London Stock Exchange Group announces the launch of a new innovative trading service, Turquoise Retail Max™. The service is designed to support European retail brokers in meeting their best execution obligations and deliver price improvement for end retail investors when trading pan-European securities. Turquoise Retail Max™ is available through Turquoise Europe™, the pan-European trading platform majority owned by LSEG in partnership with the user community.

Accessible though the Turquoise Plato Lit Auctions™ order book, Turquoise Retail Max™ enables retail brokers on Turquoise Europe™ to meet their best execution obligations on pan-European securities through a competitive multilateral auction process, with the benefit of efficient processing from trading through to clearing and settlement. Orders flagged as originating from a retail investor can achieve best possible outcomes by utilising a price formation mechanism based on liquidity provided by both specialist retail liquidity providers and all other market participants. By creating this new service, Turquoise Europe™ is extending the benefit of price improvement on aggressive and passive orders to retail orders.

Hudson River Trading and Stifel will be the first retail liquidity providers to utilise Turquoise Retail Max™.

Adam Wood, CEO, Turquoise Global, and Head of Equities Trading Commercial Proposition, LSE plc, said: “We are delighted to expand our trading services through Turquoise Retail Max™. For the first time, retail brokers will be able to achieve execution at primary market midpoint in a fully pre-trade transparent order book. Clients’ orders will benefit from a diverse source of liquidity, with competitive pricing through a traditional auction process. By placing retail investor orders at the centre of the price formation mechanism, the new service will assist retail brokers in achieving best execution.”

Jamal Tarazi, Head of Dublin Business Development, Hudson River Trading, said: “With the launch of Turquoise Retail Max™, retail brokers can now offer clients institutional grade trading experiences. Hudson River Trading will now provide liquidity to retail firms on a continuous basis on a wide range of European equities and ETPs.”

Paul Makepeace, Head of Trading, Stifel Europe, said: “We believe that joining Turquoise Retail MaxTM as a retail liquidity provider is an opportunity to enhance Stifel’s execution value proposition in Europe. We see Turquoise Plato Lit Auctions Order BookTM as a novel way to enable specialised liquidity to interact with retail orders in a multilateral order book.”

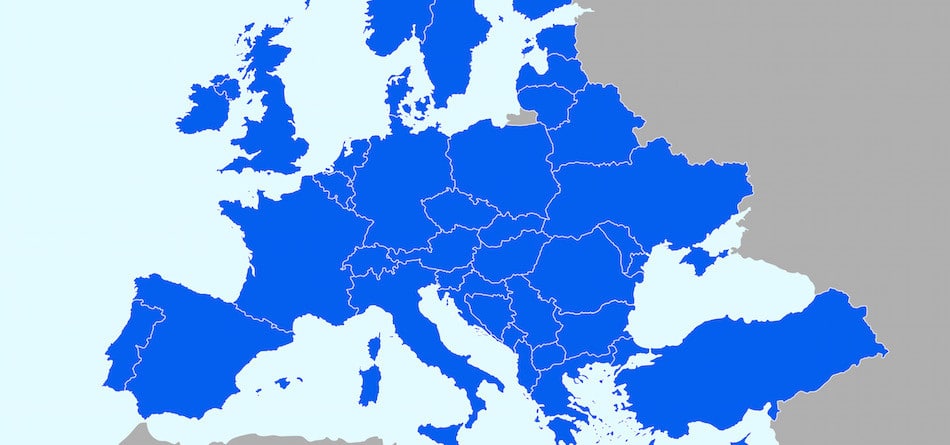

Over 2,400 securities, including depository receipts, ETP and rights issues (excluding UK and Swiss securities) across 17 European countries are available for trading on Turquoise Europe™. Turquoise Europe™ also offers preferred clearing functionality which enables the consolidation of clearing within the members’ CCP of choice.

Source: LSEG