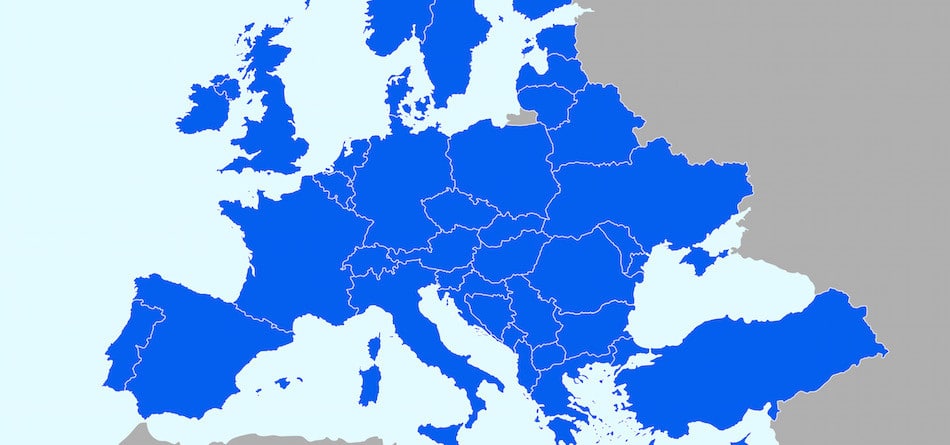

Liquidnet, the global institutional investment network, announced it has enhanced its continental European coverage by deploying specialists in equities and fixed income in Paris, Madrid, Frankfurt and Copenhagen to offer a range of execution services including client coverage, sales trading and trading.

The strategic move taps into the existing geographic infrastructure and expertise within the pan-European TP ICAP Group allowing Liquidnet to deploy coverage teams locally to serve the buy side Member community.

John Ruskin, CEO of the Agency Execution division of TP ICAP Group said: “Leveraging the TP ICAP footprint means we have an amazing opportunity to enhance the Liquidnet offering in a very efficient and effective way. One of the reasons Liquidnet’s model works so well is because we are focused on co-creating and delivering solutions that address the challenges our Members face. To do that, we need to be where they are and that is exactly what we are doing.”

Equities coverage: strengthening its service model

Having local teams in key European hubs enables Liquidnet’s Equity business to offer an ever more tailored client service in the region and deepen its pool of liquidity, which currently offers $74Bn of global average daily liquidity across 46 equity markets.

“We are a Member community. Enhancing our footprint in continental Europe enables us to grow this community, deepen the liquidity proposition for all Members and improve the service we provide,” added Chris Jackson, Global Head of Equity Strategy and Head of EMEA Equities.

Fixed Income coverage: supporting growth and development

Now with offerings in both primary and secondary markets and one of the largest pools of buy side liquidity, the firm’s Fixed Income business is also developing its coverage capabilities.

Mark Russell, Global Head of Fixed Income commented: “Having specialists in place who are close to our Members means that we are better placed to develop our offering.”

Source: TP ICAP