This article first ran in GlobalTrading Journal.

By Kathryn Zhao, Global Head of Electronic Trading, Cantor Fitzgerald, Liang Liu, Head of Electronic Trading Quant, Cantor Fitzgerald, Haixiao Cai, Senior Electronic Trading Quant, Cantor Fitzgerald, Yan Yu, Electronic Trading Quant, Cantor Fitzgerald

The deep liquidity at equity markets’ open and close auctions typically provides price discovery and facilitation of block order executions. Trading at these centralized, large-scale liquidity events permits institutional investors to establish sizeable positions without undue complexity [1]. To participate effectively in auctions, we need to understand how an order can potentially affect the auction price, namely the market impact. While market participants have a relatively good understanding of the market impact in continuous trading sessions, there is much less knowledge about auction market impact in the public domain.

The conventional method to calibrate a market impact model is to run regression analysis on the price change before and after the order against the order size using proprietary order data accumulated over many years. However, applying this method to estimate auction market impact has two major drawbacks:

There is only a single open and a single close auction each day, so a large data set takes a very long time to accumulate. Moreover, the auction price used in such regressions reflects only the final equilibrium price and not the price dynamics to reach the equilibrium, which is often used in the calibration of a continuous market impact model.

The regression using a given firm’s trading data is often noisy because the firm’s orders only represent a small percentage of the total number of orders entering the auction.

In order to address these shortcomings, the next natural source of data to utilize is the auction imbalance messages published every second from the various exchanges (after 09:28 for open auctions and after 15:50 for close auctions on NSDQ & NYSE). Using these imbalance messages, we obtain aggregated interest for an auction from all market participants (NYSE imbalance messages include d-Quotes at 15:55) and have many more data points for each symbol and day. The time series of the imbalance quantity and the near indicative clearing price offer a rich data set to analyze the market impact for the auction. Our goal is to find out how much the auction price will be “pushed” by additional imbalance quantities on average and then use that as a proxy for the market impact for the auction.

Methodology

Each second the exchange publishes imbalance messages, which are “snapshots” of the auction book, including paired quantity, imbalance quantity, reference price and near indicative clearing price [2, 3]. Near indicative clearing price indicates a tentative auction price where the current auction book and the continuous book would clear against each other. As additional orders are added to the auction book, the near indicative clearing price will change, reflecting the impact of those newly added orders. The change of imbalance quantity captures the “net flow” of auction eligible orders. However, the imbalance quantity is the unexecuted quantity at the current reference price, while the reference price floats with the market NBBO. In other words, each imbalance message only gives us a glimpse of the order imbalance through the “open window” of the reference price. In order to gain a full understanding of the order imbalance, it is imperative to string those “snapshots” together. By leveraging those insights, we develop a linear impact model and a proprietary algorithm to estimate the market impact coefficients for open/close auctions.

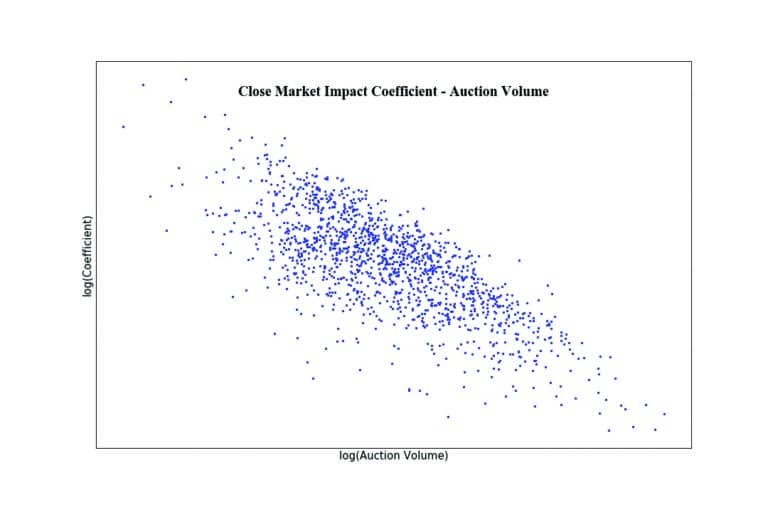

The richness of imbalance messages increases with auction volume. As a result, the impact model of stocks with active auction trading is statistically more significant than that of stocks with less auction activities. We calibrate stock-specific market impact coefficients for all Russell 3000 stocks, and then we recalibrate them on a quarterly basis. We have found a strong correlation between a given stock’s average auction volume and its market impact coefficient. As shown in Figure 1, on a log-log scale, market impact coefficient and auction volume exhibit a clear negative linear relationship. Using this finding, we create a model that relates the market impact coefficient to the auction volume and then use it to estimate the market impact coefficient for stocks outside the Russell 3000.

Examples

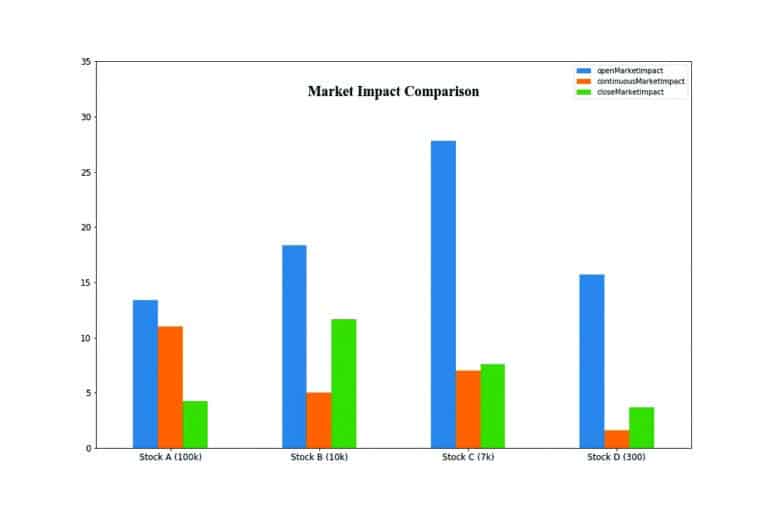

To give some concrete examples of the market impact estimation, let us look at some hypothetical orders with size equivalent to 30% of the last five minutes volume of the continuous session for four stocks. The market impact cost estimations for open/close auction are shown in Figure 2. For comparison, the market impact cost for the corresponding continuous session estimated by our proprietary model [4] is also shown. For illustration purposes, order sizes of those examples are chosen based on the stocks’ liquidity, so that the market impact cost estimates have similar orders of magnitude. We observe that for all stocks, the market impact cost at the open auction is greater than at the close auction. In addition, the relative value of the impact cost for auctions compared to the continuous session varies from stock to stock.

Our Precision Liquidity Seeking algorithm utilizes market impact models for all three trading sessions (open, continuous, and close) to minimize the market impact cost while satisfying traders’ risk constraints. The optimal trading schedule for executing 1,000,000 shares of Stock A through all three trading sessions, with a target average participation rate of 10%, features no allocation to the open auction, a front-loaded schedule during the continuous session, and a significant allocation to the close auction (more than 10% of the order size is allocated to the close auction).

In contrast, the optimal schedule of executing 100,000 shares of Stock B, with the same 10% target participation rate, has no allocation to the open auction, a skewed U-shaped schedule during the continuous session, and a moderate allocation to the close auction (only 2% of the order size, which is much smaller than that for the Stock A example). The underlying reason for this difference is shown in Figure 2: relative to the corresponding continuous session, Stock A’s close auction is more advantageous than Stock B’s close auction in terms of minimizing the total market impact cost.

Conclusion

Using the imbalance messages from stocks’ primary exchanges, we derive a linear market impact model for open and close auctions, which complements our continuous market impact model. Stock-specific market impact coefficients for auctions are calibrated for Russell 3000 stocks, which are inversely correlated with auction volumes. This relationship is then used to calculate the market impact coefficients for stocks outside the Russell 3000.

With market impact models for all three trading sessions in place, our Precision algorithm is capable of allocating order shares to different sessions in a truly optimized way, which properly addresses traders’ concerns when deciding on the optimal trading trajectory. This capability has been desired for a long time, and we believe that Precision is the first algorithm to provide a complete and coherent treatment of market impact models with this capability.

References

[1] Zhao, K., Cai, H. & Yu, Y. (2019, Q3). Closing Volume Discovery. Global Trading Q3 2019, 15-20. https://www.fixglobal.com/home/closing-volume-discovery/

[2] NYSE (March 8, 2019). XDP Imbalances Feed Client Specification.

[3] Nasdaq (August 12, 2019). Net Order Imbalance Indicator Support Document.

[4] Zhao, K. & Liu, L. (2019, Q2). Market Impact in Continuous Market. Cantor Fitzgerald Precision White Paper.