Baton Systems (“Baton”), a provider of post-trade solutions for financial markets, has integrated with LCH, a leading global clearing house, to automate the end-to-end collateral workflow for derivatives participants. J.P. Morgan will be the first of Baton’s clients to manage their collateral at LCH using the Baton platform. The partnership expands Baton’s network of central counterparties (CCPs) that now includes several of the world’s largest exchange operators.

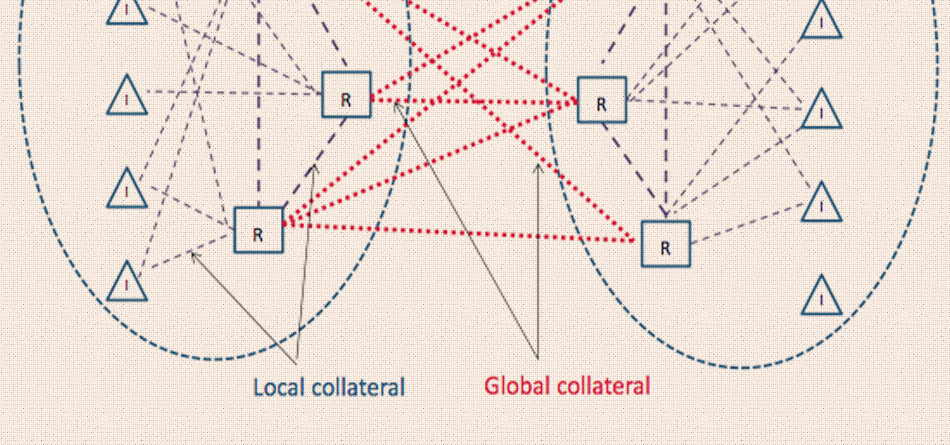

Baton’s shared permissioned ledger integrates with existing collateral and cash systems of external providers, including CCPs and custodians, to enable real-time visibility and accelerated movement of assets.

Baton Systems has integrated with @LCH_Clearing to automate the end-to-end collateral workflow for derivatives participants. @jpmorgan will be the first of Baton’s clients to manage their collateral at LCH using the Baton platform. https://t.co/AOg2P8lZ7x#fintech #derivatives

— Baton Systems (@batonsystems) May 6, 2021

“Baton’s integration with LCH is a significant milestone in our aim to have a comprehensive global coverage of CCPs on the platform,” said Anthony Fraser, Head of Global Clearing Operations and Cost & Commission Services at J.P. Morgan. “This will bring further efficiency in our collateral management process and will provide greater real-time visibility of our margin and collateral holdings.”

By normalizing and harmonizing data and collateral workflows for all integrated CCPs, Baton enables access to consolidated intra-day information in a single dashboard, with true visibility into the full collateral lifecycle. This includes visibility of margin requirements, a standardized process for pledging and recalling collateral, and clear visibility of the progress of asset movements at external custody banks and CCPs.

“The growing network of market participants on Baton’s platform is a testament to our vision of revolutionizing payments and settlements in capital markets,” said Tucker Dona, Head of Business Development and Client Success at Baton Systems. “With additional CCP connectivity, we are streamlining the collateral workflow process for market participants and enabling greater efficiency while also reducing costs typically associated with legacy systems.”

In 2019, Baton and J.P. Morgan developed a solution that enables the near real-time orchestration of cash and collateral transfers to multiple clearing houses. Baton’s platform is being scaled across global clearing houses and is available for deployment across all major derivatives firms.

Source: Baton