As its name suggests, Systematic Alpha Management doesn’t wing it in trying to beat the market; rather, the New York-based hedge fund seeks alpha by deploying methodical and regular procedures. These entail market-neutral, absolute-return oriented quantitative trading strategies, which are high-frequency in nature and mostly contrarian. The firm’s trading and investing professionals include theoretical physicists, mathematicians, and computer scientists.

Systematic Alpha generates some of its investment ideas from analogies with physics, particularly in such areas as fluid dynamics and fluid turbulence, statistical physics, plasma physics, and critical phenomena. Its investment approach relies heavily on the extensive studies of the statistical relationships that have existed in the past, either in the individual markets or in relationships between the markets.

Markets Media interviewed Richard Flom, vice president of trading for Systematic Alpha, via e-mail on May 28.

Richard Flom

Markets Media: Briefly explain the history of the firm, from inception to current day.

Richard Flom: In June 2000 Peter Kambolin, who was running an introducing broker-dealer in New York, met with Alexei Chekhlov, who had vast experience working for investment firms such as BNP Paribas, Wexford Management and TrendLogic Associates. The two principals have combined Peter’s multi-year financial business and trading experience with the hard science and quantitative finance background of Alexei, who worked at Princeton University and now serves on the faculty of the mathematics department at Columbia University. Soon, they co-founded with a third partner an asset-management firm that initially managed individual accounts. In 2004 the firm consolidated the individual accounts into a fund which is now known as Systematic Alpha Futures Fund, Ltd.

In 2007, after a corporate restructuring, Peter Kambolion and Alexei Chekhlov co-founded Systematic Alpha Management LLC — an independent CTA/CPO that manages two funds and a number of institutional managed accounts, and has relationships with two major platforms: dbSelect and AlphaMetrix. In 2009 and 2012 one of their funds, Systematic Alpha Futures Fund, Ltd., won the HFMWeek US Performance Awards in the Managed Futures category. The firm’s peak assets under management was achieved in February of 2011, at $721M.

MM: Who are your investors and what is your assets under management?

RF: Our investors are primarily multi-asset and CTA-specific funds of funds, family offices, private banks, high net worth individuals, and proprietary trading firms that also allocate money externally. Current AUM is $115M. We have a strong pipeline of investors that we are in close contact with and (we) expect our AUM to grow steadily in the coming months.

MM: Describe your investment strategy. What is your edge vis-à-vis other funds with similar strategies?

RF: We run two investment programs: Systematic Alpha Futures Program (SAFP) and Systematic Alpha Multi Strategy Program (SAMSP).

The SAFP program is a unique market-neutral, contrarian (or mean-reversion), short-term (average holding of about one day) program that trades market relationships between most liquid global equity indexes, major currencies and commodities. The program has near-zero correlation to broad CTA indices, hedge funds and to traditional asset classes such as equities and fixed income. This very liquid program has no beta exposure to the direction of equity, commodity, currency and fixed-income markets; low positive correlation to the volatility, and stable (72% profitable months) and high risk-adjusted returns (Sharpe ratio in excess of 1) since inception in June 2004. The source of return comes from the intrinsic mean-reverting properties in the global equity markets and delayed reactions between the markets to each other’s moves intraday, related to different geographical locations of the markets traded and asymmetric intraday liquidity patterns.

The SAMSP program is a 50%/50% blend between the SAFP program described above and directional momentum and short-term trend-following strategies, which trade all major asset classes. Average holding time in the directional component of the SAMSP is about five days. The market-neutral and directional components of the SAMSP program have negative correlation to each other, mitigating the drawdowns in the portfolio.

We believe it is a good time for Systematic Alpha because many quantitative traders were actually forced to exit the markets due to the regulatory environment and drop in the volatility and liquidity in the markets.

MM: What performance numbers can you share?

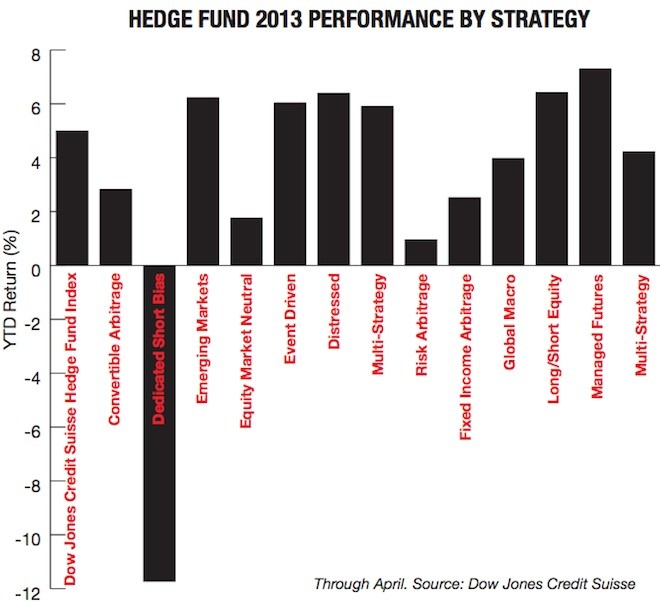

RF: Both programs in the single leverage version (standard deviation of 7% to 9%) were up over 10% net in 2012. Both are positive single digits in 2013.

MM: Is it a good time to be a quantitative trader or is the space getting crowded?

RF: We believe it is a good time for Systematic Alpha because many quantitative traders were actually forced to exit the markets due to the regulatory environment and drop in the volatility and liquidity in the markets that reduced the number of trading opportunities. Our programs are seemingly unaffected by trends that are worrisome for an average quantitative trader.

MM: How would you characterize the current capital-raising climate for hedge funds?

RF: Capital raising at the moment is strenuous, and we are optimistic about the climate as we can see it is slowly getting better.

MM: How frequently do you trade / turn over positions? How is the liquidity in the markets you trade in?

RF: Our holding periods range from minutes to several days, with an average time of one to two days across both investment programs that we are running. We trade the most liquid set of futures instruments and we see no visible liquidity issues at our current AUM level.

MM: What market-structure issues and/or regulatory initiatives are meaningful for Systematic Alpha?

RF: An introduction of a per-transaction fee would dampen the trading opportunities that we are seeking. At the same time, regulatory crackdown on HFT trading firms and dramatic reduction in bank proprietary trading activities could be beneficial for us.

MM: Discuss your approach to risk management.

RF: We have multi-level risk management that covers both individual positions/trades and the overall portfolio.

On the per-trade level, we employ market neutrality via hedging (in the SAFP), stop-loss levels, and systematic deleveraging if a particular model is experiencing above-expected losses. The short-term nature of our trading is also helpful to reduce the risk when trades go against you.

We have implemented portfolio optimizers that use the expected conditional drawdown-related risk measures, which are used when allocating the risk between various sub-strategies. We have published some academic results which prove the validity of this risk measure and its superiority versus such conventional measures, such as standard deviation.

On the portfolio level, we control maximum risk exposure and concentration of risk in any particular market. If we reach certain drawdown levels, the overall risk will be reduced to minimize the likelihood of having a larger drawdown.

MM: Please discuss anything else pertinent that we wasn’t specifically asked about.

RF: Both SAFP and SAMSP have very attractive correlation properties and solid risk-adjusted returns, which should complement any well-diversified portfolio.