By Christian Voigt, Senior Regulatory Adviser, Fidessa

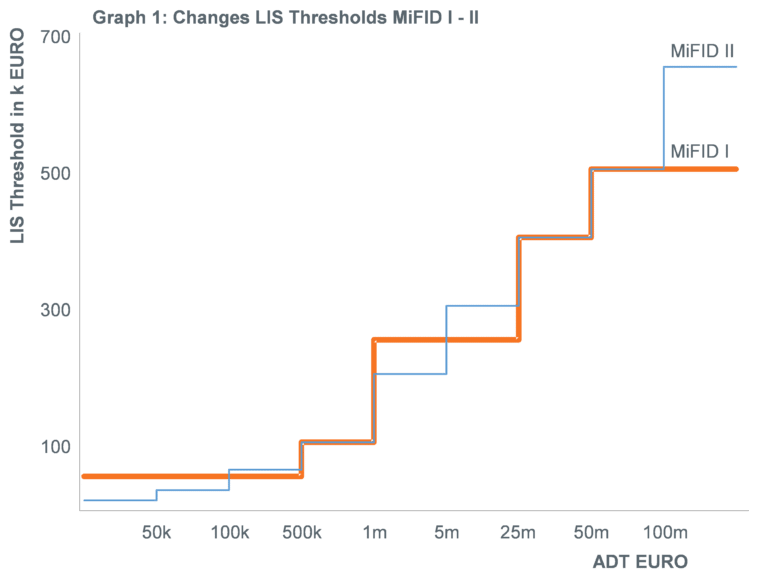

Changes to the Large in Scale (LIS) thresholds in MiFID II appear to be relatively balanced at first sight – lower than under MiFID I for shares with a low average daily turnover (ADT) and significantly higher for those with a high ADT (Graph 1).

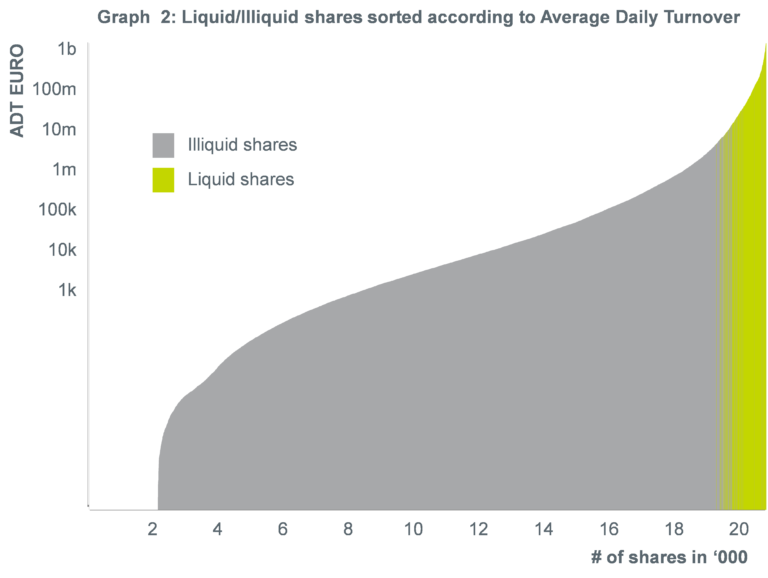

However, include the transparency calculations recently published by ESMA and it paints a starkly different picture. As Graph 2 shows, shares with a high ADT are deemed liquid by ESMA, and those with a low ADT are classified as illiquid. By combining Graph 1 and 2 it becomes apparent that it’s mainly illiquid shares that benefit from the decrease in LIS thresholds, whereas most liquid shares experience an increase in minimum block sizes.

This becomes crucial when considering the double volume caps (DVC) which are now expected to bite sometime after March 2018. For liquid instruments, use of the LIS waiver is one of the few available options to stay outside the DVC, hence the growing importance for block trading (as shown in our Top of Blocks report). Under MiFID II illiquid instruments can continue to trade in the dark without restrictions and outside the DVC.

In other words, the LIS waiver is particularly significant for liquid instruments (for which the thresholds have increased). The reduction in the threshold that might benefit illiquid stocks is largely immaterial. The fact is MiFID II simply increases the minimum block size for many instruments.

Understanding the intricacies of MiFID II is rather like peeling an onion – you peel enough layers and you’re bound to shed some tears.