording the delivery order information using blockchain technology.

Start Timing/Number of Users

Start Timing/Number of Users

From the delivery for Jan. 2023 Contract Month Contracts (Date of Settlement by Delivery: January 31, 2023 (Tuesday))

Total of 13 firms consisting of selling/buying Clearing Participants and clients in the settlement by delivery of rubber, and warehouses taking custody of rubber to be delivered

Expected Effect

By this, the delivery order process, such as preparation and delivery, that have been performed among seller/buyer/warehouse at each time of the settlement by delivery of rubber, will no longer be necessary and the settlement by delivery will complete on-line, and thus an efficiency of the settlement by delivery will be enhanced.

Future Prospect

Expansion to Precious Metals

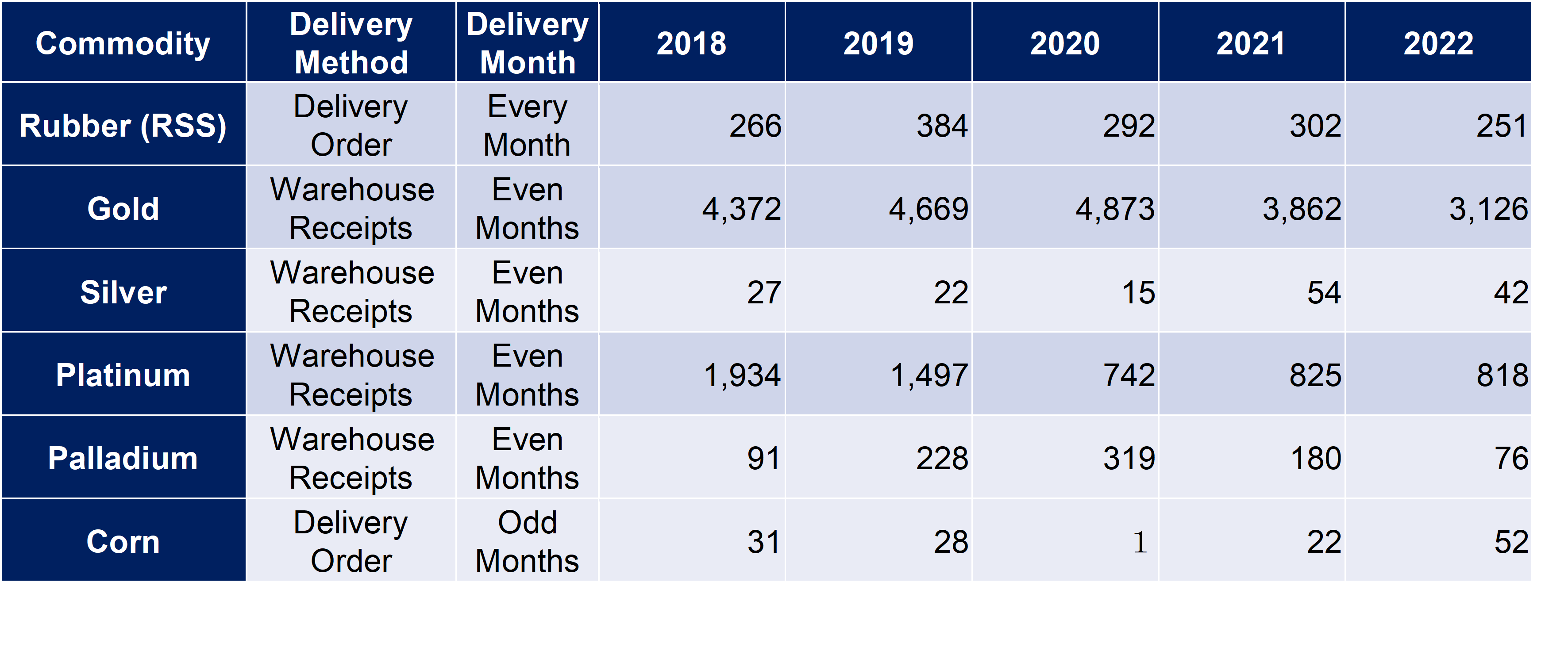

A settlement by delivery of precious metals, such as gold, silver and platinum, which are more liquid than rubber, is currently performed through an exchange of the securities called “warehouse receipts.”

Unlike delivery orders, warehouse receipts are securities which can also be used as collateral for various trades. Its digitalization is expected to be discussed at the Legislative Council of the Ministry of Justice going forward. So, we will keep our eyes on a status of such discussions and study feasibility of its digitalization as next step.

Further Enhancement of Settlement Efficiency and Strengthening of Response Capacity for Future

Digitalization of assets using blockchain technology has already been realized in small-lot securities, such a less liquid real estates or bonds.

Japan Securities Clearing Corporation decided its utilization of Blockchain Technology this time as a first trial in the area of Japanese listed products trading. It will strive for an enhancement of settlement efficiency through implementation of new technologies as well as strengthening of its response capacity for the future with a view to a possible expansion of utilization of new technologies like this in the trading and clearing/settlement of more liquid listed products and OTC products.