It’s the economy stupid.

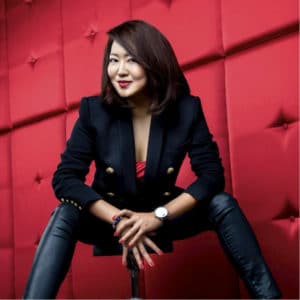

Well, maybe the global economy and fear it might dip into recession territory has gotten the better of the cryptocurrencies. The flight to traditional safe haven assets such as gold or bonds have temporarily stolen some of the crypto thunder, according to , Chief Commercial Officer, Co-Founder, BOLT.Global.

Contrary to some prognosticators, cryptocurrencies still aren’t fully considered to be a “safe haven” assets under an economic slowdown, she added.

“Bitcoin and major cryptocurrencies including Litecoin, Ethereum and Ripple have declined over the last 24 hours, weighed down by concerns of a slowing economy. With increasing focus on the global economic climate under the US-China trade war, and with markets remaining nervous over a [possible recession amid faltering China and Germany economic output, investors are likely moving their money into traditional asset classes (and safe haven assets) and away from the cryptocurrency markets,” Quek said. “The recovery of the Yuan could have also moved Chinese money (a big investor pool) away from crypto markets and into safe haven investments.”

Quek said that in her view investors traditionally get into crypto currencies as alternate investment vehicles under a robust cash flow economy, as a means to experiment with the extra cash. Given the recent yield curve inversion and drop in equity markets and economic slowdown fears, this trade out of crypto appears fully justifiable and normal.

Furthermore, the current regulatory roadblock on Facebook’s plans for its digital token has also dimmed down investor sentiment for cryptocurrencies, though credit is of course due to the social media company for having rallied all the major currencies so far this year, leading to their recovery and revival from 2018.

Bitcoin dropped down below $10,000 for major part of the last 24 hours, but has made a slight recovery back into the $10K.